Securing a title loan in San Antonio requires title loan legal assistance to protect your financial health. Before signing, review contracts for terms and conditions, including interest rates and late payment consequences. Gather essential documents, file a complaint if needed, and apply for legal aid online if eligible. A lawyer will guide you through eligibility assessments, evaluate rights violations, and advise on resolution options like mediation or legal proceedings, ensuring fair treatment and avoiding debt traps.

Need help with a title loan complaint? Understanding your rights and knowing how to navigate the process is crucial. This guide breaks down the steps to file a complaint effectively, empowering you to seek title loan legal assistance. We’ll walk through deciphering complex agreements, identifying your options, and navigating the legal system. By following these steps, you can ensure your voice is heard and protect your financial interests. Discover how title loan legal assistance can guide you towards a favorable resolution.

- Understanding Title Loan Agreements: Your Rights and Options

- Navigating the Process: Step-by-Step Guide to Filing a Complaint

- Legal Assistance for Title Loans: What to Expect and How It Can Help

Understanding Title Loan Agreements: Your Rights and Options

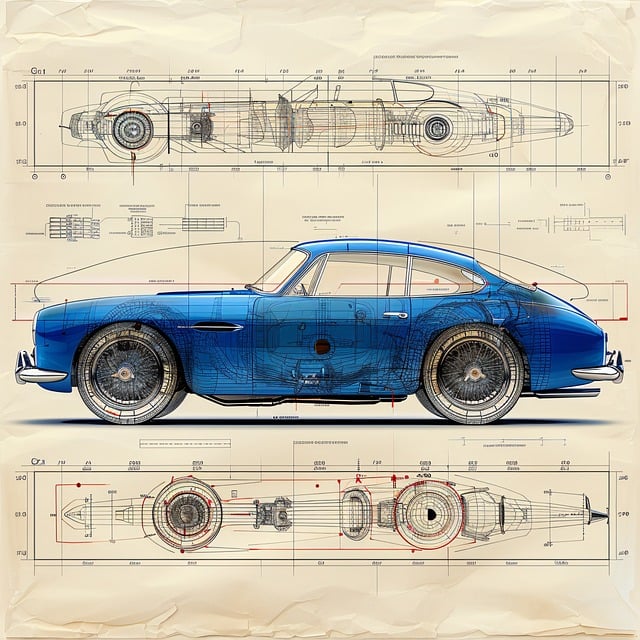

When taking out a title loan, it’s crucial to understand the agreement you’re entering into. These loans, secured by your vehicle’s title, come with specific terms and conditions that can significantly impact your financial situation. Before signing, carefully review the contract to grasp your rights and available options. Title loan legal assistance can be invaluable in this process, ensuring you fully comprehend the potential outcomes of both repayment and default.

Knowing your rights is essential, especially when dealing with San Antonio loans or any other type of loan payoff. You have the right to request a copy of the agreement, understand interest rates, and know the consequences of late payments or missed payments. Legal aid can help you navigate these details, ensuring you’re not agreeing to unfair terms that could leave you in a worse financial position than before.

Navigating the Process: Step-by-Step Guide to Filing a Complaint

Navigating the Process: Step-by-Step Guide to Filing a Complaint

The first step in seeking title loan legal assistance is to gather all necessary documentation and information related to your loan agreement. This includes the loan contract, any communication with the lender, and proof of repayment attempts or default. Once you have these prepared, it’s time to decide whether to file a complaint with the relevant regulatory body or consumer protection agency.

Next, complete an online application for legal aid if you qualify. Many organizations offer this service to ensure that borrowers receive fair treatment. After your application is approved, a lawyer will review your case and guide you through the process. They’ll help you understand your loan eligibility criteria, assess any violations of your rights, and determine the best course of action to resolve your complaint, whether through mediation, negotiation, or legal proceedings. Remember, seeking title loan legal assistance can be a crucial step in securing your financial rights and obtaining fast cash without falling into a debt trap.

Legal Assistance for Title Loans: What to Expect and How It Can Help

When facing issues with a title loan, seeking title loan legal assistance can be a game-changer. This type of help is designed to navigate the complex legal landscape surrounding these loans and ensure your rights are protected. The process typically involves a thorough review of your loan agreement, terms, and conditions to identify any discrepancies or unfair practices. Legal experts in this field can help borrowers understand their options, especially if they’re facing challenges like loan extension requests or dealing with high-interest rates.

One of the key benefits is guidance on managing bad credit loans. Many individuals turn to title loans when traditional banking options are limited due to poor credit scores. However, these loans often come with stringent requirements and penalties. Legal assistance can educate borrowers about their rights and help them negotiate better terms, ensuring they don’t fall into a cycle of debt. It empowers folks to take proactive measures, making the loan process more transparent and fair.

Title loan legal assistance is crucial for protecting your rights and navigating complex agreements. By understanding your options and taking a step-by-step approach, you can effectively file complaints and resolve issues related to title loans. Legal professionals specializing in this area provide valuable guidance, ensuring you receive fair treatment and understand your entitlements. Equip yourself with knowledge and don’t hesitate to seek help – your satisfaction and peace of mind are within reach.