Alamo Heights Title Loans offers fast, accessible funding solutions using vehicle equity as collateral, catering to borrowers with diverse needs and credit histories. The simple online application process provides same-day funding, making it an attractive alternative to traditional loans for unexpected expenses. With flexible repayment terms, these loans are ideal for short-term needs like medical bills or home repairs, but late payments may result in additional fees or repossession.

“Alamo Heights title loans offer a unique financing solution tailored to meet specific needs. This article explores who these services are designed for, delving into the range of options available. We weigh the benefits of choosing Alamo Heights over traditional methods, highlighting their efficiency and flexibility.

Additionally, we navigate when it’s suitable to opt for such loans, providing insights on scenarios where this approach could be advantageous, ensuring readers make informed decisions regarding their financial needs.”

- Understanding Alamo Heights Title Loans: Who They Serve and What They Offer

- Benefits of Choosing Alamo Heights Title Loans Over Traditional Lending Methods

- When to Opt for an Alamo Heights Title Loan: Scenarios and Considerations

Understanding Alamo Heights Title Loans: Who They Serve and What They Offer

Alamo Heights Title Loans is a financial service designed to cater to individuals seeking quick and accessible funding solutions. This type of loan utilizes the equity in one’s vehicle as collateral, offering an alternative to traditional bank loans. It serves a diverse range of borrowers, from first-time loan seekers to those with less-than-perfect credit histories, providing them with a safety net during financial emergencies.

The primary appeal lies in its simplicity and speed. Applicants can apply for these loans online, filling out a digital form that requires basic personal and vehicle information. Once submitted, the application is evaluated, and if approved, loan funds can be dispensed promptly, often within the same day. This makes Alamo Heights Title Loans an attractive option for those needing immediate financial support, especially when dealing with unexpected expenses or urgent needs. The process prioritizes vehicle equity as collateral, ensuring a more accessible lending experience without the stringent requirements of traditional loans.

Benefits of Choosing Alamo Heights Title Loans Over Traditional Lending Methods

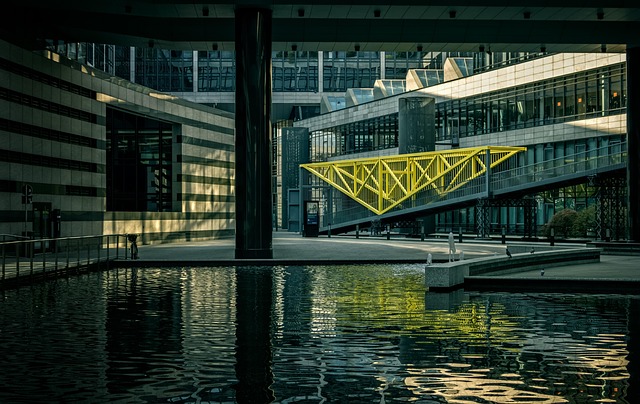

When considering financial options, opting for Alamo Heights title loans can offer several advantages over traditional lending methods. One significant benefit is the convenience and speed it provides. With an Alamo Heights title loan, borrowers can access funds by using their vehicle as collateral, eliminating the lengthy application processes and strict credit requirements often associated with banks. This alternative financing method is particularly attractive to those in need of quick cash, such as truckers looking for semi-truck loans or individuals in Fort Worth seeking immediate financial support.

Additionally, these loans offer a flexible repayment structure, allowing borrowers to pay back the loan at their own pace without the pressure of strict deadlines. Using your vehicle as collateral ensures that you retain ownership and freedom while still gaining access to much-needed funds. Compared to other collateral-based loans, like Fort Worth loans or even specialized Vehicle Collateral financing, Alamo Heights title loans often have more lenient terms, making them a convenient choice for borrowers with diverse financial backgrounds.

When to Opt for an Alamo Heights Title Loan: Scenarios and Considerations

If you’re facing a financial emergency in Alamo Heights and need quick access to cash, an Alamo Heights title loan could be an option worth considering. These loans are designed for borrowers who own a vehicle and are willing to use its equity as collateral. The process involves using your car’s valuation to secure the loan, which can lead to faster approval times compared to traditional bank loans. This makes San Antonio loans accessible to those with less-than-perfect credit or limited financial history.

Opting for an Alamo Heights title loan is most suitable in scenarios where you require a small, short-term loan amount and can comfortably make weekly or bi-weekly payments until the full balance is repaid. It’s ideal for unexpected expenses like medical bills, home repairs, or urgent travel needs. However, it’s crucial to remember that failing to repay the loan on time could result in additional fees and even vehicle repossession. Always assess your financial situation and ensure you can meet the repayment obligations before securing an Alamo Heights title loan.

Alamo Heights title loans can be a wise choice for borrowers seeking quick cash solutions, especially in unique financial situations. By understanding their benefits and targeted services, individuals can make informed decisions. These loans offer an alternative to traditional methods, catering to those who need immediate funding without the lengthy processes. Whether it’s unexpected expenses or a desire for faster access to capital, Alamo Heights title loans provide a potential solution, ensuring borrowers get the support they need when it matters most.