Allen car title loans offer a quick and accessible financing solution for short-term cash needs, secured by your vehicle's title. With attractive interest rates, flexible terms, and an extension option, these loans provide manageable repayments. To qualify, your vehicle must be free of outstanding loans, and you need a valid driver's license, proof of insurance, consistent employment (not mandatory), and good credit score. The process is swift, involving document collection, application submission, title transfer to the lender as collateral, and quick access to funds.

Looking for a fast and flexible financing option in Allen? Allen car title loans could be the solution. This comprehensive guide breaks down everything you need to know, from understanding this unique loan type to navigating the application process. We’ll delve into the eligibility criteria and step-by-step steps to secure your loan using your vehicle as collateral. Discover how Allen car title loans can provide access to funds quickly, making them a viable choice for various financial needs.

- Understanding Allen Car Title Loans: A Comprehensive Overview

- Eligibility Criteria: What Makes You Qualified?

- The Application Process: Step-by-Step Guide to Securing Your Loan

Understanding Allen Car Title Loans: A Comprehensive Overview

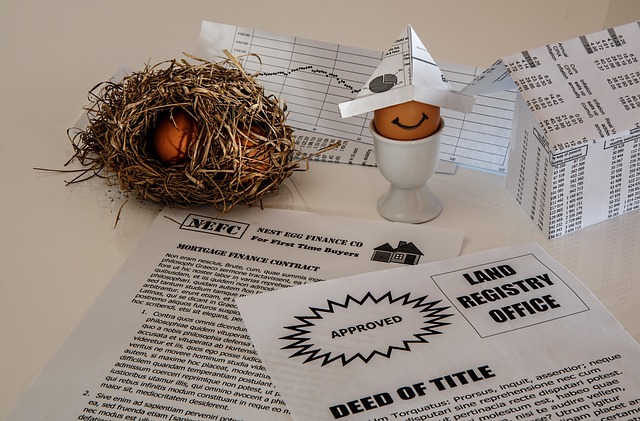

Allen car title loans are a type of secured loan that uses your vehicle’s title as collateral. This innovative financing option is designed for individuals who need quick access to cash, offering a simple and efficient solution to short-term financial needs. Unlike traditional loans that rely on credit scores, these loans assess the value of your vehicle, making them accessible to a broader range of borrowers.

In this comprehensive overview, we’ll break down the key aspects of Allen car title loans. Understanding how they work is essential when considering such an option. Secured loans like these typically feature competitive interest rates and flexible terms, allowing borrowers to manage their repayments comfortably. Moreover, with a loan extension option, you may be able to extend your repayment period if needed, providing additional financial flexibility during unexpected circumstances.

Eligibility Criteria: What Makes You Qualified?

To qualify for an Allen car title loan, your vehicle must be free and clear with no outstanding loans or leasings attached to it. This ensures that the lender has first priority in case of a repossession. You’ll also need to have a valid driver’s license and proof of insurance for your vehicle.

While these are the basic requirements, there are other factors that can enhance your eligibility. Maintaining consistent employment and a good credit score can significantly improve your chances. Furthermore, keeping your vehicle in good condition and making timely payments on existing loans can also contribute to a positive lending experience, potentially leading to better interest rates or opportunities for loan refinancing later on.

The Application Process: Step-by-Step Guide to Securing Your Loan

Applying for an Allen car title loan is a straightforward process designed to provide you with emergency funding quickly. Here’s a step-by-step guide on how to secure your loan efficiently:

1. Prepare Your Documents: Gather essential documents, including your driver’s license or state ID, vehicle registration, and proof of insurance. These are required for verification purposes.

2. Fill Out the Application: Visit the lender’s website or office and access their application form. Provide accurate details about your vehicle, such as make, model, year, and VIN (Vehicle Identification Number). This information will be used to determine the value of your car.

3. No Credit Check Required: One of the significant advantages of Allen car title loans is that they typically don’t involve a credit check. Lenders focus on the equity in your vehicle rather than your credit score, making it accessible to those with less-than-perfect credit or no credit history.

4. Evaluate and Submit: Review the provided loan details, including the interest rate, repayment terms, and the title transfer process. Once you’re satisfied, submit your application. A representative will get in touch to discuss next steps.

5. Title Transfer: After approval, you’ll need to transfer the vehicle’s title to the lender as collateral for the loan. This is a standard procedure that ensures the lender has legal ownership of your vehicle during the loan period.

Allen car title loans offer a fast and flexible solution for those needing cash. By understanding the eligibility criteria and straightforward application process, you can secure a loan quickly. These loans are ideal for individuals with good or bad credit, providing an accessible path to financial support. With a clear overview of how Allen car title loans work, you’re now equipped to make an informed decision to meet your financial needs.