Car title loans Sherman TX provide quick funds using your vehicle's title, ideal for immediate needs or debt consolidation. With faster approval than bank loans, borrowers keep their cars and can extend repayment. However, be wary of high interest rates and fees; understand the Annual Percentage Rate (APR) transparently. Prioritize lender transparency, clear terms, flexible payment plans, and competitive rates to secure a safe, beneficial car title loan aligned with your financial goals in Sherman TX.

“In the financial landscape of Sherman, Texas, understanding car title loans is crucial. This article guides you through the process and highlights common mistakes to avoid. From grasping the fundamentals of car title loans in Sherman TX to identifying potential pitfalls, we empower you with knowledge. Learn effective strategies to secure a safe and beneficial loan, ensuring a positive financial experience. Explore these insights to make informed decisions regarding car title loans Sherman TX.”

- Understanding Car Title Loans Sherman TX: The Basics

- Common Pitfalls to Avoid When Taking Out a Loan

- Strategies for Securing a Safe and Beneficial Car Title Loan in Sherman TX

Understanding Car Title Loans Sherman TX: The Basics

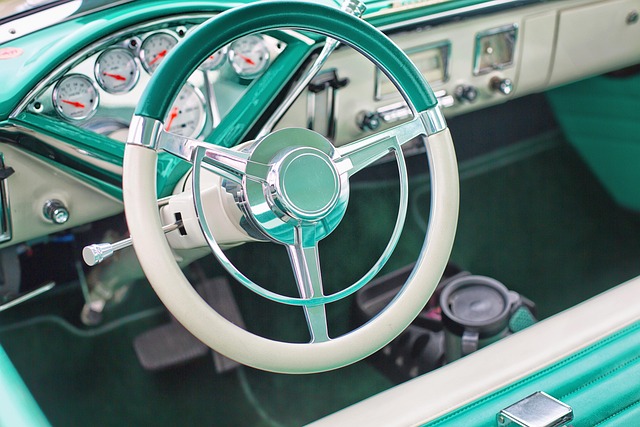

Car title loans Sherman TX are a type of secured lending where borrowers use their vehicle’s title as collateral for obtaining a loan. This option is popular among individuals seeking quick funding to cover immediate financial needs or manage debt consolidation. The process involves allowing a lender to place a lien on your car, which serves as security for the loan amount. It’s a straightforward way to access cash, often with faster approval times compared to traditional bank loans.

These loans are suitable for those who own their vehicles outright and can provide proof of income and identification. The vehicle’s value determines the loan amount offered, and borrowers typically retain possession of their car during the loan period. Car title loans Sherman TX also offer flexibility in terms of repayment, with options for extending the loan if needed. This can be beneficial when managing cash flow or unexpected expenses, providing a convenient solution for short-term financial requirements.

Common Pitfalls to Avoid When Taking Out a Loan

When considering car title loans Sherman TX, it’s essential to be aware of potential pitfalls that many borrowers fall into. One common mistake is underestimating the impact of interest rates and fees on their overall financial burden. Lenders often offer appealing initial terms, but these can quickly spiral out of control if not managed properly. It’s crucial to understand the loan’s Annual Percentage Rate (APR) and all associated fees to ensure you can comfortably afford the repayments.

Another trap to avoid is assuming that selling your vehicle is the only option to secure a loan. While car title loans Sherman TX do require using your vehicle as collateral, it doesn’t always mean you have to part with it. Many lenders offer flexible terms allowing you to keep your vehicle while making payments. Additionally, being transparent about your financial situation and income can help access more favorable loan conditions, including lower interest rates. This financial assistance can be a game-changer for those in need of quick funds without sacrificing their prized possession, whether that’s a car or even a semi truck.

Strategies for Securing a Safe and Beneficial Car Title Loan in Sherman TX

When considering a car title loan in Sherman TX, it’s paramount to prioritize safety and benefits. The first step is to ensure transparency from the lender; clear terms, interest rates, and repayment schedules are non-negotiable. Opt for reputable lenders who offer flexible payment plans tailored to your income, making the loan manageable without overwhelming your finances. This not only provides peace of mind but also helps in building trust.

Additionally, understanding your financial situation is crucial. A wise approach is to use a car title loan as a temporary financial solution, not a long-term commitment. Compare lenders offering competitive rates and quick loan approval processes. Ensure you keep accurate records of all transactions and remain on top of your repayments to avoid default, which can have severe consequences. By doing so, you’ll secure a beneficial car title loan that aligns with your financial goals in Sherman TX.

When considering car title loans Sherman TX, being aware of potential pitfalls is crucial. By understanding the basics and employing strategies to secure a safe and beneficial loan, you can avoid common mistakes. Remember, an informed decision is the best defense against financial setbacks. Make sure to thoroughly research lenders and always prioritize your ability to repay before taking out any loan.