When facing repossession of a vehicle secured by a title loan, borrowers have options like voluntary surrender to avoid legal fights and costly fees. After surrender, individuals benefit from legal protections ensuring fair and transparent repossession procedures. To recover from repossession, strategic planning is key: budget strictly, consolidate debts, and build an emergency fund to prevent future high-interest loans. Regular budget reviews empower individuals to regain financial control and secure a brighter future. (Keywords: Title loan recovery after repossession)

Title loans, like any secured lending, can lead to repossession if repayment isn’t met. However, a ‘voluntary surrender’ offers a unique avenue for borrowers to regain control. This article explores the intricate process of title loan recovery post-surrender, delving into legal rights and strategic financial planning. Understanding these steps is crucial for both lenders seeking efficient recovery and borrowers aiming to rebuild their financial standing. Discover practical insights on navigating this complex landscape and securing a brighter financial future.

- Understanding Title Loan Repossession and Voluntary Surrender

- Legal Aspects and Rights After Voluntary Surrender

- Strategies for Effective Recovery and Future Financial Planning

Understanding Title Loan Repossession and Voluntary Surrender

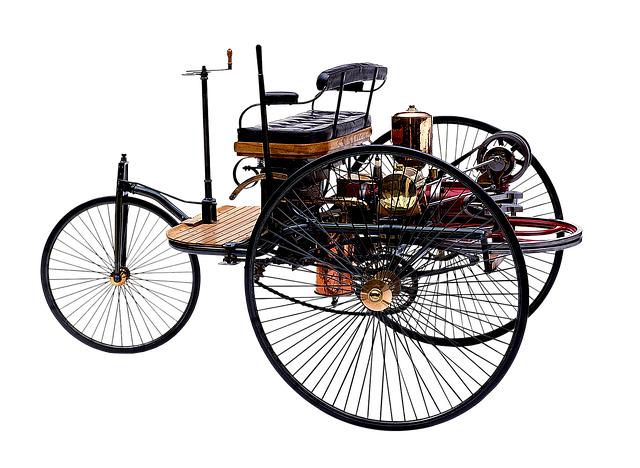

When a borrower is unable to repay their Title Loan, the lender may initiate a repossession process. This involves taking physical possession of the secured asset, typically a vehicle, from the borrower’s location. Repossession can be voluntary or involuntary; in the case of voluntary surrender, the borrower agrees to give up the vehicle before any legal action is taken. Understanding this distinction is crucial for borrowers seeking Title Loan recovery after repossession, as it influences their options and potential outcomes.

The decision to voluntarily surrender the vehicle is a strategic move that can help borrowers avoid costly legal battles and repossession fees. It also provides an opportunity to explore financial solutions, such as Same Day Funding, which could aid in repaying outstanding loans or negotiating new terms with the lender. Fort Worth Loans, for instance, offers flexible repayment plans that cater to borrowers’ unique circumstances, ensuring they have a chance at regaining control over their finances and recovering from the repossession process.

Legal Aspects and Rights After Voluntary Surrender

After voluntarily surrendering a vehicle subject to a title loan, individuals often wonder about their legal rights and obligations. This decision can be a complex one, as it significantly impacts their financial situation and future interactions with lenders. In many jurisdictions, consumers have specific protections under law when dealing with secured loans, such as title loans, which are designed to balance the interests of both parties. These laws govern various aspects of the recovery process, ensuring fairness and transparency during repossession.

Understanding one’s rights is crucial in navigating the aftermath of a voluntary surrender. For instance, borrowers may have the right to retrieve personal belongings from the vehicle after repossession. Additionally, lenders must adhere to specific procedures when taking possession of the collateral, which includes providing notice and adhering to legal timeframes for sale or disposal of the asset if full repayment is not made. These regulations are in place to offer financial assistance to borrowers facing difficult circumstances while also protecting their rights as consumers in a regulated lending market.

Strategies for Effective Recovery and Future Financial Planning

After a voluntary surrender of a title loan, recovering financially can seem daunting. However, with strategic planning, it’s achievable. One effective approach is to prioritize repaying the loan as soon as possible to minimize interest charges and penalties. This involves creating a strict budget, cutting unnecessary expenses, and allocating disposable income towards loan repayment. Additionally, exploring debt consolidation options through online applications can simplify management by combining multiple loans into one with potentially lower interest rates.

Looking ahead, future financial planning should focus on building an emergency fund to prepare for unexpected costs. This safety net can prevent the need for high-interest title loans in the future. Regularly reviewing and adjusting budgets ensures that any changes in financial circumstances are addressed promptly. By adopting these strategies, individuals can regain control of their finances and avoid repossession while fostering a more secure financial future.

Voluntary surrender of a title loan can be a complex but manageable situation. Understanding your legal rights and employing strategic financial planning can facilitate a smoother recovery process. By familiarizing yourself with the steps involved in repossession, knowing your entitlements post-surrender, and adopting measures to improve your financial standing, you can take control and work towards a more secure future. Title loan recovery after repossession is achievable through informed decisions and proactive management of your assets.