Car title loans, though offering quick cash with vehicle collateral, require responsible management for long-term financial stability. Community support groups, non-profits, and local initiatives play a crucial role by promoting budget awareness, financial education, and alternative funding options like personal secured loans. Through workshops, counseling, and peer networks, these communities teach budgeting skills, help borrowers understand loan terms, and foster accountability to prevent debt cycles. By equipping individuals with practical financial knowledge, car title loan communities enable informed decisions and successful repayment without straining borrowers' budget or vehicle ownership.

Car title loan communities are more than just financial services; they’re vital supports within their respective neighborhoods. This article explores how these communities can encourage budget responsibility, delving into the unique relationships they foster and the strategies they employ. By understanding car title loans’ impact on communities, we recognize the crucial role of community support in promoting healthy financial practices. We’ll discuss specific methods through which these communities help individuals navigate and manage their budgets effectively.

- Understanding Car Title Loans and Their Impact on Communities

- The Role of Community Support in Promoting Budget Responsibility

- Strategies for Effective Budgeting with the Help of Car Title Loan Communities

Understanding Car Title Loans and Their Impact on Communities

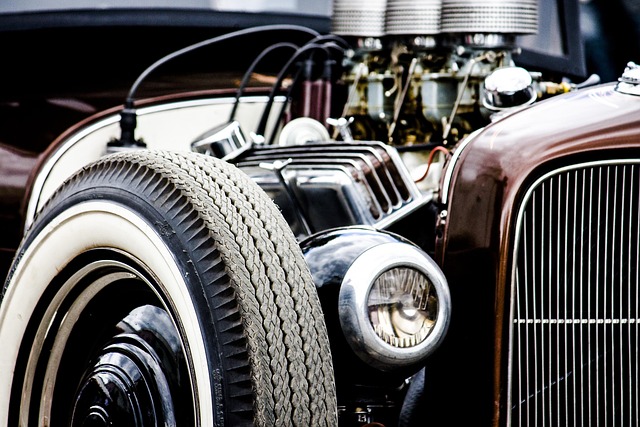

Car title loans, a form of secured lending, have become a significant part of the financial landscape for many communities. These loans utilize a person’s vehicle, typically their car or truck, as collateral, offering a quick and accessible source of cash to those in need. However, it is essential to recognize that while they provide a short-term solution, they can significantly impact borrowers’ financial stability if not managed responsibly.

Community support surrounding car title loans encourages budget awareness and education. Many organizations promote the idea of securing these loans only as a last resort, emphasizing that loan terms should be thoroughly understood before committing. By providing resources and guidance on budgeting, saving, and alternative funding options like semi-truck loans or personal secured loans, communities can help individuals make informed decisions, ensuring financial health rather than perpetuating a cycle of debt.

The Role of Community Support in Promoting Budget Responsibility

Community support plays a pivotal role in encouraging budget responsibility among individuals considering a car title loan. In many cases, these loans are accessed as a quick fix for financial emergencies, and it’s here where community backing can make a significant difference. Support groups, non-profit organizations, and local initiatives often provide resources and guidance on effective money management, helping borrowers understand the importance of adhering to a budget during and after the title loan process. By fostering an environment that promotes responsible borrowing, these communities empower individuals to make informed decisions.

Through workshops, counseling sessions, and peer support networks, community organizations teach practical financial skills, emphasizing the long-term benefits of maintaining a balanced budget. This approach ensures that borrowers not only navigate the quick approval process successfully but also develop sustainable financial habits, allowing them to keep your vehicle as collateral while ensuring they can meet their repayment obligations without further financial strain.

Strategies for Effective Budgeting with the Help of Car Title Loan Communities

Car title loan communities offer valuable support and resources for individuals seeking financial assistance. By joining these networks, borrowers can access a wealth of knowledge and strategies to enhance their budgeting skills. One effective approach is to participate in workshops or online forums where members share tips on creating and sticking to budgets. These communities often provide practical guidance, such as categorizing expenses, setting savings goals, and prioritizing debt repayment.

Additionally, car title loan community support encourages open dialogue about financial challenges. Members can exchange ideas on managing unexpected costs, negotiating with lenders, and finding legitimate financial solutions. This collaborative environment fosters a sense of accountability, motivating individuals to take control of their finances. With access to like-minded individuals and tailored advice, borrowers can make informed decisions, ensuring they receive the fast cash needed while maintaining budget responsibility.

Car title loan communities play a vital role in fostering budget responsibility within their reach. By providing educational resources and supportive networks, these communities empower individuals to make informed financial decisions. Through collaborative efforts, they encourage practices that balance short-term needs with long-term financial health, ensuring sustainability for all community members. Embracing this collective approach to budgeting paves the way for a more resilient and prosperous future for everyone involved.