Small business owners in Texas can harness the power of ROI (Return on Investment) to evaluate and optimize Texas title loans, a strategic financial tool for capital access. By calculating ROI with key factors like principal, interest rates, and terms, entrepreneurs gauge profitability. This metric guides decisions on loan extensions or alternatives. Texas title loans, secured by vehicles, offer capital for reinvestment in growth areas like expansion, equipment upgrades, or market capitalizations, freeing up cash flow by paying off higher-interest debts. Understanding vehicle valuation ensures fair loan terms and promotes sustainable business advancement.

“Unleash your Texas business’s growth potential with a strategic Texas title loan—but how do you measure its true value? This article guides small business owners through the art of calculating Return on Investment (ROI) for these unique financing solutions. We’ll break down the process, from understanding ROI’s significance to providing actionable steps for maximizing profits. By mastering this concept, Texas title loans can become a powerful tool for sustainable business success.”

- Understanding ROI: The Key to Evaluating Texas Title Loan Opportunities

- Steps to Calculate Return on Investment (ROI) for a Business Title Loan

- Maximizing Profits: Strategies for Small Businesses Using Texas Title Loans

Understanding ROI: The Key to Evaluating Texas Title Loan Opportunities

Understanding ROI: The Key to Evaluating Texas Title Loan Opportunities

When it comes to evaluating opportunities for a Texas title loan for small business owners, calculating Return on Investment (ROI) is paramount. It’s a metric that allows you to assess the profitability of such loans, helping you make informed decisions about funding options. ROI provides insights into the potential gains or losses associated with the investment, enabling smart financial planning and strategic growth.

For secured loans like Texas title loans, understanding repayment options and considering loan refinancing strategies can further optimize your ROI. By carefully examining these aspects, small business owners in Texas can maximize their financial returns while managing debt effectively. This approach ensures that the borrowed funds contribute substantially to business objectives, whether it’s expanding operations, upgrading equipment, or capitalizing on market opportunities.

Steps to Calculate Return on Investment (ROI) for a Business Title Loan

To calculate the Return on Investment (ROI) for a Texas title loan designed for small business owners, you’ll need to consider several key factors. First, determine the total amount borrowed, which includes both the principal and any associated fees. Next, establish the interest rates and loan terms, as these will dictate the overall cost of borrowing. Since title loans often come with specific repayment structures, calculate the total interest paid over the life of the loan.

Subtract all costs, including principal, interest, and fees, from the net profit generated by the business during the loan period. This provides a clear picture of the investment’s performance. A positive ROI indicates profitability, while a negative one suggests loss. Regularly reviewing these calculations is crucial for smart financial decision-making, especially when considering options like loan extensions or exploring alternative cash advance opportunities.

Maximizing Profits: Strategies for Small Businesses Using Texas Title Loans

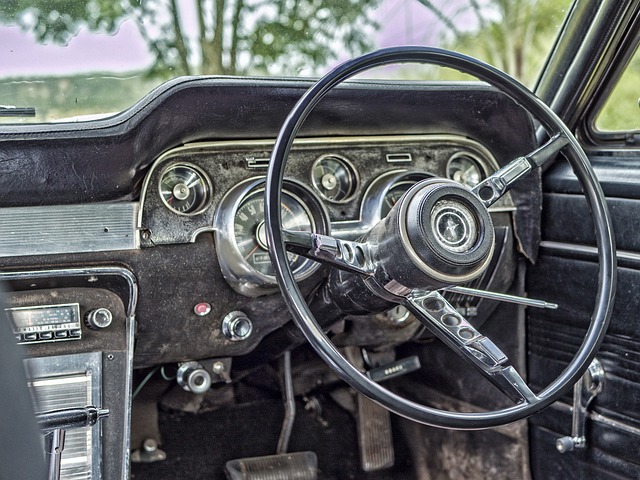

Small businesses in Texas looking to boost their profits can consider a strategic financial move: utilizing Texas title loans as a powerful tool for growth. These loans, secured by a business owner’s vehicle (such as trucks), offer several advantages. By tapping into this form of financing, entrepreneurs can unlock capital that can be reinvested back into the company, enabling them to expand operations, acquire new equipment, or capitalize on market opportunities.

Maximizing profits involves careful planning and strategic financial decisions. For small business owners, a Texas title loan can provide the means to pay off existing debts with higher interest rates, freeing up cash flow. Additionally, understanding the vehicle valuation process is key; accurately assessing the value of collateral ensures a fair loan-to-value ratio, potentially leading to more favorable loan terms and conditions. This approach not only secures a business’s future but also paves the way for sustainable growth and increased profitability.

Calculating ROI on a Texas business title loan is a powerful tool for small business owners to make informed decisions. By understanding and utilizing the steps outlined in this article, you can accurately assess the profitability of this unique financing option, maximizing your investment while navigating the complex landscape of Texas title loans. This strategic approach ensures that your business thrives with the right financial backing.