Austin car title loans provide a swift, flexible financing option for local residents with unforeseen emergencies, offering competitive rates and adaptable repayment terms despite credit history. The process is simple and quick, supported by diverse asset types like semi truck loans. With transparent fee structures, Austin shines as a premier Texas destination for borrowers needing emergency funds, outpacing Houston and Dallas in inclusivity and convenience. Responsible borrowing requires interest rate research and clear understanding of terms.

“Dive into the dynamic world of Austin car title loans, a unique financial solution that offers quick cash access secured by your vehicle. In this article, we explore how these loans stack up against other top Texas cities, shedding light on their competitive rates and flexibility. From understanding the basics of Austin car title loans to uncovering the benefits and considerations for borrowers, this guide is your key to navigating this alternative financing option in the Lone Star State.”

- Understanding Austin Car Title Loans: Unlocking Quick Cash Access

- Comparison: Austin vs Top Texas Cities for Car Title Loans

- Benefits and Considerations for Austin Title Loan Borrowers

Understanding Austin Car Title Loans: Unlocking Quick Cash Access

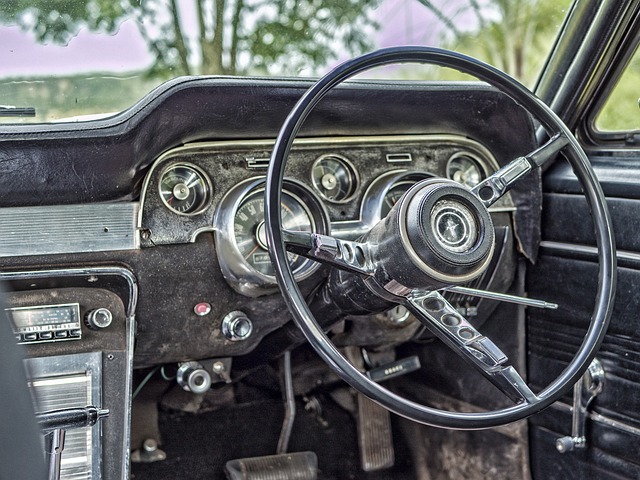

Austin car title loans have gained popularity as a quick cash solution for residents facing financial emergencies. This type of loan is secured by the borrower’s vehicle, allowing lenders to offer competitive interest rates and flexible repayment terms, even for those with bad credit. Unlike traditional bank loans, Austin car title loans provide access to funds within minutes, making them an attractive option for those needing immediate financial support.

The process involves assessing the value of your vehicle and establishing a loan amount based on that appraisal. Borrowers can then choose from various payment plans tailored to their needs, ensuring manageable monthly installments. Even unique asset types like semi truck loans are often supported, providing flexible financing options for a diverse range of Austin residents.

Comparison: Austin vs Top Texas Cities for Car Title Loans

When it comes to car title loans, Austin stands out among top Texas cities. In terms of Austin car title loans, lenders offer competitive interest rates and flexible repayment terms tailored to local residents’ needs. This is particularly beneficial for those seeking quick access to emergency funds during unexpected financial emergencies. The approval process in Austin is relatively streamlined compared to other major Texas cities, making it easier for borrowers to secure the funds they need promptly.

In contrast, while cities like Houston and Dallas also provide car title loan services, Austin offers unique advantages. Here, lenders often have more transparent fee structures and are more amenable to working with borrowers of various credit backgrounds. This inclusivity ensures that a wider range of residents can access these loans, providing them with a reliable source of emergency funds when needed most.

Benefits and Considerations for Austin Title Loan Borrowers

Borrowers seeking an Austin car title loan can expect several advantages that set this option apart from traditional financing methods. One of the key benefits is the simplicity and speed of the process. Unlike bank loans, which often require extensive documentation and a lengthy application process, Austin car title loans offer a streamlined approach with minimal paperwork. This means you can complete an online application in minutes, receive a quick funding decision, and have access to your cash advance in no time. The flexibility is another significant advantage; borrowers retain the use of their vehicle while making installment payments towards their loan.

When considering an Austin car title loan, it’s essential to weigh these benefits against certain considerations. Interest rates for such loans can vary widely, so thorough research and comparisons are crucial. Additionally, borrowers should be prepared for potential hidden fees and understand the repayment terms thoroughly. However, with responsible borrowing practices and a clear understanding of the terms, Austin car title loans can provide a convenient solution for short-term financial needs, offering a quick cash advance when other options may not be readily available.

Austin car title loans offer a unique advantage in terms of accessibility and flexibility compared to other Texas cities. The benefits outlined in this article highlight why borrowers in Austin can expect a smoother and potentially faster loan process. While each city has its own set of financial services, understanding the specific advantages of Austin car title loans can empower individuals to make informed decisions when facing cash flow challenges.