San Antonio's landscape of title loans is marked by high-interest rates and predatory practices, trapping borrowers in debt despite paying off their loans. Local advocates push for reform, advocating fairer interest rates, borrower education, and flexible payment options to protect vulnerable populations from abusive lending practices. Stricter regulations aim to balance lender interests with empowering borrowers to make informed financial choices, promoting economic well-being within the community.

San Antonio community advocates have united, calling for urgent reform of the city’s title loan industry. With a growing concern over the current state of San Antonio title loans, these groups are demanding change to protect borrowers from predatory lending practices.

This article delves into the intricate world of San Antonio title loans, explores the advocacy efforts driving reform, and examines potential solutions that could benefit both lenders and borrowers alike.

- The Current State of San Antonio Title Loans: A Look at the Industry

- Advocacy Efforts: What are Community Groups Demanding?

- Potential Reforms and Their Impact on Lenders and Borrowers

The Current State of San Antonio Title Loans: A Look at the Industry

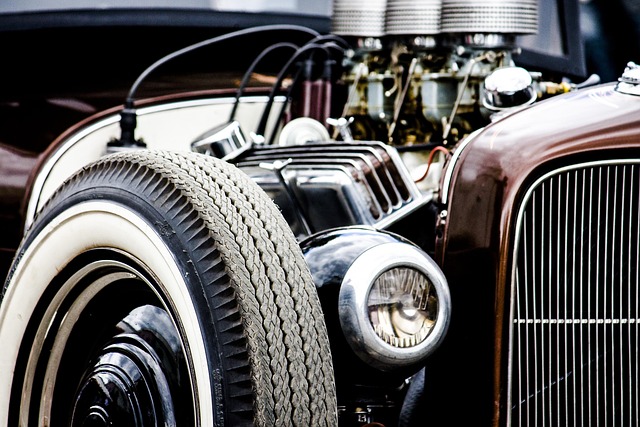

San Antonio’s landscape of title loans is a complex web where high-interest rates and stringent terms often leave borrowers in a bind. The industry, known for offering quick cash in exchange for vehicle titles, has seen a surge in popularity among San Antonians facing financial emergencies. However, this convenience comes at a cost; with average interest rates exceeding 300% APR, many consumers find themselves trapped in cycles of debt, unable to reclaim their vehicles even after repaying the loan.

The current state of San Antonio title loans is characterized by a lack of regulation and consumer protection. Lenders often target vulnerable populations, including low-income individuals and those with limited credit options. While some offer flexible terms, many still adhere to strict requirements, such as no credit check but demanding full repayment within a short period. Even more concerning are the reports of predatory lending practices, including unfair fees and hidden charges, especially in the case of motorcycle title loans. Consequently, local advocates are pushing for reforms to safeguard consumers and promote fairer lending standards, ensuring that residents can access emergency funds without falling into a financial quagmire.

Advocacy Efforts: What are Community Groups Demanding?

Community groups in San Antonio are advocating for comprehensive reform regarding title loans, with a particular focus on making repayment options more accessible and affordable. These advocates argue that the current structure often traps borrowers in cycles of debt, especially vulnerable populations such as low-income individuals and minorities. They demand regulations that ensure transparent lending practices, clear terms, and fair interest rates to prevent predatory lending.

The groups are calling for an expansion of alternatives to traditional title loans, including programs that facilitate the securitisation of assets other than vehicles, like boats in Fort Worth or other personal possessions. By diversifying repayment options, they aim to provide borrowers with more control over their financial decisions and reduce the reliance on high-interest rate loans. These efforts are a step towards protecting consumers and fostering economic well-being within the community.

Potential Reforms and Their Impact on Lenders and Borrowers

In calling for San Antonio title loans reform, community advocates highlight several potential changes that could benefit both lenders and borrowers. One suggested reform is to implement stricter regulations on interest rates and fees, ensuring that loan terms are fairer and more transparent. This move would protect borrowers from predatory lending practices, commonly associated with title loans due to their high-interest nature. Additionally, advocating for enhanced borrower education programs can empower individuals to make informed decisions about their financial commitments.

Another proposed reform is the promotion of flexible payment options, which could significantly alleviate the burden on borrowers. Allowing for more customizable repayment plans, perhaps tied to vehicle ownership and depreciation rates, would provide borrowers with the means to manage their debt more effectively. This approach aligns with the concept of quick funding, ensuring individuals gain access to immediate financial support while offering a viable path to repayment.

The current landscape of San Antonio title loans has sparked a call for reform from community advocates who aim to protect borrowers from predatory lending practices. By demanding clearer regulations, extended repayment periods, and reduced interest rates, these groups strive to create a fairer system for all. Potential reforms could significantly impact lenders by fostering more ethical business models and encouraging responsible lending. At the same time, borrowers in San Antonio stand to benefit from increased financial stability and long-term debt management options. It is imperative that these advocacy efforts lead to tangible changes, ensuring a safer and more sustainable approach to title loans in the city.