Texas motorcycle title loans provide a flexible financing option for riders needing quick cash, secured against their bike's title. Lenders assess the vehicle's value for loan amounts, allowing borrowers to keep their motorcycle during repayment. With minimal requirements and swift approval, these loans cater to urgent needs but come with risks like repossession and higher interest rates; responsible borrowing practices are essential. Treat them as short-term solutions, understanding loan terms fully before applying.

“In the world of financial options for motorcycle owners, Texas motorcycle title loans stand out as a unique and often overlooked resource. This type of secured lending allows riders to access funds by using their vehicle’s title as collateral. Understanding when and how to use these loans responsibly is crucial. This article guides you through the basics, benefits, drawbacks, and best practices to ensure informed borrowing decisions for Texas motorcycle title loans.”

- Understanding Texas Motorcycle Title Loans: The Basics

- Benefits and Drawbacks: Weighing Your Options

- Responsible Borrowing: Guidelines and Best Practices

Understanding Texas Motorcycle Title Loans: The Basics

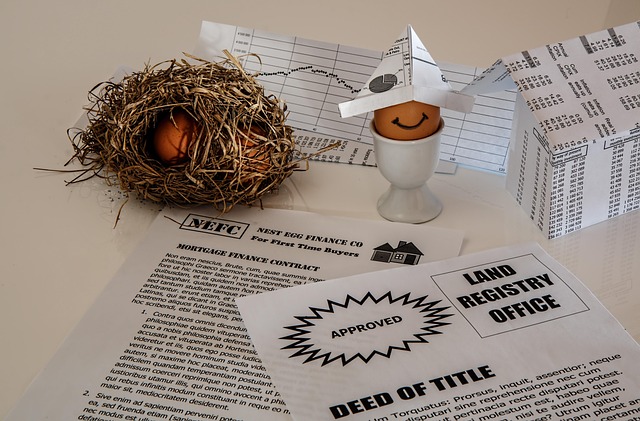

Texas motorcycle title loans are a type of secured lending option designed for individuals who own a motorcycle and need access to quick cash. In this arrangement, the borrower uses their vehicle’s title as collateral, allowing them to obtain a loan based on the value of their motorcycle. This alternative financing method is particularly appealing to those in need of financial assistance without wanting to part with their beloved bike. It provides a solution for unexpected expenses or even funding a new purchase.

The process involves applying for the loan through a lender who will assess the value of your motorcycle and determine an appropriate loan amount. Once approved, you’ll receive funds, and as long as you meet the repayment terms, you can keep your vehicle. Unlike traditional car title loans, which may require giving up your vehicle during the loan period, Texas motorcycle title loans offer flexibility while ensuring the lender has a legal claim to the bike’s title until the debt is fully settled.

Benefits and Drawbacks: Weighing Your Options

Texas motorcycle title loans can be a convenient financial solution for riders looking to access immediate funds secured by their vehicle’s title. These loans offer several advantages that make them an attractive option for many. Firstly, they provide quick approval, often within minutes, allowing riders to gain access to much-needed cash swiftly. This speed is especially beneficial when unexpected expenses arise or in situations demanding urgent financial support. Additionally, compared to traditional bank loans, Texas motorcycle title loans usually have less stringent requirements and flexible repayment terms, catering to the unique needs of motorcycle owners.

However, like any loan option, it’s essential to consider potential drawbacks. The primary concern is the risk of losing your motorcycle if you fail to repay the loan as agreed. This security interest means that defaulting on payments could result in the lender repossessing your vehicle. Moreover, interest rates for these loans can be higher than traditional bank loans, which may lead to substantial costs over time. Nonetheless, responsible borrowing practices and a solid repayment plan can help ensure a positive experience with Texas motorcycle title loans or even options like Dallas title loans, offering an efficient solution when quick approval is a priority.

Responsible Borrowing: Guidelines and Best Practices

When considering Texas motorcycle title loans, it’s paramount to adopt responsible borrowing practices. Firstly, assess your financial situation and determine if a loan is genuinely necessary. Motorcycle Title Loans can be a powerful tool for unexpected expenses, but they should never become a recurring or unsustainable part of your budget. Ensure you have a clear understanding of the loan terms, including interest rates, repayment schedules, and any associated fees.

Knowing these details helps in making an informed decision. Maintain open lines of communication with the lender, adhering to timely repayments to avoid penalties. Prioritize responsible borrowing by treating the loan as a short-term solution rather than a long-term financial strategy. Remember that while a Cash Advance can be convenient, it’s crucial to maintain control over your Vehicle Ownership and not let it become burdened by debt.

Texas motorcycle title loans can be a valuable option for riders looking for quick funding, but responsible borrowing is key. By understanding the process, weighing the benefits and drawbacks, and adhering to best practices, you can make informed decisions that ensure financial security without compromising your beloved motorcycle. Remember, access to capital should enhance your riding experience, not create additional stress.