Coppell auto title loans offer a quick and accessible financial solution for individuals borrowing against their vehicle's equity, without surrendering ownership. With flexible terms, simple requirements, and catering to various expenses, these loans are suitable for Fort Worth residents who own cars, trucks, SUVs, or even boats. Using the vehicle's title as collateral, Coppell auto title loans provide an alternative to traditional banking, especially for those with less-than-perfect credit or limited financial history, offering faster access to funds.

Coppell residents now have a convenient way to access quick cash using their vehicle’s equity. Coppell auto title loans offer a straightforward solution for funding new or used vehicle purchases, or even covering unexpected expenses. This article delves into how these loans work, exploring the benefits and eligibility criteria, and providing a comprehensive guide on navigating the process. Unlock your vehicle’s potential with the convenience of Coppell auto title loans.

- Understanding Coppell Auto Title Loans: Unlocking Access to Vehicle Equity

- Benefits and Eligibility Criteria for Borrowing Against Your Vehicle in Coppell

- Navigating the Process: How Coppell Auto Title Loans Work and What to Expect

Understanding Coppell Auto Title Loans: Unlocking Access to Vehicle Equity

Coppell auto title loans offer a unique financial solution for individuals seeking quick access to cash while retaining ownership of their vehicles. This type of loan is secured by the vehicle’s title, allowing lenders to provide funding based on the equity of your car or truck. Unlike traditional bank loans that require extensive documentation and strict credit criteria, Coppell auto title loans are designed to be more flexible and accessible.

By leveraging your vehicle’s value, you can unlock a line of credit that can cover various expenses, from unexpected bills to major purchases. The process typically involves a simple application, a quick vehicle inspection to verify its condition and value, and then immediate access to funds. Whether you own a car, truck, SUV, or even a boat (in the case of boat title loans), this alternative financing method provides an efficient way to tap into your vehicle’s equity without sacrificing ownership. Fort Worth loans, for instance, benefit from these flexible terms, making them a viable option for local residents in need of rapid financial support.

Benefits and Eligibility Criteria for Borrowing Against Your Vehicle in Coppell

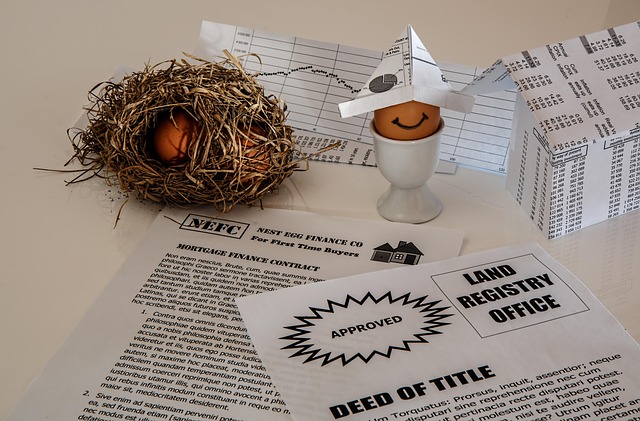

Coppell auto title loans offer a convenient and accessible solution for individuals seeking financial support. One of the key benefits is that they allow borrowers to use their vehicles as collateral, providing an alternative to traditional loan options. This means even those with less-than-perfect credit or limited financial history can gain approval for a loan, offering a second chance at securing much-needed funds. The process involves using your vehicle’s title as security, ensuring the lender has a clear path to repossession if necessary.

Eligibility criteria for Coppell auto title loans are relatively flexible. Lenders typically consider factors such as the value and condition of your vehicle, your income, and your ability to make consistent payments. This flexibility makes it possible for both used and new vehicle owners to borrow against their assets. Additionally, payment plans can be tailored to individual needs, offering a cash advance to cover urgent expenses or provide financial relief without the burden of long-term debt.

Navigating the Process: How Coppell Auto Title Loans Work and What to Expect

Navigating the process of Coppell auto title loans involves a straightforward and often quicker alternative to traditional loan methods. This type of loan uses your vehicle’s title as collateral, allowing for easier access to funds. The applicant provides their vehicle’s title to the lender, who then holds onto it until the loan is repaid in full. This ensures a secure lending environment, especially appealing to those with less-than-perfect credit or seeking quick approval.

Coppell auto title loans are designed for both new and used vehicles, offering flexibility for various borrowers. The application process begins with submitting necessary documents, including identification and proof of vehicle ownership. Lenders will then assess the value of your vehicle to determine the loan amount. Unlike traditional banks, Coppell auto title lenders prioritize the security of the title rather than extensive credit checks, making them a viable option for individuals with bad credit or those seeking a fast and convenient solution.

Coppell auto title loans offer a convenient solution for both used and new vehicle owners seeking financial flexibility. By leveraging the equity in your vehicle, you can access immediate funds without the need for traditional credit checks. This alternative financing method is particularly beneficial for those with less-than-perfect credit or urgent funding needs. With a clear understanding of the process, eligibility criteria, and benefits, Coppell auto title loans provide a reliable option to meet various financial obligations.