In Texas, a "Texas title loan no income verification" offers fast cash solutions by leveraging vehicle equity, bypassing traditional income and credit checks. This alternative financing method caters to self-employed or those without steady income streams, providing flexible repayment options and quick accessibility (same-day funding) with a lien on the borrower's vehicle title until repayment. It simplifies applications with just proof of ownership and clear title, making it accessible for diverse economic backgrounds and enabling use for unexpected expenses or debt consolidation, potentially improving future credit eligibility.

In the dynamic financial landscape of Texas, understanding unique options like title loans can be a game-changer. This article delves into “Texas Title Loan No Income Verification,” a distinct feature that sets it apart from traditional lending. We explore how this option dispenses with income verification, making it accessible to a broader spectrum of borrowers. By the end, you’ll grasp the benefits and considerations, empowering informed decisions in Texas’ diverse financial arena.

- Understanding Texas Title Loans: A Unique Financial Option

- No Income Verification: How Does It Work in Texas?

- Benefits and Considerations for Borrowers in Texas

Understanding Texas Title Loans: A Unique Financial Option

In Texas, title loans stand out as a unique financial option, particularly for individuals seeking fast cash solutions without the traditional income verification process. Unlike conventional loans that often require extensive documentation and strict credit checks, Texas title loans offer a more flexible approach. This alternative financing method allows borrowers to use their vehicle’s equity as collateral, providing access to immediate funds, which is why many turn to them in times of financial need. With a simple application process, these loans cater to those with diverse economic backgrounds, including the self-employed or those without steady income streams.

The appeal lies in the various repayment options available, making it manageable for borrowers. Whether through monthly installments or quicker payoff methods, Texas title loan no income verification provides a potential solution for those looking to bridge financial gaps. This form of financing has gained popularity due to its accessibility and ability to offer fast cash, giving borrowers a sense of security and flexibility when navigating unexpected expenses or urgent needs.

No Income Verification: How Does It Work in Texas?

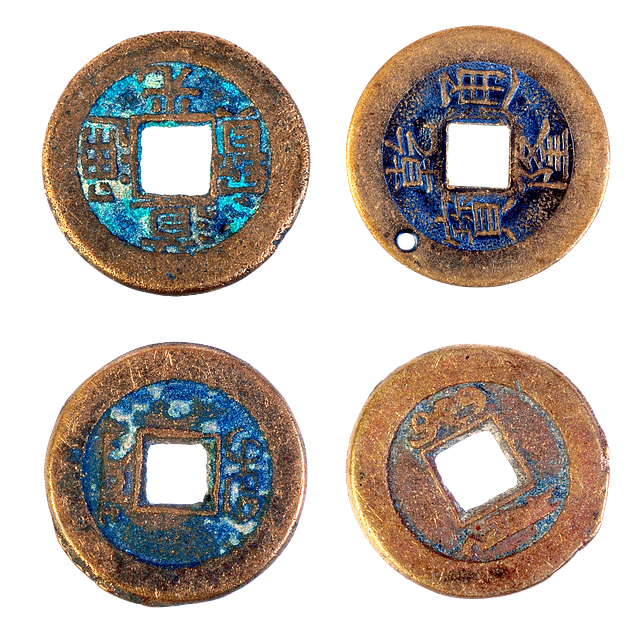

In Texas, the concept of a title loan no income verification offers a unique financial solution for individuals who need quick access to cash. This type of loan is designed to provide funding based on the value of an asset, typically a vehicle, rather than relying on traditional loan criteria that include extensive document checks and stringent financial assessments. With a Texas title loan no income verification, borrowers can avoid the usual rigors of proving their employment and income status.

The process works by allowing lenders to secure a lien on the borrower’s vehicle title. This means they hold onto the title as collateral until the loan is repaid, ensuring a form of security for the lender. Despite the lack of comprehensive income verification, these loans still have loan requirements that include minimum vehicle value and age standards. Moreover, while it might not be called out explicitly, borrowers should expect clear payment plans and terms, with options for same-day funding if they meet the necessary criteria.

Benefits and Considerations for Borrowers in Texas

In Texas, borrowers seeking financial assistance often find unique advantages with a Texas title loan no income verification option. This type of loan is particularly appealing for individuals who may not have traditional employment or struggle to provide detailed financial documentation. One significant benefit is the simplified application process; lenders typically require only proof of vehicle ownership and a clear car title, making it accessible for those in various economic situations.

Additionally, Texas title loans without income verification can offer borrowers several considerations. For instance, these loans often facilitate quick access to funds through direct deposit into the borrower’s account, enabling them to manage unexpected expenses or consolidate debt more efficiently. This flexibility is especially valuable for folks looking to improve their financial standing, as they can use the loan for various purposes like home repairs, education costs, or even debt consolidation, potentially reducing overall interest payments over time and improving loan eligibility for future credit options.

Texas title loan no income verification offers a unique financial solution for borrowers who need quick access to cash. By removing the requirement for traditional income verification, this option becomes particularly appealing for those with irregular income streams or limited work history. While it provides flexibility, borrowers must be mindful of the associated risks and high-interest rates. Understanding these nuances is crucial when considering a Texas title loan no income verification to ensure a responsible borrowing decision.