Car title loans Orange TX offer a fast cash solution secured by your vehicle's title, catering to borrowers with less-than-perfect credit. With simple online applications and flexible repayment plans, these loans provide quick financial aid (30 days – few months). However, borrowers should be aware of short terms and potential repossition risks, using them wisely for needs like debt consolidation.

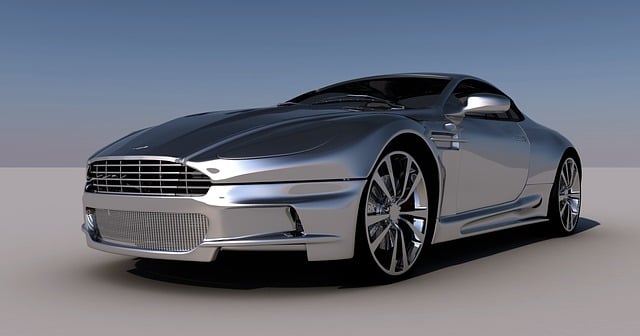

Looking for a fast way to access cash in Orange, Texas? Car title loans could be the solution. This article explores how these short-term financing options work and highlights their benefits and considerations specifically for residents of Orange, TX. Understanding car title loans can empower you to make informed decisions when needing quick cash. Learn more about this popular choice for gaining immediate access to funds using your vehicle’s title as collateral.

- Understanding Car Title Loans: A Quick Cash Solution

- How Do Car Title Loans Work in Orange TX?

- Benefits and Considerations for Car Title Loans Orange TX

Understanding Car Title Loans: A Quick Cash Solution

Car title loans Orange TX offer a fast and accessible way to secure cash using your vehicle’s title as collateral. This type of loan is designed for borrowers who need quick funding, often with less stringent requirements compared to traditional bank loans. Unlike Dallas Title Loans, which may have lengthy application processes, car title loans focus on the value of your vehicle rather than your credit history.

The loan terms for car title loans are typically shorter, ranging from 30 days to a few months, and involve a simple application process. To qualify for a car title loan, you must be the owner of the vehicle, have a clear title, and meet basic Loan Eligibility criteria. This makes it an attractive option for those in need of immediate financial assistance without the hassle of traditional loan applications.

How Do Car Title Loans Work in Orange TX?

Car title loans Orange TX are a convenient financial solution for individuals who need quick access to cash. The process is straightforward and involves using your vehicle’s title as collateral. Here’s how it works: First, you apply online with basic personal and vehicle information. Once approved, you’ll visit a lender to sign the loan agreement, providing them with your car title temporarily. The lender then issues the loan amount, which can be used for various purposes.

After fulfilling the loan terms, including making timely repayments, the lender will return your vehicle title. Car title loans offer flexible repayment options, allowing borrowers to pay back the loan over a set period, often through automated deductions from their bank account. This option is particularly appealing for Houston title loans seekers as it provides a quick and efficient way to access funds without traditional credit checks.

Benefits and Considerations for Car Title Loans Orange TX

Car title loans Orange TX offer a unique financial solution for individuals seeking quick funding. These loans are secured by the value of your vehicle, providing a faster and more accessible way to obtain capital compared to traditional loan options. One significant advantage is their simplicity; with fewer requirements and a streamlined application process, car title loans can be a suitable choice for those with less-than-perfect credit or no credit history. This alternative financing method allows borrowers to access substantial funds, enabling them to cover immediate expenses or explore opportunities that require capital.

When considering car title loans Orange TX, it’s essential to weigh the benefits against potential drawbacks. While these loans offer speed and flexibility, they are generally designed for short-term financial needs due to their structured repayment terms. Additionally, borrowers must be mindful of the loan extension implications and the risk of default, which could lead to the repossession of their vehicle. Proper planning and a clear understanding of the terms can help ensure a positive experience with car title loans, even considering debt consolidation as an option for managing existing debts more effectively.

Car title loans Orange TX offer a convenient and fast cash solution for those needing immediate financial support. By leveraging their vehicle’s equity, borrowers can access substantial funding with relatively simple qualification criteria. However, it’s crucial to weigh the benefits against potential drawbacks, such as interest rates and possible repossession risks, before securing a car title loan. Understanding these aspects will help ensure an informed decision tailored to individual financial needs.