Title loans for seniors provide quick cash by using your vehicle's title as collateral, simplifying borrowing for those who struggle with traditional banks. Ideal for emergencies and debt consolidation but carry higher interest rates, potential traps if not managed responsibly. The process involves clear steps: providing docs, discussing terms, signing paperwork, and receiving funds quickly based on your vehicle's value.

“Exploring Title Loans for Seniors: Unlocking Financial Solutions in Today’s Market

In today’s financial landscape, understanding accessible options is paramount, especially for seniors seeking short-term liquidity. This article serves as a comprehensive guide to demystifying title loans and their relevance for older adults. We’ll delve into the fundamentals of these secured loans, highlighting their unique benefits and potential drawbacks. Furthermore, we’ll provide an insightful step-by-step process overview, ensuring seniors know what to expect when navigating this alternative financing avenue.”

- Understanding Title Loans: A Simple Guide for Seniors

- Benefits and Considerations for Using Title Loans Today

- Navigating the Process: What to Expect Step-by-Step

Understanding Title Loans: A Simple Guide for Seniors

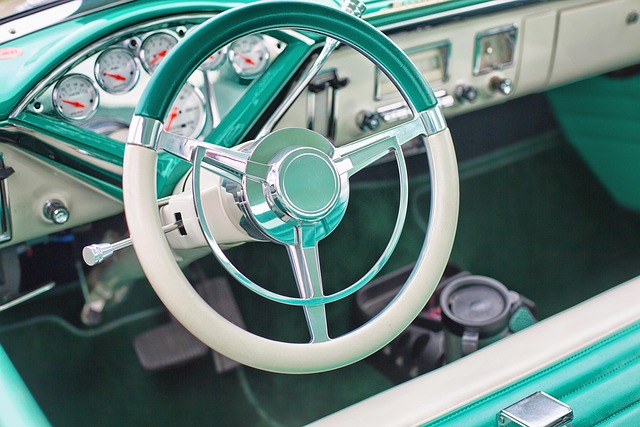

Title loans for seniors are a type of secured lending option designed to provide quick funding based on the value of their asset—typically their vehicle. Unlike traditional loans, these loans use the title of the vehicle as collateral, which means approval processes can be faster and simpler. This can be particularly beneficial for seniors who might face challenges in meeting stringent bank requirements due to age or health issues.

For those seeking debt consolidation or emergency funding, title loans can offer a viable solution. The process usually involves providing the lender with your vehicle’s title and proof of ownership, then driving your car to receive your loan funds. Once the loan is repaid, you get your title back. This option can be attractive due to its convenience and speed, but it’s crucial to understand the terms, including interest rates and repayment periods, before agreeing to any agreement, especially given the potential impact on future financial stability.

Benefits and Considerations for Using Title Loans Today

Title loans for seniors can be a viable financial solution during unexpected emergencies or when immediate funding is required. One of the key benefits is their accessibility; seniors with ownership of a vehicle can easily convert its equity into much-needed cash, providing them with quick access to emergency funds. This option is particularly appealing for those facing urgent expenses, such as medical bills or home repairs, without sufficient savings.

When considering title loans as an Emergency Funding mechanism, it’s crucial to evaluate both the advantages and potential drawbacks. While they offer speed and convenience, interest rates can be higher compared to traditional loan options. Seniors should also be mindful of the loan terms and ensure they have a clear understanding of the repayment process to avoid falling into debt traps. However, when used responsibly as a last resort for short-term financial needs, title loans can prove beneficial in providing much-needed relief during challenging times.

Navigating the Process: What to Expect Step-by-Step

Navigating the process for title loans for seniors involves several clear steps. First, you’ll need to provide documentation verifying your age and identity, as well as proof of vehicle ownership and its registration. This ensures that both parties are legitimate and protects the lender from potential fraud.

Next, discuss loan terms with a representative. They will explain interest rates, repayment schedules, and any fees associated with the car title loans. Be sure to ask about the direct deposit process if you prefer to have funds transferred electronically into your bank account. The lender will assess your vehicle’s value and determine the maximum loan amount available to you. Once you agree on terms, sign the necessary paperwork, and your funds could be accessible within a short timeframe.

Title loans for seniors offer a unique financial solution, providing quick access to cash secured by their vehicle’s title. Understanding this simple process and its benefits can empower older adults to make informed decisions about their financial needs. By navigating the steps outlined in this guide—from loan evaluation to repayment options—seniors can capitalize on the flexibility and convenience of today’s title loans while ensuring they are making a choice that aligns with their financial goals and circumstances.