Fast title loans Texas provide quick cash but come with higher interest rates, potential hidden fees, and stringent collateral requirements. To avoid financial surprises, thoroughly research lenders, compare fee structures, and consider alternative financing options like personal loans or credit unions before taking out a fast title loan in Texas.

“In the fast-paced world of finance, Fast Title Loans Texas have emerged as a quick solution for immediate cash needs. However, understanding the true cost of these loans is essential. This article delves into the hidden fees associated with Fast Title Loans Texas, shedding light on the potential pitfalls. From upfront charges to steep interest rates, we explore what borrowers should expect. Additionally, we offer valuable strategies to protect yourself, ensuring you make informed decisions when considering Fast Title Loans Texas.”

- Understanding Fast Title Loans Texas: Unveiling the Basics

- The Hidden Costs: A Closer Look at Fees in Fast Title Loans

- Protecting Yourself: Strategies to Avoid Unwanted Surprises with Fast Title Loans Texas

Understanding Fast Title Loans Texas: Unveiling the Basics

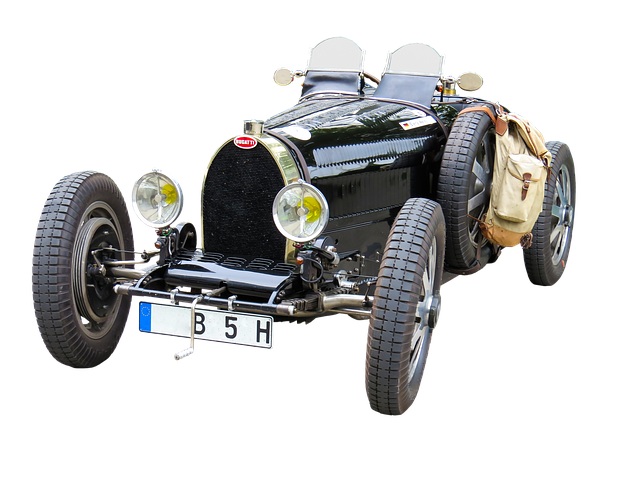

Fast title loans Texas offer a quick solution for individuals needing cash fast. These loans are secured against a person’s vehicle, allowing them to access funds while retaining ownership of their car. The process is straightforward and often involves less paperwork compared to traditional loan options. Lenders assess the value of the vehicle and provide a loan amount based on that assessment, along with an agreed-upon interest rate. This type of loan can be particularly appealing for those facing urgent financial needs, as it offers quick funding, usually within a few hours or the same day.

While fast title loans Texas provide a convenient option, borrowers should be aware of the associated fees and terms. Lenders typically charge interest rates that are higher than traditional bank loans. Additionally, there might be various other charges, such as administrative costs, inspection fees, or prepayment penalties. Borrowers must carefully review the loan agreement, understanding the total cost of borrowing, including both interest rates and any additional fees related to vehicle collateral.

The Hidden Costs: A Closer Look at Fees in Fast Title Loans

When considering fast title loans Texas, it’s crucial to understand that convenience comes at a cost. Beyond the principal amount borrowed, there are several hidden fees associated with these short-term, high-interest loans. These costs can significantly impact your overall financial burden, often adding up to more than expected.

Fees in fast title loans Texas encompass various charges, including application fees, processing fees, and even early repayment penalties. One notable aspect is the title transfer fee, which is a one-time charge for transferring ownership of your vehicle to the lender as collateral for the loan. Additionally, interest rates on secured loans like these are typically higher than those of traditional banking options, further exacerbating the financial strain.

Protecting Yourself: Strategies to Avoid Unwanted Surprises with Fast Title Loans Texas

When considering a fast title loan in Texas, it’s crucial to be proactive in protecting yourself from unexpected fees and charges. The first step is to thoroughly understand the title loan process. Researching and comparing lenders is essential; each lender may have different fee structures and terms. Look beyond the advertised interest rates and focus on what additional costs are associated with the loan. Ask about any hidden fees, such as processing or administrative charges, which can vary widely between lenders.

Additionally, consider alternative financing options if a fast cash need arises. While boat title loans might seem like a quick solution, they often come with higher interest rates and more stringent requirements. Opting for a secured personal loan or exploring credit union options could provide better terms and save you money in the long run. Remember, being informed and cautious is key to avoiding financial surprises when dealing with fast title loans Texas.

When considering fast title loans Texas, it’s crucial to be aware of the hidden fees that can significantly impact your financial situation. By understanding these costs and implementing protective strategies, you can make an informed decision and avoid unwanted surprises. Stay vigilant, do your research, and remember that transparency is key when dealing with any loan product.