Car title loan low-income assistance programs like Fort Worth Loans provide a crucial lifeline for individuals and families with limited finances, using their vehicle's equity as collateral. These loans offer flexible repayment terms, quick access to cash, and are ideal for those denied conventional loans due to low incomes or poor credit. By spreading out payments and avoiding strict eligibility criteria, these programs alleviate financial stress, encourage responsible borrowing, and help borrowers build or rebuild their credit score.

Car title loan low-income assistance programs provide a flexible financial safety net for those in need. With an increasing cost of living, these programs offer much-needed support, especially for low-income earners. This article explores how car title loan low-income assistance works, focusing on its key benefit: flexible repayment terms. By understanding these options, individuals can access the funds they require while managing their debt responsibly, paving the way towards financial stability and improved lives.

- Understanding Car Title Loan Low-Income Assistance

- How Flexible Repayment Terms Can Help

- Accessing and Navigating This Financial Support

Understanding Car Title Loan Low-Income Assistance

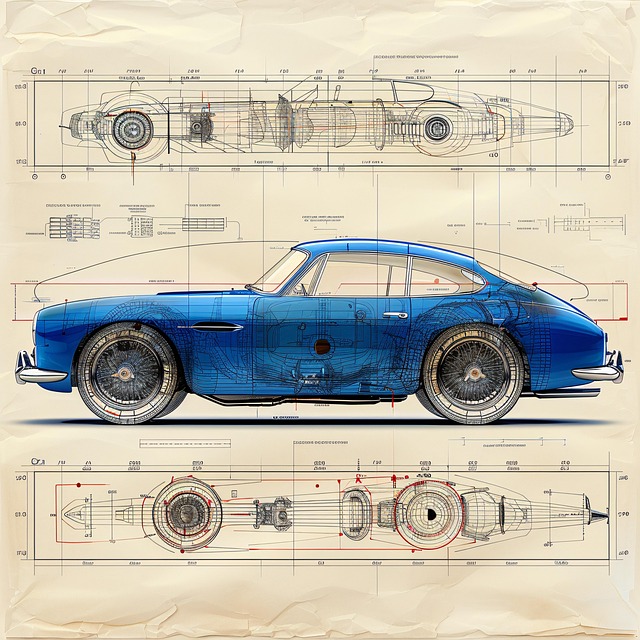

Car title loan low-income assistance is a program designed to help individuals and families with limited financial resources access much-needed funding by using their vehicle’s equity as collateral. This type of loan offers a unique benefit in that it allows borrowers to keep their vehicle while repaying the loan, unlike traditional pawn or secured loans that may require surrendering personal items. Fort Worth Loans, for instance, provides this assistance by focusing on flexible repayment terms tailored to the borrower’s budget, ensuring they can comfortably pay back the loan without sacrificing daily transportation.

The program is particularly appealing as it caters to those who may not qualify for conventional loans due to low incomes or poor credit histories. By using their car title as collateral, borrowers can gain access to a predetermined amount of cash, which can be used for various purposes such as covering unexpected expenses, paying bills, or improving living conditions. Moreover, with Car Title Loans, the process is often simpler and faster compared to traditional loan applications, providing much-needed relief in times of financial stress.

How Flexible Repayment Terms Can Help

Flexible repayment terms offered by car title loan low-income assistance programs can significantly ease financial burdens on individuals with limited income. This option allows borrowers to spread out their payments over a longer period, making each installment more manageable and affordable. Unlike traditional loans that often come with rigid repayment schedules, these terms provide a sense of security and predictability for those struggling financially. By adjusting the loan’s terms, borrowers can avoid the stress of abrupt, large-sum repayments, which is particularly beneficial when navigating low-income circumstances.

This flexibility also encourages responsible borrowing. With no credit check required and the potential for loan refinancing based on improved financial stability, individuals have an opportunity to build or rebuild their credit score. Quick funding from these programs can be a game-changer, enabling those in need to access necessary capital without the usual stringent eligibility criteria.

Accessing and Navigating This Financial Support

Accessing car title loan low-income assistance is a straightforward process designed to be accessible and confidential. Individuals interested in this financial support can start by researching reputable lenders who specialize in car title loans. Many online platforms and community resources provide directories of such lenders, making it easier to find one that aligns with your needs. Once identified, the next step involves evaluating loan eligibility based on factors like vehicle valuation and income verification.

Lenders will assess the value of your vehicle during the application process, ensuring it meets their minimum requirements for collateral. This step is crucial as it determines the loan amount you can secure. While low-income individuals may face challenges in obtaining traditional loans, car title loans offer an alternative by leveraging vehicle ownership. By understanding these processes and requirements, prospective borrowers can navigate this option effectively and potentially gain access to much-needed funds with flexible repayment terms tailored to their financial situation.

Car title loan low-income assistance provides a flexible solution for those in need, offering repayment terms tailored to their unique circumstances. By understanding this program and its benefits, individuals can access much-needed financial support with greater ease and peace of mind. Navigating this resource is a crucial step towards managing financial obligations effectively and securing a brighter future.