Pecos auto title loans offer quick funding (1-30 days) for individuals without perfect credit, using their vehicle's equity as collateral. Lenders assess the vehicle's condition, age, and market worth to determine loan eligibility and limits. Approved borrowers gain access to funds for diverse needs while retaining ownership rights; repayment terms are flexible. Understanding borrower rights and local regulations is crucial to make an informed decision regarding Pecos auto title loans.

“Pecos auto title loans have emerged as a popular financial solution for vehicle owners seeking quick cash. This comprehensive guide unravels the intricacies of these loans, offering a clear understanding of their functionality and benefits. We explore how Pecos auto title loans work, highlighting the advantages for borrowers while emphasizing the importance of knowing your rights. By delving into this topic, individuals can make informed decisions regarding their vehicle ownership rights in these transactions.”

- Understanding Pecos Auto Title Loans: A Comprehensive Overview

- How Do Pecos Auto Title Loans Work? Unlocking Vehicle Ownership Benefits

- Your Rights as a Borrower: Protecting Your Vehicle in Pecos Auto Title Loans Transactions

Understanding Pecos Auto Title Loans: A Comprehensive Overview

Pecos auto title loans are a type of secured loan where the borrower uses their vehicle’s title as collateral. This innovative financial solution allows individuals to access a predetermined amount based on their vehicle’s value, without needing perfect credit. It’s an attractive option for those in need of quick funding, offering a straightforward and relatively hassle-free process. The application typically involves providing personal information and details about the vehicle, after which lenders assess the asset’s worth to determine loan eligibility and approval amounts.

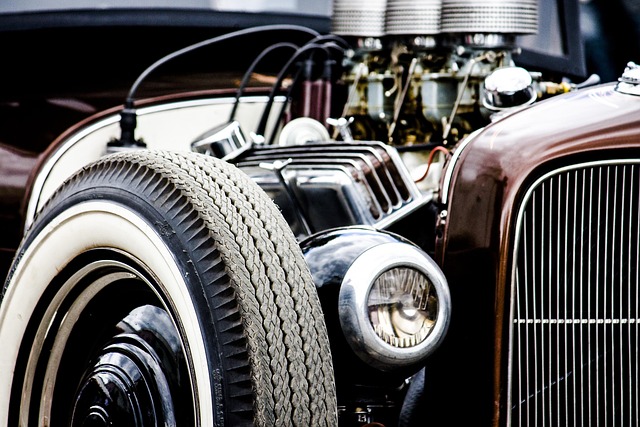

Understanding the fundamentals of Pecos auto title loans is crucial. Lenders conduct a thorough evaluation of the vehicle’s condition, age, and overall market value to establish the loan limit. This process ensures both fairness and protection for all parties involved. Once approved, borrowers can utilize the funds for various purposes, from unexpected expenses to business investments. It’s important to familiarize oneself with the specific loan requirements and terms offered by different lenders in Pecos to make an informed decision regarding this alternative financing method.

How Do Pecos Auto Title Loans Work? Unlocking Vehicle Ownership Benefits

Pecos auto title loans offer a unique opportunity for individuals to access immediate funding by using their vehicle’s equity as collateral. Here’s how it works: You present your vehicle’s title to a lender, who assesses its value and offers a loan based on that appraisal. Unlike traditional loans, these don’t typically require a credit check, making them accessible to borrowers with less-than-perfect credit. Once approved, you receive the funds, and the lender retains the car title until the loan is repaid in full. This process provides a quick solution for emergency expenses or business needs.

One of the key benefits of Pecos auto title loans is that they offer semi truck loans and Fort Worth loans with flexible repayment terms, allowing borrowers to manage their debt without additional strain on their finances. By harnessing your vehicle’s value, these loans provide an efficient way to gain access to capital while maintaining ownership rights over your asset, making them a viable option for those seeking financial flexibility.

Your Rights as a Borrower: Protecting Your Vehicle in Pecos Auto Title Loans Transactions

When considering Pecos auto title loans, it’s crucial to understand your rights as a borrower. These rights are designed to protect both you and your vehicle throughout the loan process. One of the primary safeguards is that lenders must conduct a thorough vehicle inspection before approving any loan. This ensures the value of your collateral and can help prevent fraud or inaccurate appraisals.

Moreover, understanding your ownership rights is key. Even with an outstanding loan, you retain legal ownership of your vehicle. Lenders only hold a lien on the title during the loan period. This means you’re free to sell or transfer ownership of the vehicle as long as the loan is paid in full. Comparing this to Houston title loans or even Motorcycle title loans, the rights and protections can vary, so it’s essential to familiarize yourself with local regulations and industry standards for optimal security and peace of mind.

Pecos auto title loans offer a unique solution for individuals seeking quick access to capital, allowing them to leverage their vehicle’s equity. By understanding how these loans work and knowing your rights as a borrower, you can make informed decisions regarding vehicle ownership. This comprehensive overview highlights the benefits and safeguards in place, ensuring that borrowers in Pecos can navigate these transactions with confidence, maintaining their vehicle ownership while accessing much-needed funds.