Missouri City car title loans provide a popular and accessible financing option, leveraging vehicle value for borrowers with varied credit histories. Unlike traditional bank loans, these offer competitive rates and flexible terms with swift access to funds. This section details the application process, approval times, and repayment options, while customer experiences offer valuable insights into lenders' services, transparency, and satisfaction. Residents can make informed decisions by understanding the benefits and potential risks of these loans as a short-term solution for financial emergencies.

“Missouri City residents often seek alternative financing options, and Missouri City car title loans have emerged as a popular choice. This article delves into the world of these secured loans, offering a comprehensive overview for local borrowers. We explore ‘Understanding Missouri City Car Title Loans’ and dive deeper into ‘Customer Experiences,’ analyzing reviews to uncover real-life insights. Furthermore, we provide an in-depth look at the ‘Advantages and Considerations’ to help residents make informed decisions regarding this unique financial service.”

- Understanding Missouri City Car Title Loans: A Comprehensive Overview

- Customer Experiences: Uncovering Reviews and Insights

- Advantages and Considerations: Weighing the Options for Missouri City Residents

Understanding Missouri City Car Title Loans: A Comprehensive Overview

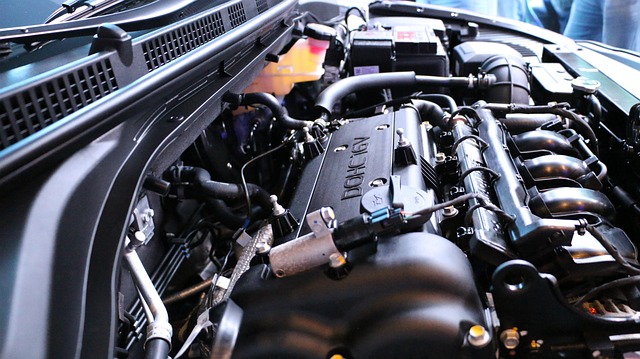

Missouri City car title loans have gained popularity as a quick and accessible form of financing for individuals in need of cash. These loans are secured by the value of a person’s vehicle, allowing lenders to offer competitive interest rates and flexible loan terms. Unlike traditional bank loans that often require strict creditworthiness criteria, Missouri City car title loans provide an alternative option for borrowers with less-than-perfect credit or no credit history.

In this comprehensive overview, we’ll explore the mechanics of how these loans work, including the application process, loan approval times, and repayment options. Prospective borrowers can benefit from understanding the benefits of Missouri City car title loans, such as fast access to funds, flexible payments tailored to individual needs, and the option for a quicker payoff if desired. By familiarizing themselves with this unique financing solution, residents of Missouri City can make informed decisions regarding their financial needs.

Customer Experiences: Uncovering Reviews and Insights

Customer Experiences offer a wealth of insights into the Missouri City car title loan process. Uncovering reviews from past borrowers provides an authentic perspective on lenders’ services, transparency, and overall customer satisfaction. These testimonials serve as a powerful tool for prospective borrowers, allowing them to gauge reliability and make informed decisions. By delving into these experiences, individuals can learn about the loan application process, interest rates, repayment terms, and the level of support provided by different lenders in Missouri City.

Many customers share their stories, highlighting the ease or challenges they faced when securing bad credit loans through car title loans. The reviews often emphasize the importance of understanding loan requirements and how quick funding can be a significant advantage. These first-hand accounts not only shed light on successful transactions but also caution against potential pitfalls, ensuring borrowers are well-prepared before engaging with any Missouri City car title loan provider.

Advantages and Considerations: Weighing the Options for Missouri City Residents

Missouri City residents looking for quick cash solutions have an option with Missouri City car title loans. This type of loan offers several advantages, especially for those with limited credit options. The primary benefit is accessibility; unlike traditional bank loans, car title loans do not require a perfect credit score or extensive financial history for approval. This makes it an attractive choice for individuals with bad credit or no credit at all, providing them with a chance to gain access to funds quickly.

When considering Missouri City car title loans, residents should weigh the potential benefits against some key considerations. Loan terms can vary, and borrowers should understand the repayment period and interest rates. It’s crucial to read the fine print and compare offers from different lenders to ensure fair and transparent loan approval processes. Additionally, while these loans can be a lifeline in financial emergencies, they should be seen as a short-term solution due to the potential for high-interest rates.

Missouri City car title loans can offer a valuable solution for residents facing financial challenges. By understanding the process, reviewing customer experiences, and considering both advantages and potential drawbacks, individuals can make informed decisions. Customer reviews highlight the benefits of quick access to cash and flexible repayment terms, making Missouri City car title loans an attractive option for those in need. However, it’s crucial to weigh these options carefully, ensuring a loan that aligns with your financial goals and capabilities.