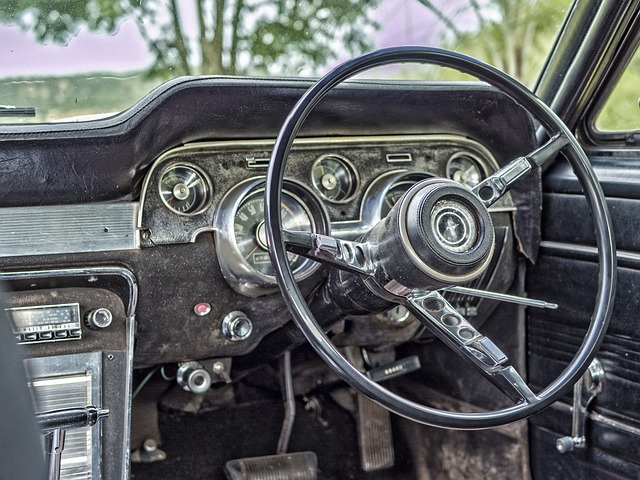

New Braunfels auto title loans offer a swift and accessible financial safety net for San Antonio residents, providing substantial funds secured by a borrower's vehicle. These loans cater to individuals with poor or no credit history, allowing them to retain ownership while gaining immediate cash access. With flexible repayment plans and a simple application process, these loans are ideal for covering unexpected expenses and planning longer-term financial strategies, including options for semi-truck owners seeking semi truck loans.

New Braunfels residents facing financial crises now have a powerful tool at their disposal: New Braunfels auto title loans. This innovative financing option allows borrowers to access immediate cash by leveraging the equity in their vehicles. With these loans, individuals can overcome short-term financial hurdles and regain control of their lives. The article explores the benefits, process, and how New Braunfels auto title loans provide much-needed solutions during challenging times.

- Understanding New Braunfels Auto Title Loans: Unlocking Immediate Financial Support

- Benefits for Borrowers in Financial Crises: How These Loans Provide Solutions

- Navigating the Process: Ensuring a Smooth Experience for New Braunfels Residents

Understanding New Braunfels Auto Title Loans: Unlocking Immediate Financial Support

New Braunfels auto title loans offer a unique solution for individuals facing financial crises and need immediate access to cash. This type of loan is secured by the borrower’s vehicle, allowing them to unlock a substantial amount of funds with minimal requirements. Unlike traditional loans that often come with stringent credit checks and complex application processes, New Braunfels auto title loans provide an alternative option for those with less-than-perfect credit or no credit at all. Borrowers can apply for these loans without worrying about strict credit evaluations, making it accessible to a broader range of people.

One significant advantage is the flexibility they offer in terms of repayment. Many lenders in New Braunfels cater to borrowers’ needs by providing customizable payment plans, allowing them to choose a schedule that aligns with their financial comfort level. This feature is especially beneficial for San Antonio loans, where individuals can manage their repayments over an extended period, making it easier to overcome short-term monetary challenges and regain financial stability.

Benefits for Borrowers in Financial Crises: How These Loans Provide Solutions

New Braunfels auto title loans offer a lifeline for individuals facing financial crises, providing them with accessible and flexible funding solutions. These loans are unique in that they use a person’s vehicle as collateral, allowing borrowers to gain immediate access to cash while still retaining ownership of their vehicle. This is particularly beneficial for those who may not have traditional banking options or credit histories, as it provides an alternative lending route.

One of the key advantages is the various repayment options available. Borrowers can choose plans tailored to their financial capabilities, making the process more manageable. Moreover, these loans are versatile; while commonly associated with car titles, they can also apply to semi-truck owners seeking semi truck loans, offering a safety net during unforeseen circumstances. This accessibility and adaptability make New Braunfels auto title loans an appealing choice for borrowers navigating challenging financial situations.

Navigating the Process: Ensuring a Smooth Experience for New Braunfels Residents

Navigating financial crises can be a challenging and stressful experience for any resident. In New Braunfels, one readily available solution that offers both speed and accessibility is New Braunfels auto title loans. This process is designed to ensure a smooth experience for borrowers who need quick financial relief. By leveraging the equity in their vehicles, residents can obtain emergency funds without extensive credit checks or waiting periods.

The simplicity of New Braunfels auto title loans makes it an attractive option, especially for those in urgent need of cash. The process involves providing clear vehicle ownership documentation and a simple application. Once approved, borrowers can access their funds promptly, allowing them to cover unexpected expenses or bridge financial gaps. This financial solution is ideal for managing short-term crises while exploring longer-term strategies for improved financial stability.

New Braunfels auto title loans offer a lifeline for residents facing financial crises, providing immediate access to funds without the stringent requirements of traditional loans. By leveraging the value of their vehicles, borrowers can gain much-needed cash flow to cover unexpected expenses or consolidate debt, ultimately helping them regain financial stability. With a straightforward application process and clear terms, these loans ensure a smooth experience for New Braunfels residents seeking quick and effective solutions.