Austin car title loans offer fast cash for individuals with limited credit or poor scores, using their vehicle's title as collateral. The process involves a simple application, vehicle inspection, and a temporary lien on the title until repayment. Approval is based on vehicle details and repayment ability, but these loans have higher interest rates and shorter terms. Borrowers should weigh the benefits against risks and create a realistic repayment plan to maintain financial health.

“Uncovering the Ins and Outs of Austin Car Title Loans: Your Comprehensive Guide.

Austin car title loans offer a unique financing option for individuals in need of quick cash. This alternative lending method uses your vehicle’s title as collateral, providing access to funds without traditional credit checks. Understanding the process is key to making an informed decision. This guide breaks down the Austin car title loan application journey, from initial eligibility checks to final loan terms, ensuring you’re prepared at every step.”

Understanding Austin Car Title Loans

Austin car title loans are a type of secured lending that offers quick cash to individuals using their vehicle’s title as collateral. Unlike traditional loans, these loans provide an alternative financing option for those with limited credit history or poor credit scores. The process involves a simple application where lenders assess your vehicle’s value and your ability to repay. Once approved, you can receive funds within a short time frame, making it an attractive choice for emergency expenses or unexpected financial needs.

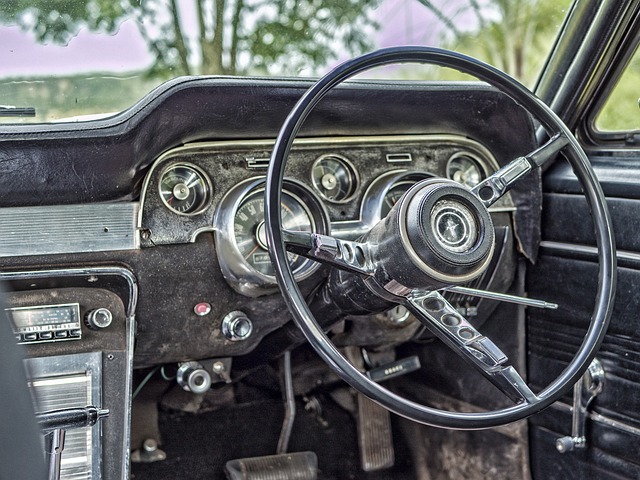

During the Austin car title loan application, a thorough vehicle inspection is conducted to determine its condition and current market value. This step is crucial in ensuring that the collateral is adequate for the loan amount requested. Following the inspection, if approved, a title transfer will take place, where the lender is listed as a secondary owner on your vehicle’s title until the loan is repaid in full. This temporary lien ensures the lender’s interest in the asset. Loan approval depends on various factors, including the vehicle’s make and model, its year, overall condition, and your ability to meet repayment terms.

– Definition and how they work

Austin car title loans are a type of secured lending where borrowers use their vehicle’s title as collateral to secure a loan. Unlike traditional bank loans that rely heavily on credit scores, Austin car title loans offer flexibility and accessibility to those with limited or poor credit history. This alternative financing option allows individuals to borrow funds by paving the way for quick approval and immediate access to cash.

The process typically involves submitting an application providing personal information and details about the vehicle. If approved, lenders will retain the physical title of the vehicle until the loan is repaid in full. The benefit lies in the ability to Keep Your Vehicle while obtaining a Loan Payoff, making it an attractive option for people seeking fast financial support without facing the inconvenience of handing over their car keys or being subjected to a No Credit Check.

– Benefits and risks outlined

When considering an Austin car title loan, it’s crucial to balance the benefits against potential risks. These short-term loans secured by your vehicle offer a quick and accessible way to obtain emergency funds, ideal for unforeseen expenses or covering unexpected financial obligations. Borrowers can expect relatively simple application processes compared to traditional bank loans, with less emphasis on credit history, making them an option for those with bad credit looking for fast cash.

However, the trade-off is the potential for higher interest rates and shorter repayment periods. Austin car title loans could put pressure on your budget if not managed responsibly. It’s essential to thoroughly understand the loan terms, including interest calculations and potential fees, to ensure you can repay the loan on time without facing significant financial strain. Prioritizing semi truck loans or bad credit loans shouldn’t overshadow the need for a realistic repayment plan, especially when considering the potential long-term impact on your finances.

When considering an Austin car title loan, understanding the process and its implications is key. This type of loan offers a quick cash solution for those in need, but it comes with significant risks, such as potential vehicle repossession if repayments are missed. By weighing the benefits against the drawbacks, borrowers can make an informed decision. Always remember to explore all options and choose reputable lenders to ensure the best possible outcome when applying for an Austin car title loan.