Title loan success stories debunk myths and highlight the positive impact of these lending options in real-life situations, especially for individuals with limited financial history or credit issues. They demonstrate how quick funding through secured title loans provides relief during emergencies, enabling people to consolidate debts, pay pressing bills, or fund business expansions. These narratives emphasize responsible borrowing, showcasing improved financial prospects and empowerment for those who leverage title loans wisely.

Title loan success stories are powerful tools in dispelling misconceptions surrounding these financial instruments. By showcasing real-life examples, we can demonstrate how title loans have lifted many individuals and families out of financial strain. This article explores the positive impact of these narratives, providing evidence to counter common myths. Through authentic stories, we reveal the reality of responsible borrowing, where success is achievable for those who need a helping hand.

- Debunking Common Myths About Title Loans: Using Success Stories as Evidence

- Real-Life Examples of How Title Loans Have Improved Financial Situations

- The Positive Impact of Title Loan Success Stories on Public Perception

Debunking Common Myths About Title Loans: Using Success Stories as Evidence

Many people hold misconceptions about title loans, often due to a lack of understanding or negative portrayals in media. Title loan success stories offer a powerful counterpoint to these myths. These real-life accounts showcase individuals who have successfully utilized title loans as a means to overcome financial challenges, providing tangible evidence that these lending options can be beneficial and accessible.

For instance, many believe that title loans are exclusively for those with excellent credit, but success stories from borrowers with bad credit or no credit history challenge this notion. Similarly, while secured loans like title loans do require an asset as collateral, these narratives demonstrate that same-day funding is possible, providing quick relief during emergencies, regardless of one’s financial background. Through sharing these experiences, we can dispel common myths and highlight the positive impact title loan success stories have on individuals’ lives.

Real-Life Examples of How Title Loans Have Improved Financial Situations

In many real-life scenarios, title loan success stories have emerged as a beacon of hope for individuals grappling with financial challenges. For instance, consider a hardworking family facing unexpected medical expenses and mounting bills. With their primary source of income stretched thin, they turn to a title loan, leveraging the equity in their vehicle for a quick cash injection. This financial lifeline enables them to consolidate debt, pay off pressing bills, and even have some left over for unforeseen future needs. It’s a testament to how these loans can provide much-needed relief during difficult times.

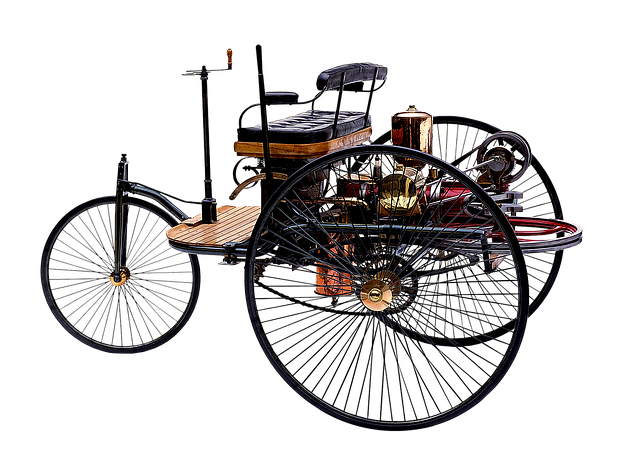

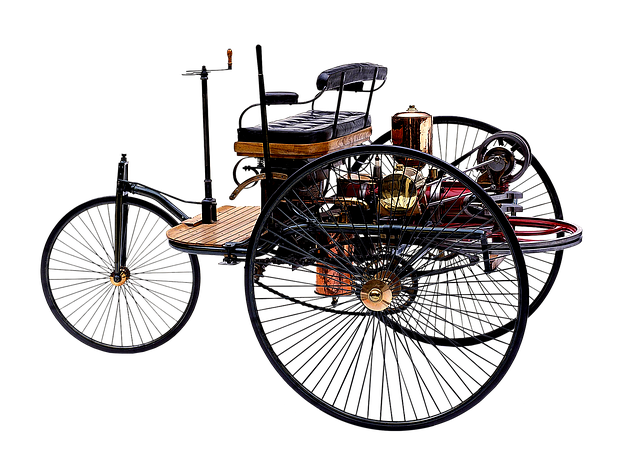

Another success story involves a small business owner who needs capital to expand their operation. Through a strategic approach involving vehicle valuation, they secure a title loan on their motorcycle, an asset they hold dear but can liquidate for immediate funds. The borrowed amount facilitates the growth of their enterprise, creating new opportunities and ultimately leading to financial stability and prosperity. These narratives underscore how title loans, when used responsibly, can empower individuals and businesses alike to overcome obstacles and chart a path towards a brighter future.

The Positive Impact of Title Loan Success Stories on Public Perception

Title loan success stories play a pivotal role in reshaping public perception about these financial tools. By sharing real-life experiences, individuals who have successfully utilized Houston title loans or similar services can dispel common myths and misconceptions surrounding title loans. These narratives often highlight the positive aspects of the Title Loan Process, such as its speed, convenience, and accessibility for those in need of quick cash.

When potential borrowers read or hear about someone successfully navigating loan terms and emerging with a favorable outcome, it fosters trust and understanding. Success stories can humanize an otherwise complex financial concept, making it easier for folks to grasp how title loans might benefit them during challenging times. This shift in perception is crucial, as it encourages responsible borrowing and empowers individuals to make informed decisions regarding their financial well-being.

Title loan success stories serve as powerful tools to combat misconceptions and misinformed opinions. By showcasing real-life examples where individuals have benefited from these loans, we can dispel myths and highlight the positive impact on financial stability. These narratives not only provide evidence but also foster a more informed public perception of title loans as viable short-term financial solutions. Embracing these success stories is crucial in building trust and understanding within communities, ensuring that those in need have access to resources without stigma or misunderstanding.