Same-day title loans cater specifically to seniors' financial needs by leveraging vehicle equity for quick access to cash within hours. With minimal paperwork, no credit check, and tailored repayment terms, these loans offer a dignified solution for urgent financial matters like unexpected medical bills or home repairs, especially in high-demand areas like Dallas.

“Exploring same-day title loans as a financial option for seniors can offer a convenient solution during times of need. This article delves into how these loans, secured against a senior’s vehicle title, provide quick access to cash with minimal hassle. We’ll examine the unique benefits and considerations for older borrowers, offering insights on navigating this process seamlessly. By understanding same-day title loans, seniors can make informed decisions, ensuring a stress-free financial experience.”

- Understanding Same Day Title Loans for Seniors

- Benefits and Considerations for Senior Borrowers

- Navigating the Process Without Hassle

Understanding Same Day Title Loans for Seniors

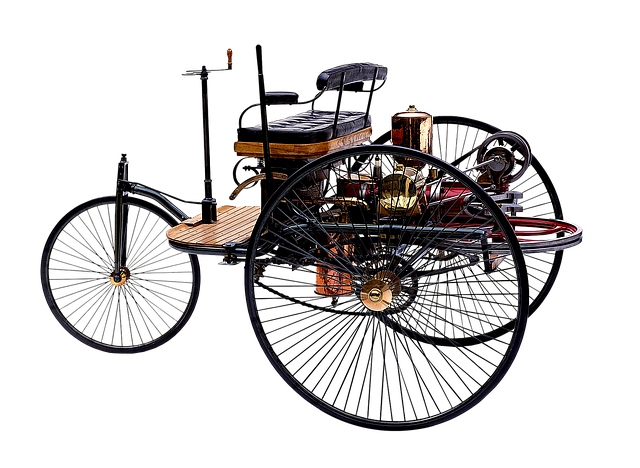

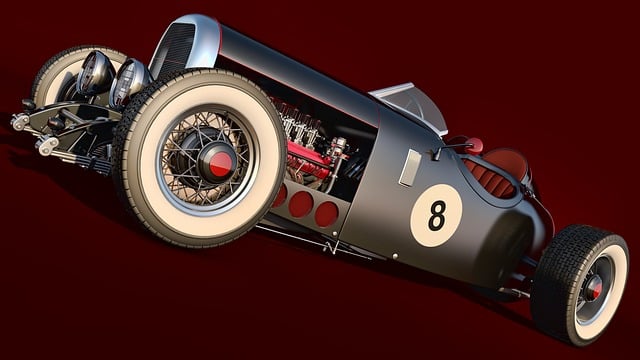

Same Day Title Loans for Seniors offer a unique financial solution tailored to meet the needs of older adults who may be facing unexpected expenses or cash flow issues. These loans, also known as senior-specific lending, provide quick access to funds by leveraging the equity in their vehicles. Unlike traditional bank loans, title loans have less stringent eligibility criteria, making them an attractive option for seniors who might struggle with complex application processes. The simplicity of the process is particularly appealing, allowing seniors to secure funding within hours through a straightforward procedure.

In Dallas, for instance, where the demand for such services is high, understanding Dallas Title Loans can be transformative for seniors. An online application process further streamlines the loan request, ensuring discretion and convenience. Once approved, funds are often deposited directly into the borrower’s account, providing immediate relief. This swiftness is particularly valuable for seniors dealing with urgent financial matters, offering them a reliable safety net during challenging times.

Benefits and Considerations for Senior Borrowers

Same day title loans can offer a much-needed financial safety net for seniors seeking quick access to cash. These short-term, secured lending options provide a straightforward alternative to traditional bank loans or credit lines, especially for those with limited credit history or low credit scores. One of the primary benefits is the quick approval process, often just requiring the title to a valuable asset like a car and proof of identity. This speed can be a game-changer when seniors face urgent financial needs.

Additionally, the loan terms are typically structured around the borrower’s ability to repay, making them more manageable for retirees on fixed incomes. While there are considerations, such as interest rates and potential fees, same day title loans can provide rapid quick funding during times of crisis or unexpected expenses. This accessibility could prove invaluable for seniors navigating financial challenges with dignity and without unnecessary stress.

Navigating the Process Without Hassle

Navigating financial challenges can be daunting, especially for seniors. However, with same-day title loans, the process is designed to be smooth and hassle-free. Unlike traditional loan options that may require extensive paperwork and credit checks, title loans use the equity in your vehicle as collateral, simplifying access to immediate funds. This means no lengthy applications or rigorous credit evaluations, making it an attractive solution for those with less-than-perfect credit histories.

The key advantage lies in the flexibility and accessibility these loans offer. Whether you need money for unexpected medical bills, home repairs, or even a boat title loan to fund your passion for boating, the process is straightforward. You can walk into a lender, provide the necessary documentation regarding your vehicle’s ownership, and receive your funds on the same day. Moreover, with no credit check required, those who may have struggled with traditional loans due to poor credit scores can still gain access to much-needed financial support.

Same day title loans for seniors offer a convenient solution for urgent financial needs without the hassle of traditional loan processes. By leveraging the equity in their vehicles, seniors can access fast funding with simplified requirements and flexible terms. However, it’s crucial to weigh the benefits against potential risks, such as interest rates and repayment terms, before making a decision. Understanding the process thoroughly and choosing a reputable lender can ensure a smooth experience for senior borrowers.