Title loan repossession can be avoided by understanding and addressing common triggers like payment defaults and vehicle maintenance issues. Borrowers should stay informed about their obligations, avoid late fees, and explore title loan repossession alternatives such as deferral programs that offer flexible payment plans and lower interest rates. These programs, including options for boat title loans, stabilize finances, allowing borrowers to regroup and manage debt responsibly while keeping their vehicles.

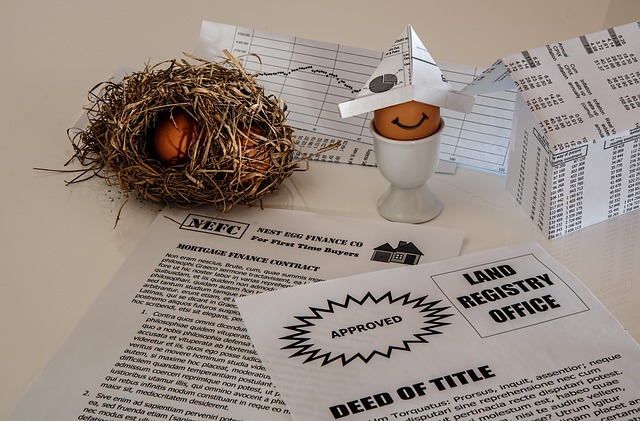

Title loans, despite their appeal as quick cash solutions, can lead to repossession if borrowers fall behind on payments. This article explores an effective alternative: Title Loan Deferral Programs. We’ll delve into the common causes and consequences of repossession, uncover how these deferral programs provide a financial lifeline for borrowers, and guide you through accessing and navigating them successfully, offering vital insights into preventing repossession and its detrimental impacts.

- Understanding Title Loan Repossession: Common Causes and Consequences

- Exploring Title Loan Deferral Programs: A Lifeline for Borrowers

- How to Access and Navigate These Programs Effectively

Understanding Title Loan Repossession: Common Causes and Consequences

Title loan repossession is a serious outcome that can occur when borrowers fail to meet their loan obligations. Understanding common causes is essential for exploring effective title loan repossession alternatives. One of the primary reasons is default on payments, where borrowers may miss or be unable to make scheduled repayments due to financial difficulties or unforeseen circumstances. This can lead to a cascade of consequences, including late fees and interest charges, ultimately resulting in the lender initiating the repossession process.

Another factor is the failure to maintain proper vehicle maintenance and insurance, especially if loan terms include specific requirements for these aspects. When borrowers let their vehicle ownership fall out of sync with loan agreements, it weakens their position and increases the likelihood of repossession. These situations underscore the importance of borrowers staying informed about their obligations and seeking help early on to avoid severe repercussions.

Exploring Title Loan Deferral Programs: A Lifeline for Borrowers

Title loan repossession alternatives, such as deferral programs, offer a lifeline for borrowers facing financial distress. These initiatives allow individuals to temporarily pause repayment, preventing the repossession of their vehicle collateral. By providing flexible payment plans and reduced interest rates, deferral programs give borrowers a chance to get back on track without losing their valuable assets.

Exploring these alternatives is crucial for anyone leveraging their vehicle as collateral for short-term financing. It’s not just about stopping repossession; it’s about accessing affordable solutions that can help stabilize financial situations, giving borrowers the opportunity to regroup and devise a long-term strategy for managing debt responsibly.

How to Access and Navigate These Programs Effectively

Accessing and navigating title loan deferral programs effectively involves a few key steps. First, research reputable lenders who offer such programs and ensure they are licensed and have clear terms and conditions. Many online platforms now provide convenient Online Application processes for various types of loans, including Boat Title Loans, making it easier to apply from the comfort of your home.

Before applying, understand the eligibility criteria, which may include factors like credit score, loan amount, and the value of your vehicle. Keep in mind that while these programs offer relief from repossession by allowing you to Keep Your Vehicle, they come with conditions and fees. Read through all the details to make an informed decision that best suits your financial situation.

Title loan repossession need not be the final outcome. By understanding common causes and exploring alternative solutions like deferral programs, borrowers can find a lifeline to avoid repossession. These programs offer a temporary respite, providing time to regain financial stability. Accessing and navigating these options effectively requires knowledge and proactive communication with lenders. Embracing these alternatives opens doors to new possibilities, offering not just relief but also a chance for long-term debt management. Thus, borrowers can break free from the cycle of repossession and chart a course towards financial health.