Exploring title loan alternatives empowers individuals with bad credit to access emergency funds flexibly while rebuilding their credit score. These options avoid using a car title as collateral, offering various repayment methods like direct deposit. By prioritizing credit repair, users can improve their chances of qualifying for better loan options in the future, including traditional bank loans or enhanced title loan alternatives. Building good financial habits enhances credit standing, enabling access to flexible financing and improved vehicle ownership through structured payment plans.

Struggling with bad credit and in need of a loan? Traditional title loans might not be an option, but there are viable alternatives available. This article explores powerful solutions for those seeking financial support without the stringent requirements of title loans. We’ll delve into understanding alternative loan options, repairing your credit score, and the long-term benefits of developing good financial habits. Discover how to access funds, restore your financial health, and chart a course towards stability.

- Understanding Title Loan Alternatives

- Exploring Credit Repair Options

- Benefits of Building Good Financial Habits

Understanding Title Loan Alternatives

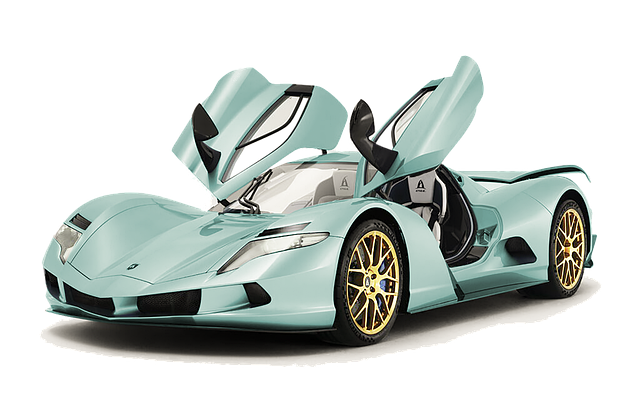

When considering Title Loan Alternatives for people with bad credit, it’s crucial to understand the options available beyond traditional loans. These alternatives cater specifically to those with limited credit history or poor credit scores, offering a chance to access much-needed funds without the strict requirements of a title loan. Instead of using a car title as collateral, these alternatives explore various repayment options, making them flexible for borrowers in need of emergency funds.

Exploring Title Loan Alternatives allows individuals to navigate their financial challenges with more control and less risk. With some providers offering direct deposit as a repayment method, borrowers can access funds promptly and manage their finances effectively. This shift from traditional title loans provides an opportunity for responsible borrowing, enabling individuals to rebuild their credit while meeting their immediate financial needs.

Exploring Credit Repair Options

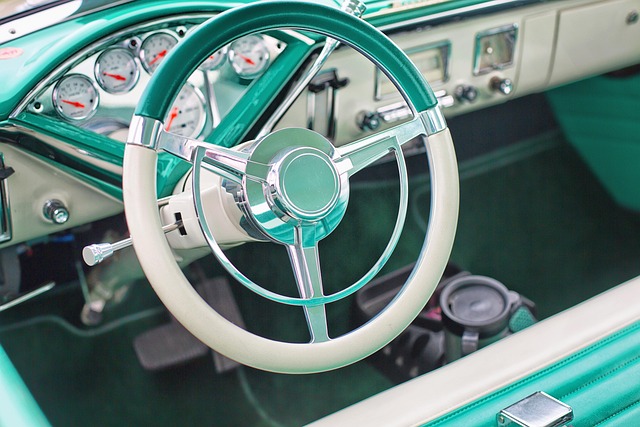

For those with less-than-perfect credit, exploring title loan alternatives can open doors to financial opportunities. One effective strategy is to focus on repairing and improving your credit score. This involves understanding your current Credit Check standing and taking proactive steps to address any errors or negative items on your report. Many reputable companies in cities like San Antonio Loans offer specialized services for credit repair, helping individuals navigate the process and ultimately improve their financial health.

By investing time in credit repair, you can make yourself eligible for better loan options in the future. This might include traditional bank loans, personal loans from credit unions, or even improved terms on existing title loan alternatives. Remember, the Title Loan Process isn’t the only route to take; with some patience and effort, repairing your credit can lead to a brighter financial future.

Benefits of Building Good Financial Habits

Building good financial habits can open up numerous doors for individuals with less-than-perfect credit, offering a more sustainable path to financial stability. One of the key advantages is improved access to various financing options, including title loan alternatives. Many lenders now recognize the value of responsible financial behavior and are willing to offer flexible payment plans, regardless of past credit issues. This shift allows people with bad credit to borrow money without the stringent requirements traditionally associated with loans, such as a thorough credit check.

By adopting good financial habits, individuals can also strengthen their relationship with vehicle ownership. Responsible borrowing practices demonstrate maturity and reliability to lenders, which can lead to more favorable terms on car titles or other asset-based loans. This approach empowers people to maintain or improve their Vehicle Ownership while managing debt effectively through structured payment plans tailored to their needs.

When facing financial challenges with bad credit, exploring title loan alternatives can open doors to better options. Understanding these alternatives, such as credit repair services and building good financial habits, empowers individuals to break free from debt traps. By adopting these strategies, folks can navigate their financial journeys more confidently, securing a brighter future without the constraints of poor credit. Remember that each person’s situation is unique, so tailoring solutions to individual needs is key.