Affordable car title loans offer quick cash access using a vehicle's registration as collateral, ideal for individuals with limited banking access or poor credit in areas like Dallas. These loans have fast approval times but come with high-interest rates and repossession risk if not repaid promptly. Key requirements include proof of ownership and valid driver's license. Best suited for emergencies or refinancing existing loans with better terms.

“In today’s financial landscape, Affordable Car Title Loans (ACTLs) present an attractive option for those seeking quick cash. This alternative financing method allows borrowers to use their vehicles as collateral, offering benefits like swift approval, competitive interest rates, flexible terms, and smaller loan amounts. However, it’s crucial to weigh the advantages against the drawbacks, including the risk of repossession, hidden fees, shorter repayment periods, and limited funds accessible. Understanding ACTLs is essential for making informed decisions regarding short-term funding.”

- Understanding Affordable Car Title Loans

- – Definition and how they work

- – Who they are for (i.e., eligibility requirements)

Understanding Affordable Car Title Loans

Affordable car title loans refer to a type of secured lending where individuals can use their vehicle’s registration (title) as collateral to secure a loan. This financial solution is designed for those in need of quick funding, offering a straightforward and often accessible path to capital. The process involves providing the lender with your vehicle’s title, which they hold until the loan is repaid. This type of loan is particularly appealing to those with less-than-perfect credit or limited banking options as it does not typically require a credit check.

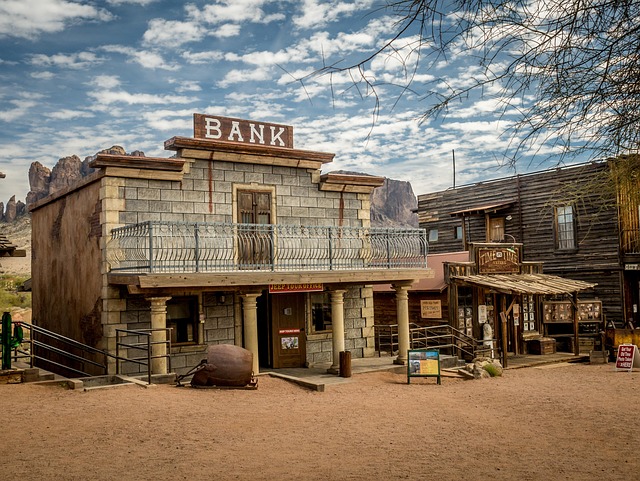

In Dallas, for instance, where traditional banking services might be less readily available, Dallas title loans can serve as an alternative financial solution. The benefits include fast approval times and easy access to funds, making them ideal for covering unexpected expenses or urgent financial needs. However, like any loan, there are potential drawbacks, such as high-interest rates and the risk of default leading to repossession of your vehicle. Understanding these aspects is crucial when considering an affordable car title loan as a temporary financial bridge.

– Definition and how they work

Affordable car title loans are a type of secured financing option where borrowers can use their vehicle’s title as collateral to secure a loan. This alternative lending method is popular for those in need of quick cash, often with less stringent credit requirements compared to traditional bank loans. The process typically involves assessing the vehicle’s value through a title pawn or vehicle valuation service, after which a lender sets the loan amount based on this appraisal.

The loan is then extended to the borrower, who agrees to pay back the sum, plus interest, within a specified period. The key advantage lies in the accessibility it offers; individuals with poor credit or no credit history can still gain access to funds. However, there are potential drawbacks, such as high-interest rates and the risk of repossession if repayments aren’t met, which should be considered before taking out an affordable car title loan. Loan requirements may vary between lenders but usually include proof of vehicle ownership and a valid driver’s license.

– Who they are for (i.e., eligibility requirements)

Affordable car title loans are a quick solution for borrowers who need access to cash and own a vehicle. These loans are designed for individuals with varying financial backgrounds, including those with bad credit or no credit at all. The primary eligibility requirement is having a clear vehicle title, which means you are the sole owner without any outstanding loans or liens. This makes car title loans an attractive option for borrowers seeking immediate funding, as they can often receive approval and access to funds within the same day.

While these loans provide a safety net for unexpected expenses, it’s important to consider potential drawbacks. Interest rates tend to be higher compared to traditional personal loans, and if you fail to repay on time, you risk losing your vehicle. However, for those in need of quick cash for emergency situations or who want to refinance an existing loan with better terms, affordable car title loans can offer a practical solution, ensuring same-day funding to meet immediate financial needs.

Affordable car title loans can provide a quick financial solution for those in need, but it’s crucial to understand both the benefits and drawbacks before proceeding. While these loans offer accessibility and potentially lower interest rates compared to traditional options, they come with risks such as high-interest accrual if not repaid promptly. Individuals considering this option should carefully evaluate their financial situation, ensure they meet eligibility criteria, and thoroughly research lenders to make an informed decision that aligns with their long-term goals.