Kyle auto title loans provide an alternative financing option for individuals with limited credit, using their vehicle's title as collateral. To qualify, borrowers must be 18+, have a valid ID/license, clear vehicle titles, and proof of income. Gathering necessary documents facilitates a smooth process. Effective management involves understanding flexible repayment options, maintaining open communication, creating a budget, ensuring timely payments, and promptly addressing financial difficulties with rescheduling or term adjustments.

Looking to borrow with Kyle auto title loans? This guide breaks down best practices for a smooth, informed process. First, understand what these loans entail and how they work in Kyle, Texas. Next, explore eligibility criteria and gather necessary documents. Learn about repayment options that suit your budget and discover tips for effective loan management to maintain a healthy financial profile. Optimize your experience with Kyle auto title loans by following these expert recommendations.

- Understanding Kyle Auto Title Loans: What You Need to Know

- Eligibility Criteria and Preparation for Borrowing

- Repayment Options and Best Practices for Loan Management

Understanding Kyle Auto Title Loans: What You Need to Know

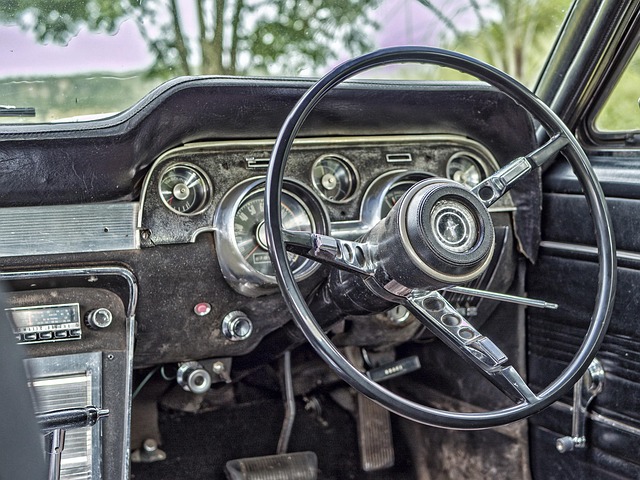

Kyle auto title loans are a type of secured lending where individuals can use their vehicle’s title as collateral to secure a loan. This alternative financing option is designed for borrowers who may need quick access to cash, especially if they have poor or no credit history. Unlike traditional loans that rely heavily on credit scores, Kyle auto title loans assess the value and condition of your vehicle to determine repayment terms.

When considering Kyle auto title loans, it’s crucial to understand the process involves a title transfer, where you temporarily hand over your vehicle’s registration until the loan is repaid. The lender will hold onto the title as security, ensuring they have recourse if you default on the loan. Fort Worth loans, like any other type of borrowing, come with interest rates and fees that can vary among lenders. It’s essential to compare offers from different providers to ensure you get a fair deal and understand the terms and conditions before signing any agreements involving your vehicle collateral.

Eligibility Criteria and Preparation for Borrowing

Before considering Kyle auto title loans, it’s essential to understand the eligibility criteria and what’s required for a smooth borrowing process. Lenders typically require borrowers to be at least 18 years old with a valid driver’s license or state ID. They must also have clear vehicle titles in their names, meaning no liens or existing loans on the car. Good credit is not always mandatory, but it can improve interest rates and loan terms. Additionally, lenders may ask for proof of income to ensure repayment capability.

Preparation plays a significant role in securing Kyle auto title loans. Borrowers should gather important documents like their ID, vehicle registration, insurance papers, and recent pay stubs. Keeping your vehicle insured and up-to-date with maintenance is crucial. Moreover, understanding flexible payment options available for motorcycle title loans can help manage loan repayments effectively while keeping your vehicle.

Repayment Options and Best Practices for Loan Management

When managing a Kyle auto title loan, understanding your repayment options is crucial. Lenders typically offer several flexible strategies to ensure borrowers can repay their loans comfortably. The most common methods include structured monthly installments and extended repayment plans. It’s important to discuss these with your lender in advance to choose an option that aligns with your budget. Select plans may also come with additional benefits, such as lower interest rates or the ability to prepay without penalties, which can help you save money over time.

Best practices for loan management involve keeping a close eye on your repayments and maintaining open communication with your lender. Creating a budget that accommodates loan payments is essential. Additionally, ensuring timely payments demonstrates responsible borrowing and can lead to improved loan terms in the future. If you encounter financial difficulties, reach out to your lender promptly to explore options like rescheduling payments or adjusting your loan terms. This proactive approach ensures you stay on top of your debt and maintain a positive relationship with your lending institution, which is key for managing Kyle auto title loans effectively.

When considering Kyle auto title loans, understanding the process, meeting eligibility criteria, and adopting best practices for loan management are key. By preparing thoroughly, choosing the right lender, and selecting a suitable repayment plan, borrowers can access much-needed funds while maintaining financial stability. Remember that responsible borrowing enhances your creditworthiness and ensures a positive experience with Kyle auto title loans.