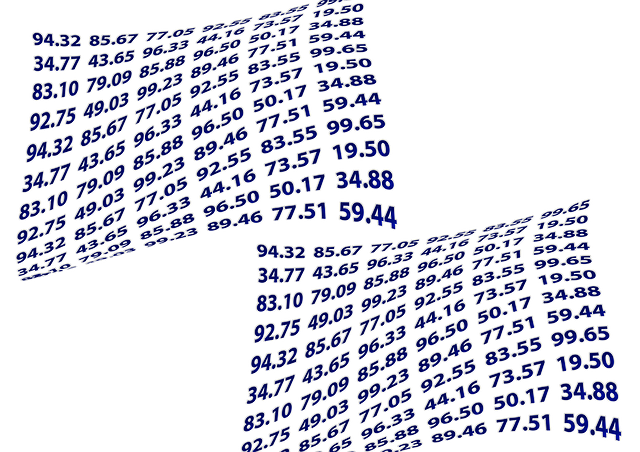

Hereford auto title loans offer a swift, flexible financial solution leveraging vehicle equity, with potentially lower interest rates and more manageable terms compared to traditional Fort Worth payday loans. The approval process is quick, extensions are available, and the loans prioritize long-term financial stability, making them a responsible alternative for borrowers with poor or no credit history. These loans provide higher approval rates, flexible repayment terms, and continued vehicle ownership, escaping the high-interest debt cycle often associated with payday advances.

Hereford auto title loans offer a distinct financial solution, leveraging the value of your vehicle for quick cash. Unlike payday loans, these loans provide longer terms and lower interest rates, making them a more sustainable choice. This article delves into the key differences and advantages of Hereford auto title loans, highlighting why they’re a preferable alternative to traditional payday advances. By understanding these distinctions, you can make an informed decision tailored to your needs.

- Understanding Hereford Auto Title Loans: A Unique Financial Option

- Key Differences Between Auto Title Loans and Payday Loans

- Advantages of Choosing Hereford Auto Title Loans Over Traditional Payday Advances

Understanding Hereford Auto Title Loans: A Unique Financial Option

Hereford auto title loans offer a unique financial solution for individuals seeking an alternative to traditional payday loans. This innovative option allows borrowers to use their vehicle’s equity as collateral, providing access to funds with potentially lower interest rates and more flexible repayment terms. Unlike Fort Worth loans that often come with stringent requirements and short-term deadlines, Hereford auto title loans prioritize long-term financial stability.

One of the key advantages is the quick approval process, ensuring borrowers can receive their loans swiftly during times of need. Additionally, should unforeseen circumstances arise, loan extensions might be available, offering a safety net and allowing for better management of repayment schedules. This feature distinguishes Hereford auto title loans from traditional payday advances, making them a considerate choice for responsible borrowing.

Key Differences Between Auto Title Loans and Payday Loans

Hereford auto title loans offer a unique alternative to traditional payday loans, providing borrowers with several key advantages. One of the most significant differences lies in the collateral requirement. Unlike payday loans that demand strict eligibility criteria and often require proof of income, Hereford auto title loans allow individuals to use their vehicle’s equity as security. This means that even if you have poor credit or no credit history, you can still access a loan approval based on your vehicle’s value.

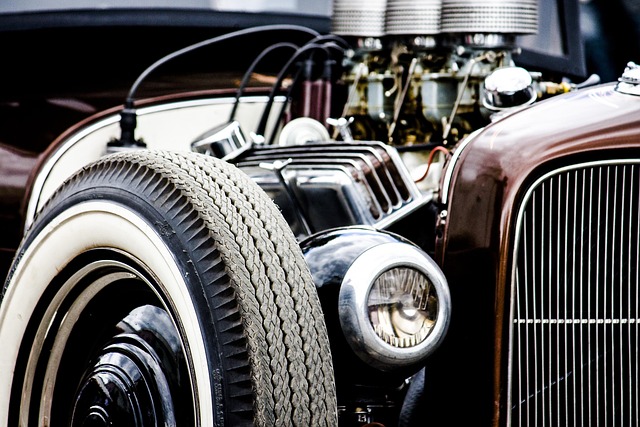

Another advantage is the flexibility they offer in terms of payments. With payday loans, borrowers typically face a single repayment date, often leading to a cycle of debt. However, with Hereford auto title loans, you can enjoy more flexible payments over an extended period. This enables better budget planning and the opportunity to keep your vehicle throughout the loan process, ensuring continued mobility and freedom.

Advantages of Choosing Hereford Auto Title Loans Over Traditional Payday Advances

When faced with a financial emergency, opting for Hereford auto title loans over traditional payday advances offers several significant advantages. One of the primary benefits is the potential for higher loan approval rates. Unlike payday loans, which often have stringent eligibility criteria based on employment and credit history, Hereford auto title loans consider more factors, providing a broader range of individuals with access to emergency funding.

Additionally, these loans offer flexibility in terms of repayment. While payday advances typically demand full repayment on the next payday, Hereford auto title loans allow for loan extensions, giving borrowers more time to manage their finances and avoid the cycle of high-interest debt. This makes them a more sustainable option for those needing immediate yet long-term financial support.

Hereford auto title loans offer a distinct financial solution with several advantages over traditional payday advances. By utilizing your vehicle’s equity, these loans provide greater flexibility and lower interest rates compared to payday loans. This option allows you to keep driving while repaying the loan, making it a more sustainable choice for managing short-term financial needs. With their structured repayment plans and potential for higher borrowing limits, Hereford auto title loans present a responsible alternative, catering to individuals seeking a reliable and accessible form of credit.