Schertz title loans provide a swift, convenient financial solution utilizing vehicle equity for immediate funding. The straightforward four-step process includes needs assessment, finding a reputable lender, submitting an application, and signing paperwork transferring the vehicle's title as collateral for direct deposit of the approved loan amount. Offering flexible repayment terms (12-36 months), these loans cater to urgent needs, even with lower credit scores, thanks to seamless direct deposit options.

“Schertz title loans offer a swift financial solution for those in need of quick cash. In this article, we’ll guide you through the fastest way to secure a Schertz title loan, demystifying the process and highlighting its benefits. Understanding Schertz title loans can empower individuals to make informed decisions about their short-term financial needs. By following a simple, step-by-step approach, you can unlock immediate access to funds, providing a reliable option when traditional loans may not be readily available.”

- Understanding Schertz Title Loans: Unlocking Quick Cash Access

- The Step-by-Step Process for Obtaining a Schertz Title Loan

- Benefits and Considerations: Why Choose a Schertz Title Loan?

Understanding Schertz Title Loans: Unlocking Quick Cash Access

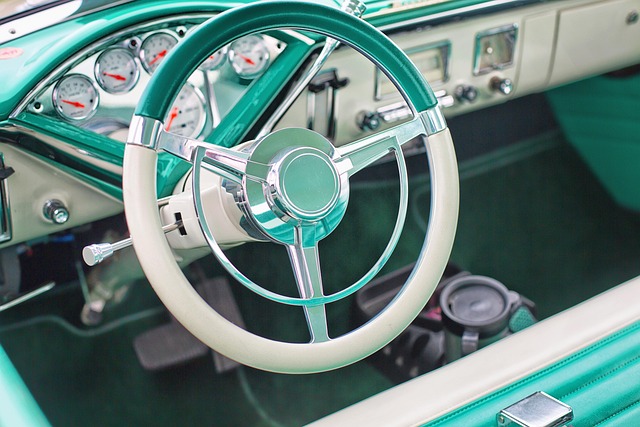

Schertz title loans offer a convenient and fast solution for individuals seeking immediate financial support. This type of loan utilizes the equity in your vehicle as collateral, allowing lenders to provide funding swiftly. The process involves assessing the value of your vehicle through a thorough vehicle valuation and evaluating your creditworthiness. Once approved, you can receive funds via direct deposit, providing quick access to cash when you need it most.

With Schertz title loans, borrowers benefit from flexible payment plans tailored to their financial capabilities. Unlike traditional loans, these titles offer a quicker turnaround time without extensive documentation or strict credit requirements. This makes them an attractive option for those in urgent need of money, ensuring they can get back on track financially with ease and speed.

The Step-by-Step Process for Obtaining a Schertz Title Loan

Obtaining a Schertz title loan is a straightforward process designed to provide you with emergency funding quickly. Here’s a step-by-step guide to help you navigate the Title Loan Process efficiently:

1. Assess Your Needs: Start by evaluating why you need the emergency funding. This will help guide your decision and ensure you choose the right loan amount. Keep in mind that Schertz title loans are ideal for short-term financial needs due to their fast turnaround time.

2. Locate a Reputable Lender: Not all lenders offer Schertz title loans, so it’s crucial to find one that does. Look for a lender with an established reputation and positive customer reviews. Compare interest rates, terms, and fees to ensure you’re getting the best deal possible. Once you’ve chosen a lender, prepare the necessary documents, such as your vehicle’s title, identification, and proof of income.

3. Submit Your Application: The application process is typically done online or in-person. Fill out the form accurately and completely, providing all the required information. Some lenders may also require additional documentation to verify your details. After submitting, you’ll receive an initial assessment of your loan request.

4. Finalise with Direct Deposit: Once approved, you’ll be asked to sign the necessary paperwork, which often includes a clear title transfer to the lender as collateral. The lender will then process a direct deposit of the agreed-upon amount into your bank account, providing you with immediate access to your Schertz title loan funds.

Benefits and Considerations: Why Choose a Schertz Title Loan?

Schertz title loans offer a unique financial solution for individuals seeking quick access to cash. One of the primary benefits is the speed at which borrowers can secure funds. Unlike traditional loan options that may involve lengthy application processes and waiting periods, Schertz title loans provide same-day funding. This means borrowers can receive their loans promptly, making them ideal for urgent financial needs.

Additionally, these loans offer flexibility in terms of repayment. Borrowers have the option to pay back the loan over a set period, typically 12-36 months, and keep their vehicle as collateral. This ensures that even with a lower credit score, individuals can still gain access to fast cash (fast cash). Furthermore, direct deposit options allow for seamless transactions, providing borrowers with convenient and efficient funding.

Schertz title loans offer a fast and flexible solution for those in need of immediate financial support. By understanding the simple step-by-step process and weighing the benefits, you can unlock quick cash access while leveraging your vehicle’s equity. Remember that while Schertz title loans provide a convenient option, it’s crucial to carefully consider the terms and conditions before making a decision.