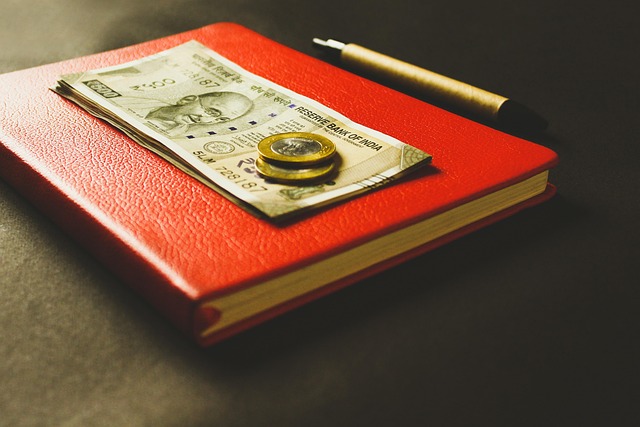

Car title loans Lockhart TX offer quick financial support secured by a borrower's vehicle, with minimal paperwork and credit checks. These loans are popular for their same-day availability via direct deposit options, suitable for unexpected expenses or debt consolidation. While accessible to those with less-than-perfect credit, borrowers must understand the potential risks of repossession and carefully research reputable lenders within legal boundaries to secure favorable terms.

In Lockhart, Texas, individuals facing financial challenges due to bad credit now have an alternative option with car title loans. These secured loans allow borrowers to use their vehicle’s title as collateral, providing access to quick funding despite past credit issues. Understanding the benefits and navigating the process is key to a positive experience. This article explores how car title loans in Lockhart TX can offer much-needed relief for those with limited credit options.

- Understanding Car Title Loans in Lockhart, TX

- Benefits and Considerations for Bad Credit Borrowers

- Navigating the Process and Ensuring a Positive Experience

Understanding Car Title Loans in Lockhart, TX

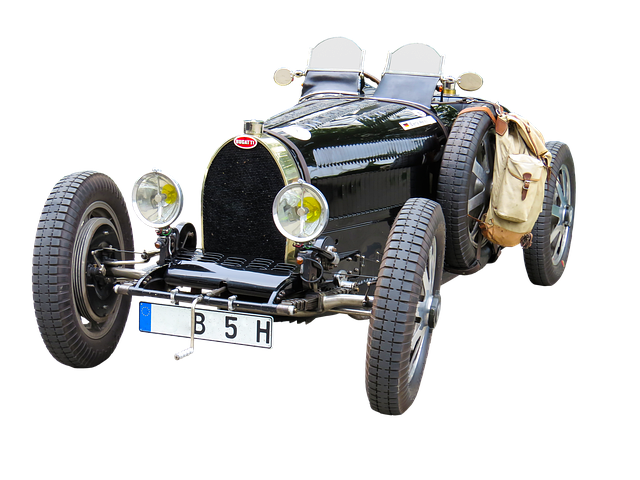

Car title loans Lockhart TX have gained popularity as a quick solution for individuals seeking financial assistance. This type of loan is secured by the borrower’s vehicle, typically a car or truck. The lender assesses the value of the vehicle and offers a loan amount based on its equity. Unlike traditional bank loans that require extensive paperwork and credit checks, car title loans in Lockhart are known for their simplicity and speed. Borrowers can obtain funds quickly, often within the same day, making it an attractive option for those with urgent financial needs.

In this process, the borrower hands over the vehicle’s title to the lender as collateral. Upon repayment of the loan, including interest and fees, the title is returned. Houston Title Loans, known for their quick approval process, offer a convenient alternative to conventional lending methods. With direct deposit options, borrowers can receive their funds seamlessly and use them for various purposes, such as covering unexpected expenses or consolidating debt. This flexibility has made car title loans an increasingly preferred choice for many individuals in Lockhart, TX.

Benefits and Considerations for Bad Credit Borrowers

For borrowers with less-than-perfect credit, car title loans Lockhart TX offer a unique opportunity to access quick funding. One significant advantage is that lenders typically focus on the value of the borrower’s vehicle rather than their credit history. This means individuals with bad credit or no credit can still qualify for a loan by providing ownership of their motor vehicle as collateral. It’s an inclusive financing option, ensuring those who may be denied traditional loans have a viable alternative.

When considering car title loans, it’s essential to understand the loan requirements and process. Lenders will assess the condition and value of your vehicle to determine eligibility. An online application is often the first step, allowing borrowers to apply from the comfort of their homes. This digital approach streamlines the process, and once approved, funds can be transferred quickly. However, borrowers should also consider the potential risks, such as repossession if unable to repay, and ensure they fully comprehend the terms before agreeing to any loan agreement.

Navigating the Process and Ensuring a Positive Experience

Navigating the process of securing a car title loan in Lockhart TX can seem daunting, but with the right approach, it can be a positive and beneficial experience for those with less-than-perfect credit. The key lies in understanding the terms and conditions clearly before committing. This involves thoroughly researching reputable lenders who specialize in car title loans Lockhart TX, ensuring they operate within legal boundaries and have a proven track record of customer satisfaction.

When dealing with these types of loans, using your vehicle as collateral is essential. It provides a safety net for lenders and often results in more favorable interest rates and repayment terms compared to traditional loans. Unlike Houston Title Loans or even Semi Truck Loans, which may have strict requirements, car title loans Lockhart TX are designed for individuals who need quick access to capital, offering a practical solution for immediate financial needs. With the right preparation and knowledge about Vehicle Collateral, you can make an informed decision and embark on a journey towards improved financial stability.

Car title loans Lockhart TX can provide a viable solution for individuals with bad credit seeking quick funding. By leveraging their vehicle’s equity, borrowers can access much-needed cash without the stringent requirements of traditional loans. However, it’s crucial to approach this option mindfully, understanding the potential risks and benefits outlined in this article. With careful consideration and a clear repayment plan, car title loans can offer a positive financial experience for those in need.