Jersey Village auto title loans offer a secured financing option where individuals borrow cash using their vehicle's title as collateral. Lenders assess the car's value, and approved borrowers can use funds for various needs while keeping their vehicle. The process is straightforward, requiring valid ID, proof of ownership, and income verification, with flexible repayment terms if consistent payments are made on time. Essential documents include a driver's license, utility bill, and vehicle title, with proof of income and social security number sometimes required.

“Exploring Jersey Village Auto Title Loans: Your Comprehensive Guide

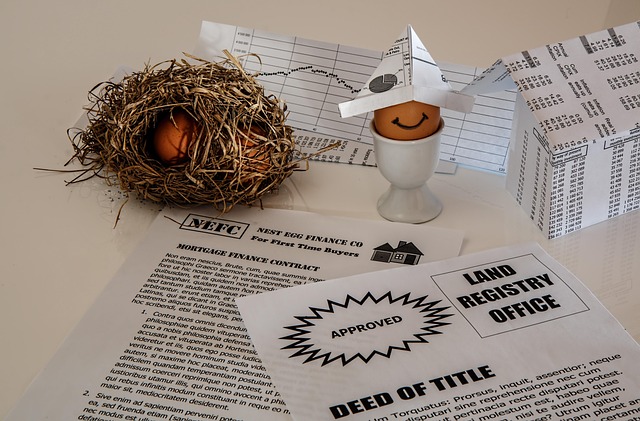

Are you considering a quick financial solution in Jersey Village? Auto title loans could be an option. This article demystifies one of the most frequently asked questions: What are Jersey Village auto title loans and how do they work? We break down eligibility criteria and the required documents for a seamless application process. By the end, you’ll have a clear understanding of this unique lending opportunity tailored to your needs.”

- What Are Auto Title Loans and How Do They Work?

- Who Qualifies for Jersey Village Auto Title Loans?

- What Documents Are Required for a Loan Application?

What Are Auto Title Loans and How Do They Work?

Jersey Village auto title loans are a type of secured loan where the borrower uses their vehicle’s title as collateral. This innovative financial solution allows individuals to access cash by leveraging the value of their car. Here’s how it works: The lender assesses the vehicle’s valuation and offers a loan amount based on its market worth. Unlike traditional loans that rely solely on credit scores, auto title loans consider both the vehicle’s appraisal and the borrower’s ability to repay.

Once approved, borrowers receive the loaned funds, which can be used for various purposes. The key to this process is the car’s title; it serves as security for the loan. Borrowers retain ownership of their vehicle but must make timely payments to avoid repossession. This unique arrangement provides a quick and efficient financial solution for Jersey Village residents in need of immediate funds, enabling them to manage unexpected expenses or consolidate debts effectively.

Who Qualifies for Jersey Village Auto Title Loans?

Jersey Village auto title loans are designed to offer financial support to individuals who own their vehicles outright. To qualify, borrowers must present a valid driver’s license or state ID, proof of vehicle ownership through a clear car title, and a stable source of income. The vehicle used for the loan should be in good working condition and have sufficient equity to cover the loan amount.

While specific requirements may vary among lenders, those seeking Jersey Village auto title loans can expect a straightforward application process. Lenders typically assess the value of the vehicle and offer loans based on a percentage of its appraisal value. Unlike traditional loans, car title loans provide flexible payments, allowing borrowers to manage their repayments over an extended period. Moreover, these loans are secured by the vehicle’s title, which means if payments are consistently made on time, borrowers can retain full use of their vehicle throughout the loan term.

What Documents Are Required for a Loan Application?

When applying for a Jersey Village auto title loan, you’ll need to provide several key documents to establish your identity and vehicle ownership. The basic requirements typically include a valid driver’s license or state-issued ID, proof of residency (such as a utility bill), and the title to your vehicle. It’s important to ensure that the vehicle is in your name and free from any liens or outstanding loans.

Additionally, you may be asked to supply proof of income, such as pay stubs or tax returns, and a social security number. For those interested in San Antonio loans or even semi truck loans, the application process remains largely similar, with the primary difference being the vehicle type. Payment plans for Jersey Village auto title loans are often flexible, designed to accommodate borrowers’ unique financial situations.

Jersey Village auto title loans offer a quick and accessible solution for those needing cash. By leveraging the equity in their vehicle, borrowers can gain approval with minimal requirements, making it an attractive option for many. Understanding how these loans work and who qualifies can empower individuals to make informed decisions about their financial needs.