Title loans for cars offer quick cash to borrowers using their vehicle's equity, but carry significant risks upon default. Regulated by laws protecting both lenders and borrowers, these loans involve credit checks, transparent terms, and potential repossession for non-payment. Informed decision-making is crucial for consumers seeking short-term financial support without long-term strain.

In today’s financial landscape, understanding title loans for cars is more crucial than ever. This article provides a comprehensive overview of these short-term lending solutions secured by vehicle ownership. We delve into the legal framework and regulations governing car title loans, ensuring consumers are informed about their rights and protections. By exploring these key aspects, we aim to empower folks navigating this option and highlight the importance of responsible borrowing in the modern market.

- Understanding Title Loans for Cars: A Comprehensive Overview

- Legal Framework and Regulations Governing Car Title Loans

- Consumer Rights and Protections in Title Loan Transactions

Understanding Title Loans for Cars: A Comprehensive Overview

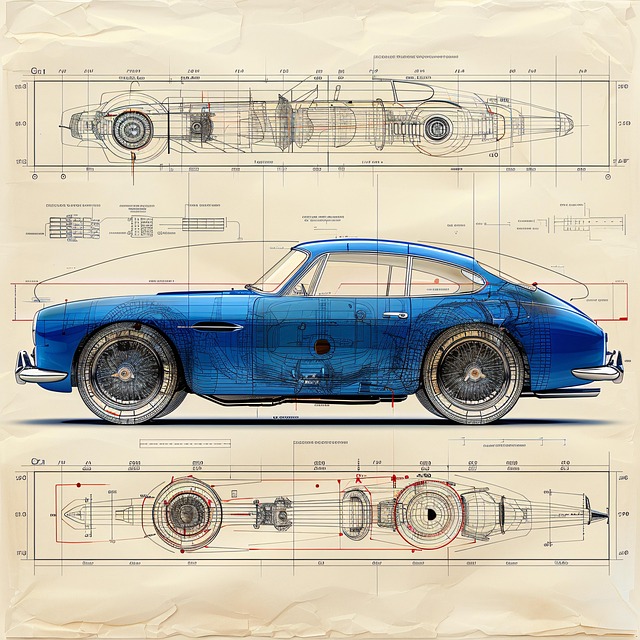

Title loans for cars have gained popularity as a quick financial solution for individuals needing immediate cash. This alternative lending option allows borrowers to use their vehicle’s equity as collateral, enabling them to access funds with relatively simple approval processes. The process typically involves assessing the vehicle’s value and offering a loan based on a percentage of its worth. This form of financing is especially attractive for those in need of rapid financial support, such as during unexpected expenses or emergencies.

Unlike traditional loans that may require extensive documentation and credit checks, title loans often have less stringent requirements. With quick approval times, borrowers can receive their funds within a short period, making it an appealing choice for those seeking immediate relief. However, it’s crucial to understand the terms and conditions thoroughly, as these loans are secured against the vehicle, posing potential risks if the borrower defaults on repayment.

Legal Framework and Regulations Governing Car Title Loans

The legal framework surrounding title loans for cars is designed to protect both lenders and borrowers. These loans, secured by the title of a vehicle, operate within a regulated environment to ensure fair practices. The specific regulations vary by jurisdiction, but common elements include cap rates on interest charges, disclosure requirements for loan terms, and provisions for borrower rights and remedies. Understanding these legal aspects is crucial for navigating the market and ensuring compliance.

Lenders must adhere to guidelines regarding loan eligibility, including credit checks, income verification, and appraisal of the vehicle’s value. Additionally, options for loan refinancing are available under certain conditions, allowing borrowers to adjust their repayment terms. While these loans can provide a quick source of emergency funds, it’s essential to familiarize oneself with local laws to make informed decisions and avoid potential pitfalls.

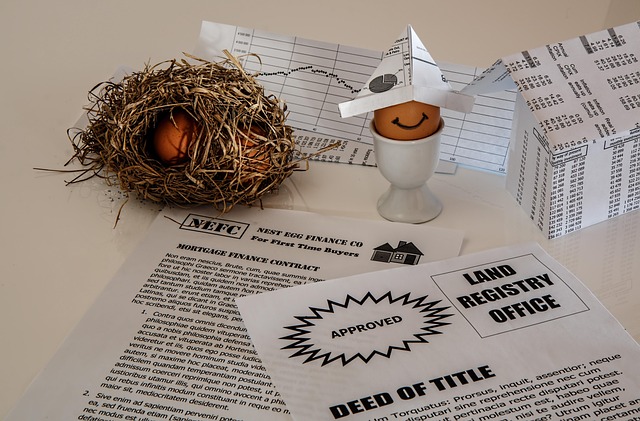

Consumer Rights and Protections in Title Loan Transactions

When entering into a title loan for cars, consumers are protected by various rights and regulations designed to safeguard them from predatory lending practices. These protections are essential, especially for borrowers who may be facing financial emergencies and looking for quick financial solutions. The primary focus is on ensuring transparency throughout the title loan process, including clear terms and conditions, interest rates, and repayment schedules.

Lenders must conduct a reasonable credit check to assess an individual’s ability to repay the loan. This step is crucial in preventing borrowers from accumulating excessive debt. Moreover, consumers have the right to understand the consequences of defaulting on such loans, including potential repossession of their vehicles. Such protections empower individuals to make informed decisions, ensuring that title loans for cars serve as a viable short-term financial solution without leading to long-term financial strain.

Title loans for cars offer a unique financial solution, but understanding the legal framework is crucial. This article has provided a comprehensive overview of title loans, highlighting their benefits and potential risks. By navigating the legal regulations and being aware of consumer rights, borrowers can make informed decisions. Remember that while title loans can provide quick cash, it’s essential to prioritize responsible borrowing practices to avoid adverse impacts on your financial health. Stay educated and always refer to local laws regarding title loan transactions.