Laredo auto title loans offer a fast and accessible financial solution for San Antonio residents, using vehicle titles as collateral for individuals with various credit histories or urgent needs. With simple applications, quick approvals, and benefits for truck owners, these loans are revolutionizing capital access. Recent initiatives in financial literacy programs empower locals to understand loan terms, interest rates, and the importance of timely repayments, fostering a healthier financial environment. These educational efforts allow residents to make informed decisions about Laredo auto title loans while maintaining financial stability.

In the dynamic financial landscape of Laredo, auto title loans have emerged as a significant resource for quick capital access. As financial education expands in this region, a closer look at Laredo auto title loans becomes imperative. This article explores the understanding and rise of financial literacy programs within the local auto loan industry. We delve into the benefits and considerations of these initiatives, highlighting their impact on Laredo borrowers by enhancing financial decision-making and overall well-being.

- Understanding Laredo Auto Title Loans: Unlocking Access to Quick Capital

- The Rise of Financial Literacy Programs in Laredo's Auto Loan Industry

- Benefits and Considerations: How Educational Initiatives Impact Laredo Borrowers

Understanding Laredo Auto Title Loans: Unlocking Access to Quick Capital

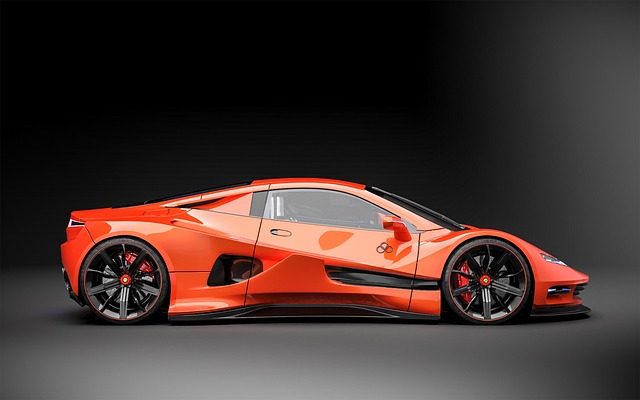

Laredo auto title loans have emerged as a powerful tool for individuals seeking quick financial assistance. This unique form of lending involves using the title of your vehicle as collateral, allowing you to access capital without strict credit requirements. It’s particularly beneficial for those in need of funds for unexpected expenses or who lack traditional loan options. By harnessing the value of your vehicle, Laredo auto title loans offer a swift and efficient solution, catering to various financial needs.

Unlike conventional loans that often demand impeccable credit history, Laredo auto title loans focus on the asset itself—your vehicle’s value. This approach makes them accessible to a broader range of individuals, including those with less-than-perfect credit or no credit at all. With a straightforward application process and quick turnaround times, these loans provide much-needed financial assistance in San Antonio and beyond. Whether it’s for truck title loans or personal expenses, this innovative financing option is redefining access to capital in the region.

The Rise of Financial Literacy Programs in Laredo's Auto Loan Industry

In recent years, the Laredo auto title loan industry has witnessed a significant surge in financial literacy programs aimed at empowering local communities. This shift is driven by a growing recognition of the importance of financial education in helping individuals make informed decisions regarding their assets, particularly when it comes to auto loans. With the rise of San Antonio loans and Fort Worth loans becoming more accessible, Laredo’s auto title loan providers are taking proactive measures to ensure borrowers understand the intricacies of these financial instruments.

These programs focus on teaching individuals how to effectively manage their vehicles as collateral for loans. By understanding concepts such as loan terms, interest rates, and the impact of timely repayments, borrowers can make strategic choices that keep their vehicles secure while accessing much-needed funds. This approach not only promotes responsible borrowing but also ensures that Laredo residents can navigate the auto loan landscape with confidence, ultimately fostering a healthier financial environment for all.

Benefits and Considerations: How Educational Initiatives Impact Laredo Borrowers

Laredo auto title loans have become a significant financial tool for many residents, offering quick access to capital secured by their vehicle equity. Educational initiatives aimed at improving financial literacy among borrowers play a crucial role in helping individuals make informed decisions about these loans. By understanding the complexities of vehicle collateral and loan refinancing options, Laredo borrowers can navigate this type of lending more effectively.

These educational efforts empower borrowers to weigh the benefits and risks associated with Laredo auto title loans. They learn how their vehicle’s equity is utilized as security, ensuring they can make responsible borrowing choices. Additionally, borrowers gain insights into potential savings through loan refinancing strategies, allowing them to manage debt efficiently. Such initiatives contribute to a more financially stable Laredo community, where residents are equipped to make the most of available resources while minimizing the risks associated with vehicle-secured loans.

Laredo auto title loans have emerged as a significant financial tool, but empowering borrowers requires more than just access to this option. The rise of comprehensive financial literacy programs focused on Laredo auto title loans is a game-changer. By educating individuals about responsible borrowing and providing tools for long-term financial health, these initiatives ensure that borrowers make informed decisions. Ultimately, expanding financial education around Laredo auto title loans benefits the community by fostering a culture of economic well-being and stability.