Car title loans, a popular option for quick cash but potentially predatory, require borrowers to use their vehicle's title as collateral. Consumer rights education is vital for informed decision-making in this industry. Advocacy groups and financial literacy programs empower individuals by providing knowledge about loan details, potential risks, and fair practices, enabling them to negotiate favorable terms and avoid exploitation, fostering responsible borrowing and transparent car title loan services.

In today’s economic landscape, many borrowers turn to car title lending as a rapid solution. However, understanding your rights is crucial when navigating this alternative financing option. This article explores the significance of consumer rights education in the context of car title loans, empowering individuals with knowledge to make informed decisions. We delve into strategies for advocacy and highlight fair practices, ensuring borrowers are protected and advocating for their interests in the car title loan industry.

- Understanding Car Title Loans and Consumer Rights

- The Importance of Education in Protecting Borrowers

- Strategies for Advocacy and Ensuring Fair Practices

Understanding Car Title Loans and Consumer Rights

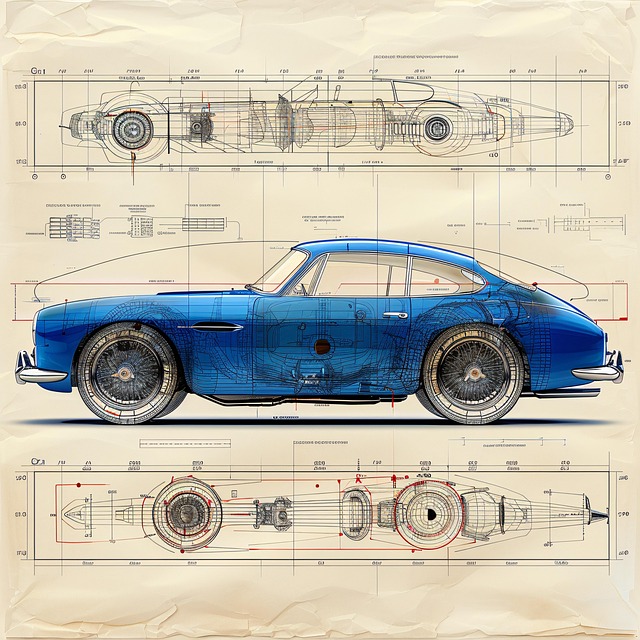

Car title loans are a type of secured lending where borrowers use their vehicle’s title as collateral. This alternative financing option is popular among individuals with limited credit history or those seeking quick cash, often referred to as bad credit loans or cash advance solutions. However, it’s crucial for consumers to understand the terms and conditions associated with such loans. Consumer rights education plays a pivotal role in empowering individuals to make informed decisions regarding car title lending.

By learning about their consumer rights, borrowers can navigate the process confidently, ensuring they meet the loan requirements fairly. This includes understanding the interest rates, repayment terms, and potential fees attached to these short-term financial arrangements. Car title loan consumer advocacy groups often provide valuable resources and guidance, helping individuals protect themselves from predatory lending practices and making informed choices when considering a car title loan as a temporary financial solution.

The Importance of Education in Protecting Borrowers

Consumer education plays a pivotal role in safeguarding borrowers who opt for car title loans, a popular yet potentially risky financial option. Many individuals turn to Fort Worth Loans as a quick solution for unforeseen expenses, but without proper guidance, they may find themselves trapped in cycles of debt. By providing comprehensive consumer rights education, lenders and advocacy groups can empower borrowers to make informed decisions. This includes understanding the intricate details of loan requirements, interest rates, and repayment terms, ensuring they know their rights and obligations.

Through awareness campaigns, individuals can learn about potential pitfalls like extensive credit checks, hidden fees, and aggressive collection practices. Armed with this knowledge, borrowers can negotiate favorable terms, avoid predatory lending practices, and maintain financial stability. Car title loan consumer advocacy is not just about preventing fraud; it’s about fostering a culture where responsible borrowing flourishes, enabling folks to access necessary funds without sacrificing their long-term economic well-being.

Strategies for Advocacy and Ensuring Fair Practices

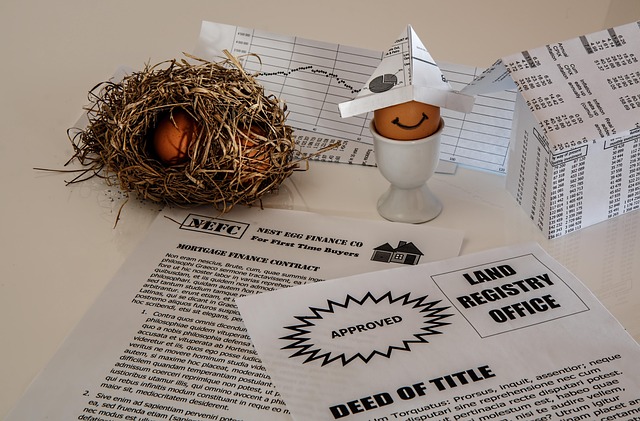

Effective consumer rights education plays a pivotal role in empowering individuals to navigate the complex landscape of car title lending. By providing comprehensive knowledge about their rights and responsibilities, borrowers can make informed decisions when seeking Houston title loans. This education should cover various aspects, including understanding repayment options, the implications of default, and the importance of maintaining vehicle ownership throughout the loan period.

Advocacy groups and financial literacy programs can significantly contribute to this cause by organizing workshops, distributing informative materials, and facilitating open discussions about fair lending practices. They can push for stricter regulations that safeguard consumers from predatory lending strategies. Encouraging borrowers to compare rates, negotiate terms, and seek second opinions before signing any agreements is a practical strategy for advocacy. Empowered consumers are better equipped to exercise their rights and ensure they have access to transparent and equitable car title loan services.

Consumer rights education plays a pivotal role in empowering individuals to navigate the complexities of car title lending. By understanding their rights and the practices involved, borrowers can make informed decisions and protect themselves from predatory loans. Through advocacy and fair practice strategies, we can ensure that car title loan services operate transparently, promoting financial stability for all consumers. This knowledge is a powerful tool in the ongoing fight for consumer advocacy in the car title loan industry.