Title loans for luxury vehicles offer a flexible financing option for car enthusiasts, allowing borrowers to use their vehicle's equity as collateral without perfect credit or extensive financial history. San Antonio and Houston lenders streamline the process with straightforward applications, quick approvals, and customizable repayment terms, empowering individuals to fund purchases like semi trucks or enjoy luxury cars without stress. Key steps include determining vehicle value, filling out an application, and discussing tailored terms including loan amounts, interest rates, and collateral requirements.

Flexibility is key when it comes to financing your dream luxury vehicle. Title loans offer a unique and accessible way to achieve this, with flexible terms tailored to your needs. This article explores how these loans can help you secure the car of your desires, providing an alternative financing solution. We’ll delve into the benefits of flexible terms, from manageable repayment plans to quick access to funds. Additionally, we’ll guide you through the process, offering insights on what to expect when applying for a title loan specifically for luxury vehicles.

- Understanding Title Loans for Luxury Vehicles: A Flexible Financing Option

- The Benefits of Flexible Terms in Securing Your Dream Car

- Navigating the Process: What to Expect When Applying for a Title Loan

Understanding Title Loans for Luxury Vehicles: A Flexible Financing Option

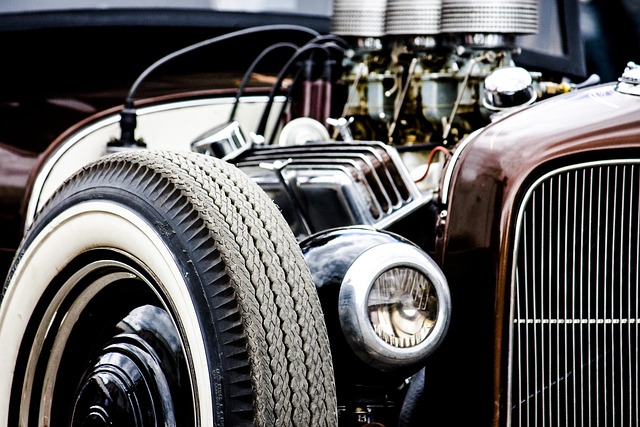

Title loans for luxury vehicles offer a flexible financing solution for car enthusiasts seeking to acquire high-end automobiles. Unlike traditional loan options that may have stringent requirements and long approval processes, these loans provide an alternative approach. With a title loan, borrowers can use the equity in their luxury vehicle as collateral, allowing them to access funds quickly without needing perfect credit or extensive financial history. This makes it an attractive option for those who own valuable cars but lack the cash flow to make large purchases outright.

In San Antonio Loans, for instance, individuals looking to fund a semi truck purchase can take advantage of this flexible financing. The process is generally straightforward; borrowers simply provide the vehicle’s title and prove ownership. Once approved, they receive a loan amount based on their car’s value, enabling them to cover expenses without disrupting their daily lives. Moreover, repayment terms are often tailored to individual needs, offering monthly installments that fit within their budgets, ensuring a manageable experience throughout the loan period.

The Benefits of Flexible Terms in Securing Your Dream Car

Securing your dream luxury vehicle just got easier with flexible terms on title loans. Unlike traditional financing options that can be restrictive and time-consuming, Houston title loans offer a streamlined process with various repayment options tailored to suit different needs. This flexibility allows you to focus on enjoying your new car without the added stress of managing complex payments.

Whether you’re looking to maintain a steady monthly payment or prefer shorter terms for quicker ownership, the Title Loan Process provides several benefits. It’s not just about acquiring your desired vehicle; it empowers you with control over how and when you repay, ensuring that owning your luxury car aligns seamlessly with your financial goals and lifestyle.

Navigating the Process: What to Expect When Applying for a Title Loan

Navigating the process of applying for a title loan for luxury vehicles can seem intimidating, but with the right understanding, it becomes a smoother experience. The first step is to determine your vehicle’s value, which will help lenders assess the maximum loan amount they can offer. This involves providing details about your vehicle’s make, model, year, and overall condition. Once your vehicle’s worth is established, you’ll need to fill out an application with personal information like your name, contact details, and employment status. Lenders may also require proof of insurance and registration for the vehicle.

After submitting your application, expect a swift response. Lenders will review your request and get in touch to discuss terms and conditions. This is where the flexibility comes into play. They’ll explain the loan amount available, interest rates, repayment periods, and collateral requirements. Remember, these Houston title loans are designed for luxury vehicles, so the process caters to the unique needs of such assets. Whether it’s a semi truck loan or financing for a sports car, lenders aim to provide tailored solutions while ensuring both parties understand the agreement.

Title loans for luxury vehicles offer a flexible financing solution, allowing enthusiasts to secure their dream cars with convenient terms. By understanding this process and its benefits, you can take the first step towards enjoying your desired vehicle without breaking the bank. Navigating the application process is straightforward, ensuring a stress-free experience. Embrace the flexibility and make your luxury car aspirations a reality today.