In the competitive higher education market, Texas title loans provide a unique solution for cash-strapped students by offering quick access to funds using vehicle value as collateral. These loans cater specifically to students' immediate financial needs without extensive credit checks, but come with high-interest rates and late repayment penalties. Qualifying requires enrollment in an accredited Texas institution and maintaining a minimum GPA, making them a responsible alternative financing option for students facing funding gaps.

“Unraveling the complexities of financial aid, this article offers comprehensive answers to pressing questions about Texas title loans tailored for college students. From understanding the concept and eligibility criteria to weighing the advantages and disadvantages, we demystify this lending option. Additionally, our step-by-step guide navigates the application process, equipping students with crucial insights on necessary documents, requirements, and responsible borrowing practices for informed decision-making regarding a Texas title loan.”

- Understanding Texas Title Loans for College Students

- – Definition and basic mechanics

- – Eligibility criteria for students

Understanding Texas Title Loans for College Students

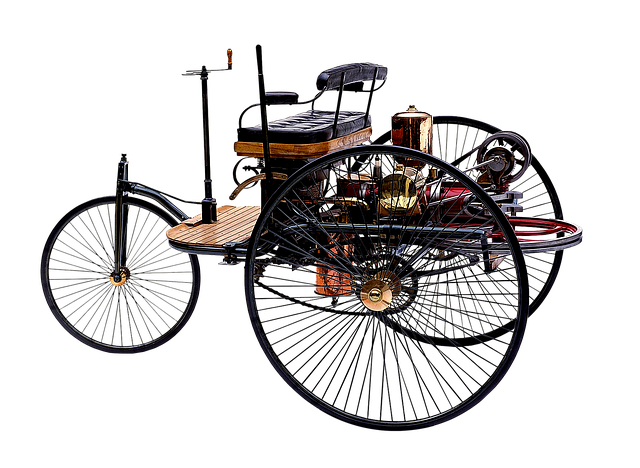

In the competitive world of higher education, many college students seek financial solutions to bridge the gap between their expenses and available aid. One option gaining traction among students is the Texas title loan for college students. This unique form of lending provides a quick and accessible way to secure funds, often with less stringent requirements compared to traditional bank loans. It’s particularly appealing to those in need of immediate financial support during their academic journey.

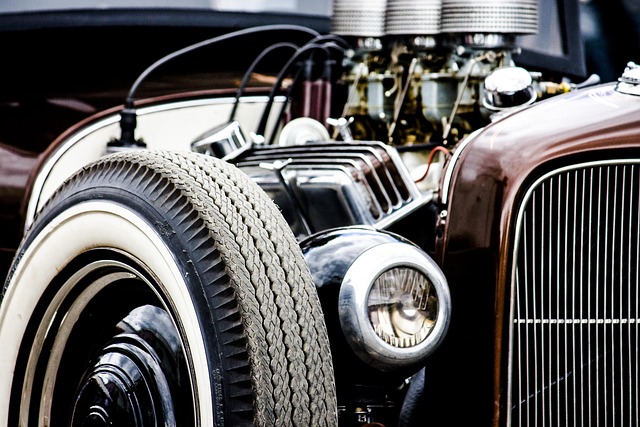

Dallas title loans, as part of this framework, offer a viable alternative when students require short-term funding. Unlike loan extensions from banks, which might involve extensive paperwork and credit checks, Texas title loans focus on the value of an individual’s asset—typically their vehicle—rather than their credit history. This makes it possible for students to gain access to much-needed cash without the usual barriers, serving as a practical financial solution tailored to their needs.

– Definition and basic mechanics

A Texas title loan for college students is a type of short-term financing that allows students to use their vehicle ownership as collateral to secure a cash advance. It’s designed to provide financial assistance during times when immediate funds are needed, such as covering unexpected expenses or paying for educational costs not covered by traditional loans. The process is relatively straightforward: the student brings in their vehicle title, which proves ownership, and agrees to repay the loan amount plus interest within a set period, usually 30 days. Once repaid, the student regains full control of their vehicle title.

This type of loan can be attractive for college students who may not have established credit or need faster access to funds compared to traditional banking options. However, it’s crucial to understand the mechanics and implications fully. Like a cash advance, Texas title loans often come with higher interest rates, making them more expensive in the long run. Students should also be mindful of potential penalties for late repayment and the risk of losing their vehicle if they fail to meet the terms of the loan.

– Eligibility criteria for students

In Texas, students interested in obtaining a loan for their college education often turn to unique financing options like Houston title loans or cash advances. When it comes to eligibility for a Texas title loan specifically designed for students, lenders typically have certain requirements. First and foremost, borrowers must be enrolled in an accredited educational institution within the state of Texas. This ensures that the funds will be utilized for educational purposes. Additionally, maintaining a minimum GPA might be necessary to demonstrate academic progress and financial responsibility.

Lenders also require proof of vehicle ownership as collateral for the loan, hence the term Houston title loans. The vehicle inspection process involves verifying the car’s condition, age, and overall value to assess its suitability as security. Students should keep in mind that while these loans can provide much-needed financial support, they come with interest rates and repayment terms that differ from traditional student loans. Responsible borrowing and understanding the conditions are essential for students considering this option for funding their college education.

Texas title loans for college students can be a quick solution for those in need of financial assistance. By understanding the basics, eligibility requirements, and responsible borrowing practices, students can make informed decisions. This option offers access to capital but should be considered as a last resort, ensuring it doesn’t hinder future prospects with high-interest rates and collateral risks.