Car title loans provide fast cash for those with limited credit options, but require understanding terms and conditions. Early payoff offers interest savings, improves credit score, and demonstrates responsible borrowing. Scheduled terms allow for structured repayment, consistent cash flow, and reduced interest rates, fostering responsible financial habits and a solid foundation.

“Unraveling the complexities of car title loans? This guide offers a clear roadmap. Car title loans, a unique financing option, come with their own set of terms and conditions. In this article, we explore two contrasting paths: early payoff versus scheduled terms. Understanding these options is crucial for borrowers looking to optimize their financial strategy. By delving into the advantages of prepaying and the intricacies of standard terms, you’ll gain valuable insights for making informed decisions regarding your car title loan payoff.”

- Understanding Car Title Loans and Their Structure

- The Advantages of Early Car Title Loan Payoff

- Navigating Scheduled Terms: What You Need to Know

Understanding Car Title Loans and Their Structure

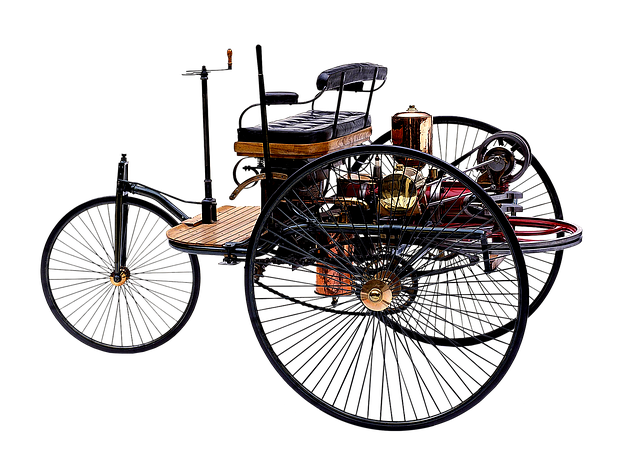

Car title loans are a type of secured lending where borrowers use their vehicle’s registration as collateral to access fast cash. This unique financial instrument offers an alternative to traditional loans, particularly for individuals with limited credit options or immediate funding needs. The structure involves a lender providing a loan amount based on the value of the borrower’s motor vehicle, typically with a shorter repayment period and higher-than-average interest rates. Despite the challenges associated with their high costs, car title loans have gained popularity due to their flexibility, especially for those in Fort Worth Loans seeking quick solutions.

Understanding how these loans work is crucial when considering a car title loan payoff. Unlike conventional loans with set monthly payments, car title loans often come with flexible payment plans, allowing borrowers to repay the loan over a shorter or longer period based on their financial capacity. This feature, coupled with the ability to obtain fast cash, makes car title loans an attractive yet potentially risky option. Borrowing against your vehicle’s equity can provide much-needed relief during financial emergencies, but it’s essential to understand the terms and conditions to make informed decisions regarding early payoff or adhering to the scheduled terms.

The Advantages of Early Car Title Loan Payoff

Paying off a car title loan early comes with several advantages that can significantly benefit borrowers. One of the primary benefits is the potential for substantial savings on interest. Car title loans, like many other types of lending, charge interest on the outstanding balance. By paying off the loan ahead of schedule, borrowers can avoid incurring additional interest charges, thereby reducing the overall cost of borrowing.

Moreover, an early car title loan payoff demonstrates responsible financial management. It shows lenders that you are committed to repaying your debts promptly and in full, which can improve your credit score over time. This is particularly beneficial for individuals with bad credit loans, as it can help them access better loan requirements and interest rates in the future. Additionally, keeping up with early payoff can give borrowers peace of mind, knowing they have successfully managed a financial obligation while maintaining ownership and control over their vehicle.

Navigating Scheduled Terms: What You Need to Know

Navigating Scheduled Terms: What You Need to Know

When taking out a car title loan, understanding repayment terms is crucial for managing your finances effectively. One common structure is the scheduled term, where payments are divided into smaller, manageable installments over a set period. This approach offers several advantages, such as consistent cash flow and potentially lower interest rates compared to lump-sum payoffs. By breaking down the Car title loan payoff into regular repayments, borrowers can avoid the stress of a large, one-time financial burden.

Scheduled terms also provide flexibility in terms of repayment options. Borrowers can often choose between weekly, biweekly, or monthly payments based on their income and cash flow patterns. This adaptability allows for better budgeting and ensures that repaying the loan aligns with your financial timeline. Moreover, a well-planned scheduled term can help establish a solid financial foundation by teaching responsible borrowing and timely repayment habits.

When considering a car title loan, understanding both early payoff options and scheduled terms is key. Early payoff can save you money in interest and fees, while adhering to scheduled terms provides predictability and convenience. Ultimately, the best approach depends on your financial situation and goals. By thoroughly evaluating each option, you can make an informed decision that aligns with your needs.