Jacksonville TX auto title loans provide a fast, accessible financing option for vehicle owners, using car titles as collateral without traditional credit checks. With quick approvals, flexible repayment plans, and transparent customer reviews, these loans cater to urgent needs and income volatility. Choosing a reputable lender with positive feedback, competitive rates, and streamlined processes ensures a positive borrowing experience tailored to individual financial goals and local regulations.

“Jacksonville TX auto title loans have gained popularity as a quick solution for cash needs. This article delves into the world of these unique financial services, offering insights into how they work and their potential benefits. We explore real customer reviews and testimonials to understand the experiences of borrowers in Jacksonville, TX. By analyzing these accounts, we provide valuable guidance on choosing the right lender, helping you make an informed decision when considering a Jacksonville TX auto title loan.”

- Understanding Jacksonville TX Auto Title Loans: How They Work

- Diving into Customer Reviews: Real Experiences and Feedback

- Choosing the Right Lender: Key Considerations Based on Testimonials

Understanding Jacksonville TX Auto Title Loans: How They Work

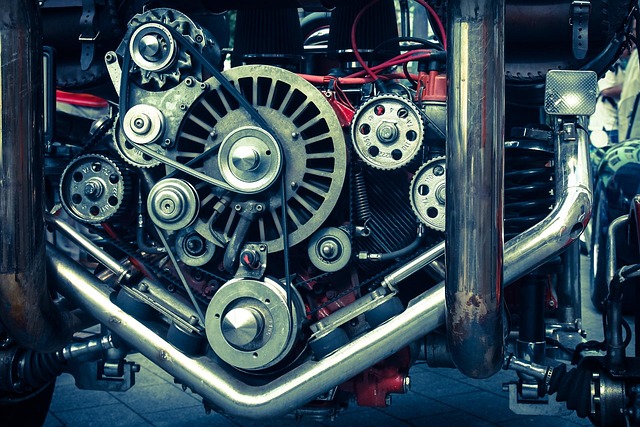

Jacksonville TX auto title loans are a type of secured lending where borrowers use their vehicle’s title as collateral to access a loan. This innovative financing option is designed for individuals who own a car free and clear and need fast cash. Unlike traditional loans that rely on credit scores, these loans focus on the value of the vehicle. The process typically involves a quick and easy application, followed by a thorough but non-intrusive vehicle inspection to determine the car’s worth. If approved, the lender will transfer the title temporarily, holding it until the loan is repaid.

Repayment for these loans often comes in flexible payment plans, allowing borrowers to spread out payments over several months. This makes them an attractive option for those with unpredictable incomes or unexpected financial burdens. Once the final payment is made and the debt is satisfied, the title is returned to the borrower, and they can continue using their vehicle without any restrictions. This streamlined approach has made Jacksonville TX auto title loans a popular choice for many seeking quick cash solutions.

Diving into Customer Reviews: Real Experiences and Feedback

When considering a Jacksonville TX auto title loan, diving into customer reviews is essential to understand real experiences and feedback from those who have utilized these services. Online platforms offer a wealth of information, providing insights into the reliability and transparency of lenders. Reviews often highlight the ease of the process, with many applicants appreciating the quick approval times, making it an attractive option for urgent financial needs.

The testimonials showcase not just satisfaction but also the flexibility offered by some providers. Loan extensions, for instance, are a common topic of discussion, indicating that customers feel at ease negotiating terms to suit their repayment capabilities. These real-life accounts offer valuable context, helping prospective borrowers gauge whether the services align with their requirements and financial comfort levels.

Choosing the Right Lender: Key Considerations Based on Testimonials

When considering a Jacksonville TX auto title loan, choosing the right lender is paramount. Based on customer reviews and testimonials, several key considerations come to the forefront. Prospective borrowers should look for lenders with consistent, positive feedback regarding their transparency in terms and conditions, competitive interest rates, and efficient application processes. A reputable lender will offer flexible repayment options tailored to individual needs, ensuring a financial solution that works without causing undue stress.

Testimonials also underscore the importance of checking for regional focus, such as those specializing in Fort Worth loans or San Antonio loans, who understand local regulations and market dynamics. This specialization can translate into better service and more suitable loan products. Borrowers should read reviews meticulously, seeking patterns of satisfaction or potential red flags, to make an informed decision that aligns with their financial goals and circumstances.

Jacksonville TX auto title loans can be a viable option for those in need of quick cash. By understanding how these loans work and choosing a reputable lender, based on customer reviews and testimonials, you can make an informed decision. This comprehensive guide has highlighted the key considerations to ensure a positive borrowing experience, allowing you to navigate this financial instrument with confidence. Remember, when considering Jacksonville TX auto title loans, it’s crucial to weigh your options and choose a lender that aligns with your best interests.