Texas online title loans have gained popularity as a swift financial solution, secured by an individual's vehicle. With competitive rates and flexible terms, the process is digital and streamlined, allowing for quick approval and access to funds within days. Borrowers must carefully review terms and conditions, including interest rates and repayment plans, while lenders assess vehicle value and income to ensure manageable repayments. These loans are ideal for emergencies or financial crises, offering flexibility for debt consolidation or emergency funding.

“Dive into the world of Texas online title loans—a convenient and fast financial solution for residents in need. This comprehensive guide breaks down the intricacies of these loans, offering a clear understanding of what they are and how they work. We explore the benefits, from swift processing to potential lower interest rates, making them an attractive option. However, we also emphasize key considerations, including loan terms, fees, and risks, ensuring borrowers in Texas make informed decisions.”

- Understanding Texas Online Title Loans: A Comprehensive Overview

- – Definition and how they work

- – Eligibility requirements for borrowers in Texas

Understanding Texas Online Title Loans: A Comprehensive Overview

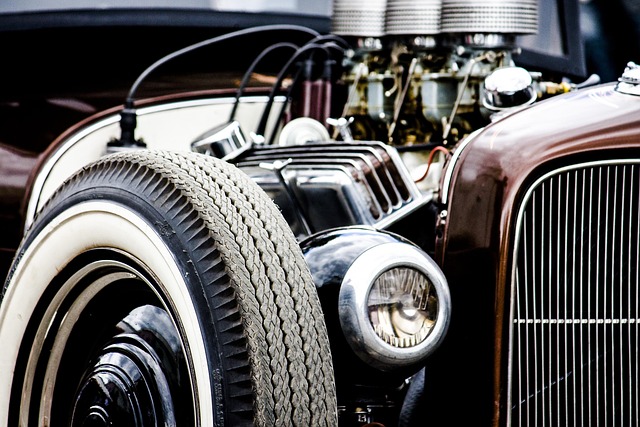

Texas online title loans have gained significant popularity as a quick solution for individuals seeking emergency funds. These loans are secured by an asset, typically a vehicle, allowing lenders to offer competitive interest rates and flexible repayment terms. The process is designed to be efficient and convenient, with many providers now offering Dallas title loans entirely online, resulting in quick approval.

Unlike traditional loan options, Texas online title loans provide access to cash within a short timeframe. Borrowers can use these funds for various purposes, from unexpected expenses to financial emergencies. However, it’s essential to understand the terms and conditions thoroughly before committing. Lenders will assess the value of your vehicle and determine the loan amount accordingly, ensuring repayment is feasible based on your income and existing obligations.

– Definition and how they work

Texas online title loans are a type of secured financing option available to residents of Texas, offering quick access to cash using your vehicle as collateral. Here’s how they work: You provide detailed information about your vehicle, including its make, model, year, and overall condition. This data is then used to assess its current market value through what’s known as a vehicle valuation. If your vehicle meets the lender’s criteria for loan eligibility, based on factors like its worth and your ability to repay, you can secure a loan against it. The funds are released upon signing the loan agreement, allowing you to use them as needed. Once repaid, or if the loan is defaulted on, the lender has the right to repossess your vehicle.

Key to this process is vehicle ownership. Lenders require clear title and proof of ownership to facilitate the transaction. This ensures they have a legitimate claim on the asset should any issues arise during the repayment period. While online title loans can be convenient, it’s crucial to understand the terms and conditions thoroughly before agreeing to one, as interest rates and repayment terms can vary significantly between lenders.

– Eligibility requirements for borrowers in Texas

In Texas, borrowers seeking a Texas online title loan must meet specific eligibility criteria to qualify for this type of secured lending option. Lenders typically require that applicants be at least 18 years old and have a valid government-issued ID. Additionally, they need to demonstrate proof of income and a clear vehicle title in their name, indicating ownership of a motor vehicle as collateral. This collateral plays a crucial role in ensuring the loan’s security.

Borrowers should also be prepared to provide information about their employment status and financial background. While there are no strict credit score requirements, having good credit can lead to more favorable loan terms. Texas online title loans offer flexibility for individuals needing quick access to cash for various purposes, such as debt consolidation, loan payoff, or even emergency funds.

Texas online title loans offer a unique financial solution for residents in need of quick cash. By leveraging the equity of their vehicles, borrowers can access funds without the traditional credit checks and lengthy applications. With a clear understanding of how these loans work and the eligibility criteria, individuals can make informed decisions to meet their short-term financial needs. Remember, while online title loans can be beneficial, it’s crucial to borrow responsibly and have a plan for repayment to avoid potential financial strain.