Car title loans offer a structured repayment solution for individuals with limited credit options, secured by their vehicle's title. Companies like Fort Worth Loans and Semi Truck Loans provide weekly payments based on the vehicle's value, promoting financial discipline. This method encourages consistent saving, responsible borrowing, and improved monetary health. To manage car title loan weekly payments effectively, create a budget, explore flexible terms, review expenses, consider debt consolidation, and always ensure thorough vehicle inspections.

“Car title loans, a fast-cash solution secured by your vehicle, can be a double-edged sword. This article explores how implementing car title loan weekly payments can positively influence payment habits. We delve into the benefits of consistent, smaller payments and their impact on financial discipline. Additionally, we provide strategies to help borrowers maintain positive payment routines, ensuring long-term financial health. Discover how structured repayment plans can empower you while managing a car title loan.”

- Understanding Car Title Loans and Their Impact on Payment Behavior

- The Benefits of Weekly Payments for Financial Discipline

- Strategies to Maintain Positive Payment Habits with Car Title Loans

Understanding Car Title Loans and Their Impact on Payment Behavior

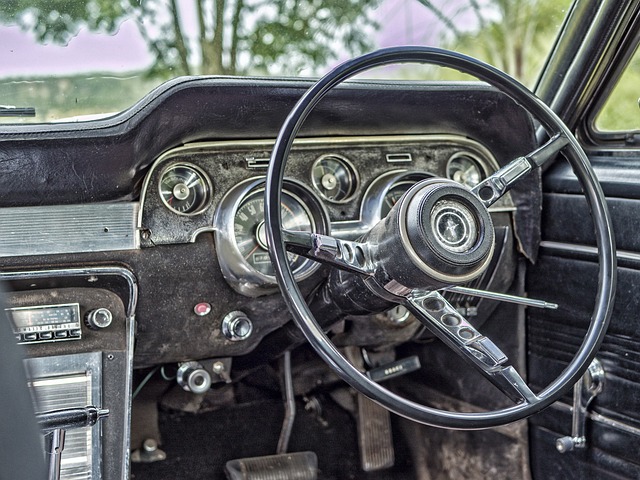

Car title loans are a type of secured loan where borrowers use their vehicle’s title as collateral. This unique financial product offers a quick and accessible way for individuals to secure funding, especially those with limited credit options. The process involves a lender assessing the value of the borrower’s vehicle and providing a loan based on that valuation. One of the key aspects that sets car title loans apart is their repayment structure, often structured into weekly payments.

This weekly payment model can significantly impact borrowers’ payment habits and financial management. Unlike traditional loans with fixed monthly installments, the weekly schedule encourages more frequent repayments, fostering a discipline in financial responsibility. For instance, Fort Worth Loans and Semi Truck Loans (which are types of car title loans) allow borrowers to make smaller, manageable payments each week, potentially improving their overall repayment behavior and reducing the risk of default. This structured approach can be particularly beneficial for individuals with unpredictable income streams, helping them stay on top of their financial obligations consistently.

The Benefits of Weekly Payments for Financial Discipline

For individuals looking to improve their financial discipline, car title loan weekly payments offer a structured approach that can significantly enhance their monetary management skills. This method encourages consistent saving and responsible borrowing by breaking down larger debts into manageable installments. With each weekly payment, borrowers develop a habit of setting aside a specific amount, fostering a sense of control over their finances.

Moreover, Houston Title Loans provide an excellent opportunity for those seeking flexible payment plans. By opting for online applications, borrowers can conveniently tailor repayment schedules to fit their income cycles. This adaptability ensures that meeting financial obligations becomes less daunting and more attainable, ultimately contributing to improved overall monetary health.

Strategies to Maintain Positive Payment Habits with Car Title Loans

Maintaining positive payment habits with a car title loan involves a strategic approach. Firstly, establish a clear budget and allocate a fixed amount for weekly payments. This discipline ensures that repayment becomes a consistent part of your financial routine. By treating it as a non-negotiable expense, like rent or utilities, you develop a consistent habit.

Additionally, explore various repayment options offered by lenders, such as extended terms or partial prepayments, to find a structure that aligns with your cash flow. Regularly reviewing and adjusting your budget can help manage unexpected expenses, ensuring timely loan payments. Moreover, consider debt consolidation if multiple debts are straining your finances, allowing for more manageable weekly payments and potentially lowering interest rates through a single, consolidated loan. Before finalizing any agreement, remember to request a thorough vehicle inspection to ensure the loan value is fair and accurate.

Car title loan weekly payments can be a strategic tool to foster positive payment habits and financial discipline. By breaking down large debts into manageable installments, borrowers can gain control over their finances and avoid the stress of lump-sum repayments. This consistent approach not only improves creditworthiness but also encourages a disciplined mindset, benefiting both short-term and long-term financial goals. Embracing these structured payments can be a game-changer for those seeking to navigate their debts effectively.