Car title loans without a bank account provide a flexible financing option for individuals in need of quick cash, leveraging vehicle equity as collateral. These loans skip traditional credit checks and banking requirements, appealing to those with limited credit history or savings. Key steps involve proving your vehicle's value and repaying via structured payments over a set period, often at higher interest rates. Suitable for debt consolidation or urgent needs, car title loans offer accessibility but require careful consideration of terms to avoid long-term financial strain. Options like Houston Title Loans cater to such demands, simplifying processes for short-term financing without the need for traditional banking services.

“Unbanked individuals seeking quick cash solutions often turn to car title loans as an alternative financing option. But do credit scores play a factor in securing such loans without a traditional bank account? This article demystifies the process, delving into the key requirements for car title loans and how your credit history influences approval chances. We’ll also explore alternatives tailored for unbanked borrowers, offering valuable insights for those navigating financial challenges outside the mainstream banking system.”

- Understanding Car Title Loans and Their Requirements

- The Role of Credit Score in Securing a Title Loan Without a Bank Account

- Exploring Alternatives and Options for Borrowers Without a Traditional Bank Account

Understanding Car Title Loans and Their Requirements

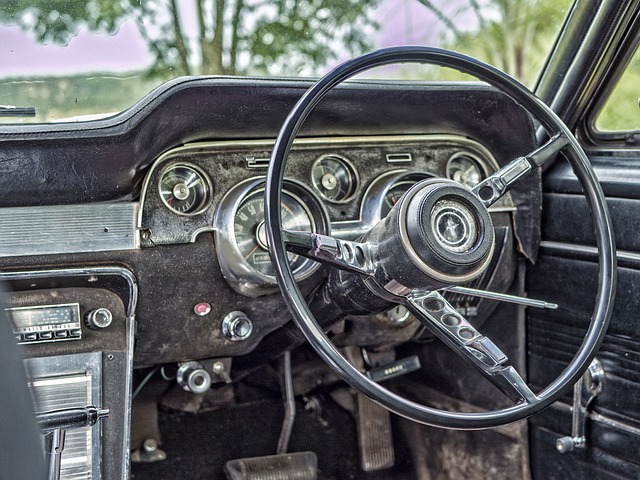

Car title loans have gained popularity as an alternative financing option for individuals who need quick cash. Unlike traditional loans that require a thorough credit check and a bank account, car title loans offer a more flexible approach to lending, especially for those without a conventional financial history or a savings account. This type of loan is secured by the value of your vehicle, allowing lenders to provide funds based on the car’s equity rather than strict creditworthiness criteria.

When considering a car title loan without a bank account, it’s essential to understand the key requirements. Lenders will assess the condition and value of your vehicle and offer a loan amount based on its worth. Repayment options typically involve structured payments over a set period, often with higher-interest rates compared to traditional loans. Some borrowers use these loans for debt consolidation or urgent financial needs, providing them with access to cash quickly. However, it’s crucial to carefully review the terms and conditions to ensure you can meet the repayment obligations to avoid potential financial burdens.

The Role of Credit Score in Securing a Title Loan Without a Bank Account

When considering a car title loan without a bank account, your credit score plays a pivotal role. Traditionally, lenders rely on this financial indicator to assess an applicant’s creditworthiness. A higher credit score generally means better access to loans and often results in more favorable terms. However, with a title loan, the focus shifts slightly. Lenders still perform a credit check, but they also place significant emphasis on the value of your vehicle during the vehicle valuation process. This alternative approach allows individuals without traditional banking services or strong credit histories to access much-needed funds.

Despite not relying solely on credit scores, lenders will still factor in your financial health. A solid payment history and stable income can compensate for a lower credit score. Furthermore, understanding that these loans are secured against your vehicle’s title means the lender prioritizes the vehicle valuation as collateral rather than strict credit requirements. This flexibility has made car title loans without a bank account an attractive option for many, offering a chance to navigate financial challenges with less stringent barriers.

Exploring Alternatives and Options for Borrowers Without a Traditional Bank Account

For individuals lacking a traditional bank account, exploring alternatives for accessing short-term financial solutions is essential. Fortunately, there are options available that can cater to their needs, such as car title loans without a bank account. These loans utilize the equity in an individual’s vehicle, providing a quick and accessible way to secure funds. In Houston, for instance, where the demand for flexible financing options is high, Houston Title Loans offer a viable financial solution for borrowers in need.

By tapping into their vehicle’s value, borrowers with no bank account can still gain access to much-needed capital. The loan requirements typically involve presenting the car’s title and a government-issued ID. This simplified process bypasses the traditional banking system, making it an attractive choice for those who may struggle to meet conventional loan eligibility criteria or lack a personal checking account. It provides a way to access funds quickly, offering relief in times of financial urgency without the usual barriers associated with bank accounts.

When considering a car title loan without a bank account, understanding how your credit score impacts approval is key. While a traditional credit check is often a requirement, there are options available for borrowers with less-than-perfect credit or no credit history. By exploring alternative lending platforms and showcasing responsible borrowing habits, individuals can access much-needed funds despite not having a conventional banking setup. Embracing these alternatives opens doors to financial flexibility during unexpected situations.