Title loan responsible borrowing involves understanding short-term loans' high costs and risks. Houston Title Loans offers flexibility but consumers should strategically secure loans with collateral, keep primary transportation, and prioritize transparency. Clear agreements, flexible repayment plans, budgeting, savings, and timely repayments help maintain financial stability, rebuild credit, and demonstrate creditworthiness.

In today’s financial landscape, understanding title loan responsible borrowing is crucial for consumers seeking quick cash. This article guides borrowers through essential aspects of navigating these short-term loans, focusing on both immediate and long-term financial health. We’ll explore basic title loan concepts, responsible borrowing strategies to mitigate risk, and rebuilding credit post-loan. By adhering to best practices, consumers can make informed decisions, ensuring a positive impact on their financial journey.

- Understanding Title Loan Basics: What Borrowers Need to Know

- Responsible Borrowing Strategies for Minimizing Financial Risk

- Building Credit Responsibly After a Title Loan

Understanding Title Loan Basics: What Borrowers Need to Know

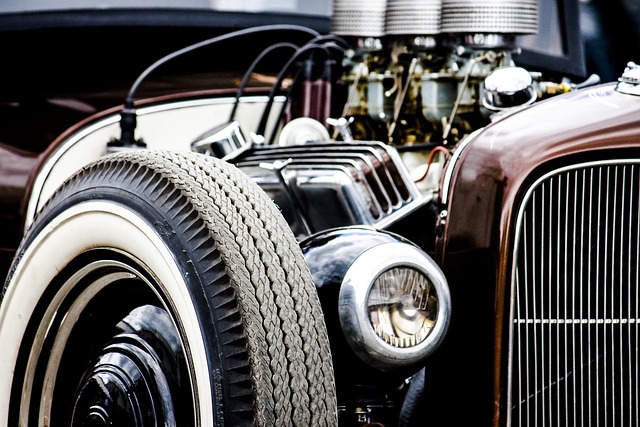

Title loans, a form of secured lending, offer quick cash by using an individual’s vehicle title as collateral. This alternative financing option is growing in popularity, especially among those with limited access to traditional banking services. However, understanding the intricacies of these loans is crucial for responsible borrowing. Borrowers should grasp that this type of loan is typically short-term, often requiring repayment within 30 days, with high-interest rates and fees.

Houston Title Loans, like other similar services, provide flexibility in terms of repayment, allowing borrowers to spread out payments over a longer period. This can make the process more manageable. Additionally, knowing that there’s an option for loan payoff without penalty can empower borrowers to plan their finances effectively, ensuring they meet their obligations while avoiding potential debts traps.

Responsible Borrowing Strategies for Minimizing Financial Risk

In the realm of title loan responsible borrowing, consumers can significantly minimize financial risk by adopting strategic approaches. One key strategy is to ensure that you keep your vehicle (or other collateral) as this not only provides a safety net but also keeps the loan amount manageable. For instance, if considering truck title loans or motorcycle title loans, borrowers should assess their ability to repay without compromising their primary mode of transportation.

Additionally, transparency and proactive communication with lenders are vital. Understanding the terms, interest rates, and repayment schedules can prevent unforeseen financial burdens. Consumers should aim for transparent agreements, clear conditions, and flexible repayment plans to ensure they stay on top of their finances while borrowing against their vehicle titles.

Building Credit Responsibly After a Title Loan

After securing a title loan, it’s crucial to focus on rebuilding and maintaining your credit score responsibly. While emergency funding solutions like Dallas title loans can be helpful in times of need, they should be considered as a temporary measure. To ensure long-term financial stability, individuals must adopt responsible borrowing habits. One effective strategy is to create a budget and stick to it, prioritizing savings whenever possible. By doing so, you reduce the reliance on short-term loans and demonstrate creditworthiness to lenders.

Additionally, timely loan repayments play a significant role in enhancing your credit profile. Make sure to meet all repayment obligations as agreed upon with the lender. This consistent behavior signals to credit bureaus that you are a reliable borrower. Moreover, exploring alternative financing options with lower interest rates and more flexible terms can contribute to responsible borrowing. Remember, understanding loan requirements and comparing different offers before committing is key to making informed decisions regarding your financial health.

Consumers seeking title loan responsible borrowing need a clear path forward. By understanding basic title loan principles, employing strategic borrowing habits, and restoring credit responsibly afterward, individuals can navigate these loans with minimal financial risk. Adopting these practices ensures a more secure future for borrowers looking to access short-term funds.