Bedford title loans provide quick cash for borrowers leveraging their vehicle's equity, regardless of credit history. Unlike traditional car loans, these loans assess value, not credit scores, making them accessible even with less-than-perfect credit. They offer a flexible solution for debt consolidation and unexpected expenses, refuting myths about trapping users in debt. Responsible individuals can use Bedford title loans as short-term solutions without penalties.

“Unraveling the mysteries surrounding Bedford title loans, this article aims to dispel common myths and provide a clear understanding of this financial option. Many misconceptions cloud the perception of Bedford title loans, leading to confusion and doubt. We delve into the reality behind these myths, offering insights into how these loans work, their benefits, and who they serve best. By the end, you’ll have a factual grasp of Bedford title loans.”

- Bedford Title Loans: Fact vs. Fiction

- Debunking Common Misconceptions About Bedford Title Loans

- The Reality Behind Bedford Title Loan Myths

Bedford Title Loans: Fact vs. Fiction

Bedford Title Loans: Unraveling the Myths

When it comes to accessing fast cash, Bedford title loans have often been shrouded in mystery and misconceptions. Many individuals are unaware of the process, benefits, and eligibility criteria associated with this type of loan. In reality, Bedford title loans provide a secure and efficient way for people to borrow money using their vehicle’s equity as collateral. This option is particularly appealing for those who own cars or trucks and need quick financial assistance.

One common myth is that Bedford title loans are only accessible to individuals with perfect credit. However, this isn’t entirely true. While a good credit score can increase your chances of approval, many lenders offer these loans to borrowers with less-than-perfect credit history. The primary focus is on the value and condition of your vehicle rather than strict credit checks. Unlike traditional car title loans or truck title loans, which often come with stringent requirements, Bedford title loans provide a faster and more flexible alternative for obtaining fast cash.

Debunking Common Misconceptions About Bedford Title Loans

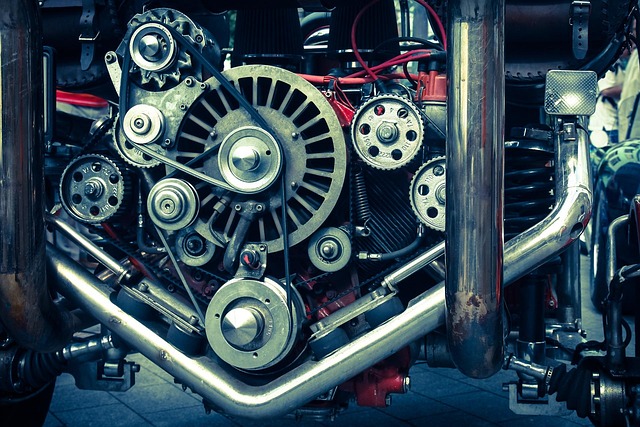

In the world of Bedford title loans, several misconceptions often cloud the facts for potential borrowers. One common myth is that these loans are only accessible to individuals with impeccable credit histories. However, this couldn’t be further from the truth. Bedford title loans, also known as car or vehicle title loans, offer a unique opportunity for borrowers with less-than-perfect credit to gain access to immediate funding. The loan amount is typically determined by the value of your vehicle rather than your credit score. This makes it an attractive option for those seeking quick funding without the stringent requirements of traditional loans.

Another misconception surrounding Bedford title loans is that they are only suitable for purchasing a new vehicle. In reality, these loans can be used for various purposes, including debt consolidation and covering unexpected expenses. Unlike semi truck loans or other specialized financing options, Bedford title loans provide a simple and straightforward process. Borrowers can use the funds to consolidate high-interest debts, offering them better management over their finances. This flexibility makes it an appealing solution for many individuals looking for swift financial aid.

The Reality Behind Bedford Title Loan Myths

Many people are quick to dismiss Bedford title loans as a risky or unappealing option for fast cash due to common myths and misconceptions. However, the reality is far from it. These loans are designed to offer a secure and flexible financial solution for those in need of immediate funds. One of the most persistent myths is that title loans are solely for desperate individuals with poor credit; this couldn’t be further from the truth. Many responsible borrowers opt for Bedford title loans as a preferred method of securing a loan, especially when considering loan refinancing or seeking fast cash to cover unexpected expenses.

Another myth suggests that these loans trap borrowers in a cycle of debt, but with careful planning and timely repayment, they can provide a reliable financial safety net. Loan extensions are available, allowing borrowers to manage their repayments without incurring additional penalties. Fast cash is indeed an option with Bedford title loans, but it’s crucial to approach them as a short-term solution, not a long-term debt burden. By dispelling these myths, individuals can make informed decisions and leverage the benefits of this unique loan type for their financial needs.

In navigating the landscape of Bedford title loans, it’s essential to dispel common myths that can often be misleading. By understanding the reality behind these misconceptions, borrowers can make informed decisions about their financial needs. Bedford title loans, when utilized responsibly, offer a flexible and accessible solution for those seeking quick cash. Embrace knowledge as your most powerful tool when considering this alternative financing option.