Weatherford title loans provide a swift and flexible borrowing solution for quick liquidity needs. Secured against vehicle titles, these loans offer lower interest rates and simplified application processes. With customizable payment plans tailored to individual financial capabilities, borrowers can access funds quickly while keeping their vehicles, making them an attractive alternative to traditional financing. Strategic repayment planning is crucial for effective management and long-term financial stability.

“Planning Ahead with Weatherford Title Loans: Your Strategic Guide explores the world of Weatherford title loans, offering a comprehensive insight into this financial tool. From understanding the basics of Weatherford title loans and their unique benefits to navigating the repayment process, this article is your one-stop resource. We delve into strategic planning, ensuring you make informed decisions for both current and future financial goals. Discover how Weatherford title loans can provide flexible solutions while considering essential factors for a successful loan experience.”

- Understanding Weatherford Title Loans: A Comprehensive Overview

- Benefits and Considerations for Borrowing with Weatherford Title Loans

- Strategic Planning for Repayment and Future Financial Decisions

Understanding Weatherford Title Loans: A Comprehensive Overview

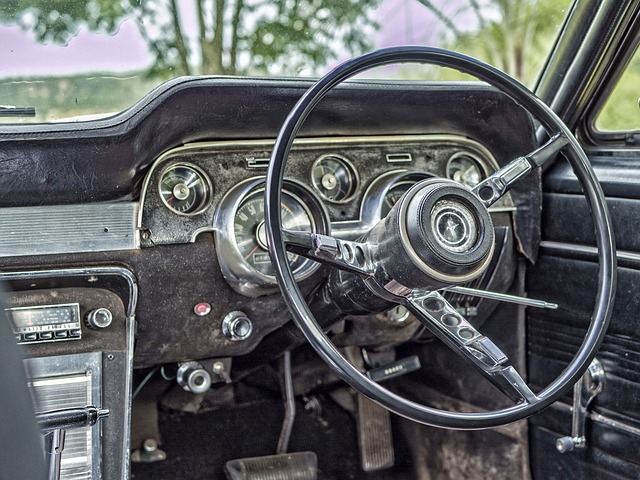

In the competitive financial landscape, Weatherford title loans have emerged as a unique and flexible option for borrowers seeking quick liquidity. These loans, secured against an individual’s vehicle title, offer several advantages, including lower interest rates compared to traditional short-term financing. The process begins with a simple application where lenders evaluate the value of the borrower’s motor vehicle, ensuring it meets the required criteria for collateral. Upon approval, the lender facilitates a swift title transfer, allowing borrowers to retain possession of their vehicles while enjoying access to much-needed funds.

Weatherford title loans provide borrowers with the benefit of manageable payment plans, tailored to suit individual financial capabilities. Unlike other loan types, these agreements focus on the eventual loan payoff without burdening borrowers with strict repayment schedules. This flexibility makes them an attractive alternative for those in need of immediate financial assistance, offering a path to repayment that aligns with their cash flow patterns.

Benefits and Considerations for Borrowing with Weatherford Title Loans

Weatherford Title Loans offer a unique and beneficial approach to borrowing money, providing an alternative solution for those in need of quick funding. One of the key advantages is the ease and speed of the loan process. Unlike traditional bank loans, Weatherford Title Loans have simplified requirements and a streamlined approval system. This means borrowers can secure their loan in a fraction of the time, making it ideal for urgent financial needs. The application process is straightforward, often requiring only a few basic documents and information.

Additionally, these loans offer flexible interest rates and repayment terms tailored to the borrower’s comfort level. Weatherford Title Loans understands that every individual has unique financial circumstances, so they provide customizable plans to ensure manageable monthly payments. With a focus on customer satisfaction, their dedicated team guides borrowers throughout the loan journey, ensuring transparency and peace of mind. This comprehensive approach makes Weatherford Title Loans an attractive option for those seeking a reliable and accessible borrowing experience, especially when traditional financing is not readily available.

Strategic Planning for Repayment and Future Financial Decisions

Strategic planning for repayment is a key aspect of managing Weatherford title loans effectively. When considering loan refinancing options, borrowers should evaluate their financial landscape. This involves understanding current income, fixed expenses, variable costs, and any upcoming commitments that could impact affordability. By meticulously assessing these factors, individuals can create a robust repayment strategy tailored to their unique circumstances.

In terms of future financial decisions, Weatherford title loans offer a flexible framework. Borrowers may choose from various payment plans, allowing them to align repayments with their cash flow patterns. This proactive approach ensures that loan refinancing becomes a strategic tool for financial stability rather than a sudden burden. Additionally, understanding the specific loan requirements and terms is vital to making informed choices that support long-term financial health.

In conclusion, Weatherford title loans offer a strategic financial solution for those needing immediate access to cash. By understanding the comprehensive overview of these loans, their benefits and considerations, and implementing a thoughtful repayment plan, individuals can make informed decisions that align with their future financial goals. Strategic planning ensures not only short-term relief but also long-term stability, making Weatherford title loans a game-changer for navigating unexpected expenses.