Texas title loan financing operates under strict OCR guidelines for consumer protection and fair lending, including mandatory vehicle inspections to assess condition, value, and transferability, mitigating repossition risk. Lenders manage creditworthiness through income, employment, and debt assessments, offer flexible repayment options like direct deposit, streamline title transfers with clear documentation, and educate borrowers to reduce late payments, fostering trust and minimizing repossitions in the competitive Texas market.

In the competitive landscape of Texas title loan financing, mitigating repossession risk is paramount for lenders. This article guides you through a comprehensive approach to manage this challenge effectively. We explore essential aspects like understanding stringent Texas regulations governing these loans and assessing borrower creditworthiness. Additionally, we delve into proven strategies for preventing repossessions, ensuring a robust and sustainable Texas title loan financing model.

- Understanding Texas Title Loan Regulations

- Evaluating Borrower Creditworthiness

- Implementing Repossession Prevention Strategies

Understanding Texas Title Loan Regulations

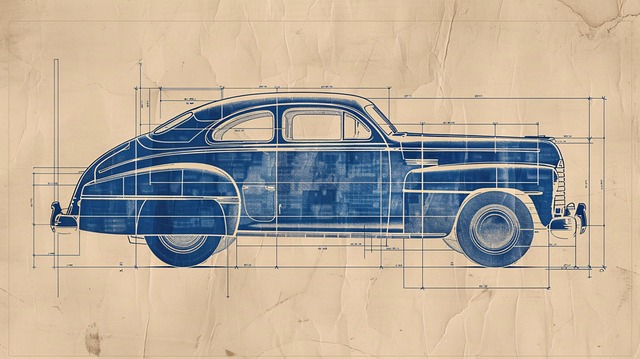

Texas title loan financing is a unique and regulated financial service within the state. Lenders offering Texas title loans must adhere to strict guidelines set forth by the Texas Office of Credit Regulation (OCR). These regulations are in place to protect consumers and ensure fair lending practices. Understanding these rules is crucial for both lenders and borrowers, especially as they navigate the potential risks associated with repossession. One key aspect involves requiring lenders to conduct thorough vehicle inspections before approving loans secured by vehicles like cars, trucks, or even boats (Boat Title Loans).

The inspection process plays a vital role in mitigating repossession risk. It helps assess the vehicle’s condition, value, and potential for future ownership transfer. For instance, in the case of Semi Truck Loans, where heavy equipment is involved, lenders must consider factors like maintenance records, driver history, and industry regulations to determine the borrower’s ability to repay and maintain possession of the asset. By adhering to these regulations and employing comprehensive inspection procedures, Texas title loan financing can offer a more secure lending environment, reducing the chances of repossession and fostering a positive financial experience for all parties involved.

Evaluating Borrower Creditworthiness

In the realm of Texas title loan financing, mitigating repossession risk starts with a thorough evaluation of borrower creditworthiness. Lenders should assess each prospective borrower’s financial health by examining their income, employment status, and existing debt obligations. This comprehensive review ensures that the borrower has the means to consistently make timely repayments, thereby reducing the likelihood of default and subsequent repossession.

By offering flexible repayment options, such as direct deposit and various loan repayment schedules, lenders can cater to different borrower needs. These tailored approaches not only enhance customer satisfaction but also foster responsible borrowing behaviors. Additionally, streamlining the title transfer process ensures that both parties involved have clear and accessible documentation, further minimizing potential disputes or delays that could lead to repossession.

Implementing Repossession Prevention Strategies

In the realm of Texas title loan financing, mitigating repossession risk is a delicate balance between securing assets and supporting borrowers’ repayment abilities. One of the most effective strategies to prevent repossession is to offer flexible repayment options. This can include structured payment plans tailored to the borrower’s income schedule, allowing them to gradually repay the loan without the burden of immediate large-sum payments. Such approaches foster trust and encourage timely repayments, significantly lowering the risk of default and subsequent repossession.

Additionally, educating borrowers about the implications of late payments and providing clear communication channels can act as a deterrent. Secured loans, by their nature, offer lenders a safety net—the collateral ensures repayment. However, it’s crucial to balance this security with reasonable expectations and same-day funding processes, ensuring borrowers feel supported rather than pressured. This proactive approach to repossession prevention not only benefits lenders but also fosters a positive relationship with Texas title loan financing customers.

Texas title loan financing can be a powerful tool for both lenders and borrowers, but mitigating repossession risk is paramount. By understanding state regulations, rigorously evaluating borrower creditworthiness, and implementing robust repossession prevention strategies, lenders can minimize defaults and ensure a more secure lending environment. These measures not only protect the lender’s interests but also foster a fair and transparent system for Texas residents seeking title loan financing.