Car title loans for branded titles provide quick cash for individuals with less-than-perfect credit, offering a convenient alternative to traditional loans. Securing the loan with the vehicle's title ensures a reliable asset, allowing for same-day deposits and swift access to funds within hours. While ideal for urgent needs, borrowers must assess risks like repossession by understanding loan terms and long-term implications.

“Uncover the benefits of car title loans for branded titles, a fast and innovative financing solution. This article guides you through the process and highlights the advantages of same-day deposits. From understanding the fundamentals of these loans to navigating potential risks, we provide a comprehensive overview. Discover how this option can offer quick access to cash, ideal for those needing immediate financial support. Get ready to explore a powerful tool in today’s financial landscape.”

- Understanding Car Title Loans for Branded Titles

- Advantages of Same-Day Deposit Options

- Navigating Risks and Benefits: A Comprehensive Look

Understanding Car Title Loans for Branded Titles

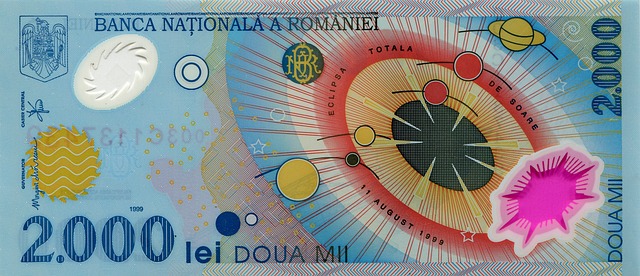

Car title loans for branded titles offer a unique financial solution for individuals needing emergency funds quickly. Unlike traditional loans that often require extensive paperwork and credit checks, car title loans leverage the value of your vehicle’s brand new or pre-owned condition to provide immediate cash. This alternative financing option is particularly appealing to those with less-than-perfect credit, as it doesn’t rely on credit scores.

Branded titles represent a reliable asset for lenders since the loan amount is secured against the car itself. The process involves signing over your vehicle’s title temporarily, and upon repayment, the title is returned. This streamlined approach makes obtaining emergency funds faster and more accessible, providing a financial safety net when Bad Credit Loans aren’t an option through conventional means.

Advantages of Same-Day Deposit Options

One of the key advantages of opting for a car title loan with same-day deposit is the speed and convenience it offers. This option allows borrowers to access their funds in a matter of hours, providing a quick solution for urgent financial needs. It’s particularly beneficial for those who require fast cash to cover unexpected expenses or take advantage of time-sensitive opportunities.

The process streamlines traditional loan procedures by eliminating lengthy paperwork and in-person visits. Instead, online applications enable users to submit their details from the comfort of their homes. This digital approach not only saves time but also ensures a more transparent and efficient loan payoff experience for branded title car loans.

Navigating Risks and Benefits: A Comprehensive Look

Navigating Risks and Benefits: A Comprehensive Look

Taking out a car title loan for branded titles with same-day deposit can offer a quick solution for those in need of emergency funds. However, it’s crucial to weigh the risks and benefits thoroughly before making such a decision. These loans are secured by your vehicle’s title, which means if you fail to repay, the lender has the right to repossess your car. This should be taken into consideration, especially if the loan is for essential expenses rather than discretionary ones, as losing one’s primary mode of transportation can have significant repercussions.

On the positive side, car title loans often come with simpler eligibility criteria compared to traditional loans, making them accessible to a broader range of borrowers, including those with less-than-perfect credit scores. Moreover, for specialized cases like semi truck loans, this type of financing can be particularly beneficial as it allows owners to access much-needed capital quickly. Nevertheless, understanding your financial situation, loan terms, and potential outcomes is key to making an informed choice that aligns with your needs without setting you back financially in the long term.

Car title loans for branded titles offer a unique financial solution, especially with same-day deposit options. While this alternative financing method provides quick access to cash, it’s crucial to weigh the risks and benefits thoroughly before applying. Understanding both the advantages, such as rapid funding, and potential drawbacks, like high-interest rates, will enable informed decision-making for those seeking fast financial relief.