Car title loan balloon payments provide short-term cash but carry high-interest rates and hidden fees. These plans can trap borrowers in debt cycles if not managed carefully. Alternatives like same-day funding from reputable financial institutions offer flexible weekly/bi-weekly repayments, benefiting individuals with stable incomes.

Are car title loan balloon payment plans a red flag? This article delves into the intricacies of these financing options, exploring whether their seemingly flexible terms are actually masked pitfalls. We break down the concept of car title loan balloon payments, highlight potential risks, and offer safer alternatives for securing car loan funding, empowering readers to make informed decisions.

By understanding the mechanics behind balloon payments, you can navigate this complex landscape with confidence and avoid unexpected financial straits.

- Understanding Car Title Loan Balloon Payments

- Potential Pitfalls of Balloon Payment Plans

- Alternatives to Consider for Car Loan Financing

Understanding Car Title Loan Balloon Payments

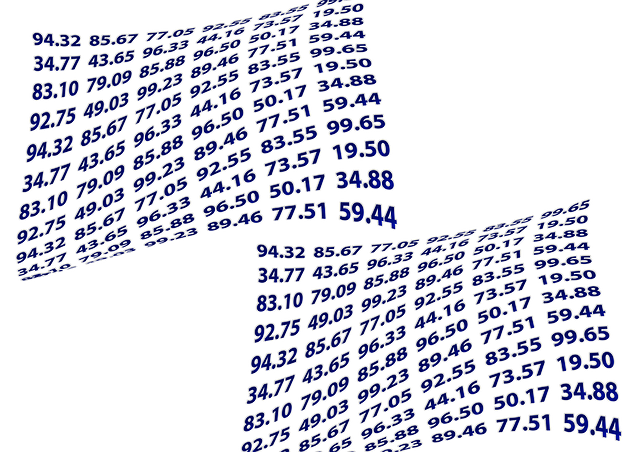

Car title loan balloon payments refer to a repayment structure where a borrower takes out a short-term loan secured by their vehicle’s title, with a large final payment due at the end of the loan term. This is in contrast to traditional car loans that have fixed monthly payments over an extended period. While this option can provide much-needed financial assistance for those in urgent need of cash, it’s not without its red flags.

In San Antonio Loans, borrowers should be wary of the high-interest rates and potential hidden fees associated with these types of loans. The large final balloon payment can make it challenging for borrowers to come up with the full amount at once, leading to a cycle of debt. It’s crucial to thoroughly understand the terms and conditions before agreeing to such a plan, as it could have significant financial implications.

Potential Pitfalls of Balloon Payment Plans

Car title loan balloon payment plans can seem appealing due to their potential for lower monthly payments and the ability to pay off a loan with a larger final balloon payment. However, there are several potential pitfalls to consider before taking this route. One significant risk is that these plans often come with higher interest rates, which can lead to paying more in interest over the life of the loan compared to traditional financing options.

Additionally, borrowers may find themselves struggling to afford the substantial final balloon payment, which can cause financial strain and potentially require them to take out a new loan to cover it. This creates a cycle of debt that can be challenging to break free from. It’s crucial for borrowers to carefully evaluate their financial situation and understand the terms of any car title loan balloon payment plan before committing, ensuring they have the means to repay both the principal and the large final payment without putting themselves at risk of defaulting on the loan or facing penalties.

Alternatives to Consider for Car Loan Financing

When considering short-term financing for your car, it’s crucial to explore alternatives to the traditional car title loan balloon payment plan. These plans, while offering quick funding, often come with high-interest rates and unfavorable terms. Instead of opting for a loan with a large final balloon payment, there are several other options worth exploring.

One viable alternative is securing a cash advance or short-term personal loan from a reputable financial institution. These loans provide same-day funding, allowing you to access the money you need promptly. Many lenders offer flexible repayment terms, including weekly or bi-weekly payments, making it easier to manage your finances without the burden of a substantial balloon payment at the end. This approach can be particularly beneficial if you have a stable income and can afford smaller, manageable installments.

Car title loan balloon payment plans, while offering a potential path to immediate financial relief, come with significant risks. The high-interest rates and potentially unmanageable final balloon payment can lead to a cycle of debt. Before considering this option, it’s crucial to understand the terms fully and explore alternative financing methods like traditional auto loans or lease-to-own programs, which often provide better long-term financial stability. By doing so, you can avoid potential pitfalls and make an informed decision that aligns with your financial goals.