Bedford title loans offer swift funding leveraging vehicle equity with minimal paperwork and quick approvals. Eligibility requires age (18+), valid ID, proof of income, and collateral assessment. Good credit enhances terms while accurate info is crucial for informed decisions. Strategic repayment through timely payments and communication reduces risks and safeguards against default.

“Exploring the Best Practices for Borrowing Bedford Title Loans offers a strategic financial path for those in need of quick funding. This comprehensive guide delves into the fundamentals, highlighting the benefits of Bedford title loans as a secure lending option. We demystify eligibility requirements, ensuring clarity for prospective borrowers. Furthermore, our article equips readers with strategies to manage repayments effectively and mitigate risks, providing a roadmap for responsible borrowing. By understanding these best practices, individuals can navigate Bedford title loans with confidence.”

- Understanding Bedford Title Loans: Basics and Benefits

- Eligibility Criteria for Secure Loan Applications

- Strategies for Effective Repayment and Avoiding Risks

Understanding Bedford Title Loans: Basics and Benefits

Bedford title loans offer a unique financial solution for individuals seeking quick access to cash. This type of loan utilizes the equity in your vehicle as collateral, providing an alternative to traditional banking options. The process involves pledging your vehicle’s title, allowing lenders to hold onto it until the debt is repaid. Despite the name, these loans are not limited to Bedford; they are available nationwide and can be particularly beneficial for those with poor credit or no credit check history.

One of the key advantages of Bedford title loans is their accessibility and speed. Lenders often offer quick approval, requiring minimal paperwork and avoiding the lengthy applications and strict credit requirements associated with bank loans. This makes them an attractive option for those in need of immediate funding. Additionally, unlike Houston title loans or other secured loans, these services can be more flexible, allowing borrowers to retain possession of their vehicle during the loan period.

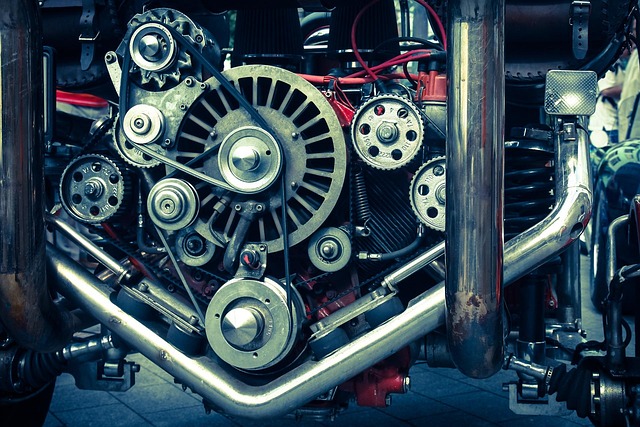

Eligibility Criteria for Secure Loan Applications

When applying for Bedford title loans, understanding the eligibility criteria is key to a smooth borrowing process. Lenders typically require borrowers to meet specific standards to ensure repayment capability and minimize risk. In most cases, applicants must be at least 18 years old, have a valid government-issued ID, and provide proof of income or employment. This verification process is essential for securing the loan since it demonstrates the borrower’s ability to repay. Additionally, lenders often assess the value and condition of the asset being used as collateral, such as a vehicle (including Truck Title Loans or Boat Title Loans) or real estate.

The presence of Bad Credit Loans isn’t automatically a barrier, as many lenders specialize in non-traditional credit checks, focusing more on the value of the collateral than on conventional credit scores. However, having good credit can improve loan terms and interest rates. Lenders will evaluate the overall financial health based on income, existing debt, and the purpose of the loan. It’s crucial to approach these applications with accurate information and an understanding of the loan conditions to make informed decisions regarding Bedford title loans.

Strategies for Effective Repayment and Avoiding Risks

When considering Bedford title loans, a strategic approach to repayment is essential for avoiding potential risks. The first step in effective repayment is understanding your financial obligations. Before securing a loan, thoroughly review the terms and conditions, ensuring you comprehend the interest rates, fees, and the overall repayment schedule. This knowledge empowers you to budget accordingly and make informed decisions.

Another crucial strategy is to prioritize timely repayments. Many lenders offer flexibility through various Repayment Options, including online platforms that facilitate the process. By opting for an Online Application, you can conveniently manage your loan, ensuring prompt payments and potentially saving on interest charges. Additionally, maintaining open communication with your lender regarding any challenges or changes in your financial situation is vital to avoiding default and the associated risks.

Bedford title loans offer a unique opportunity for individuals seeking quick access to capital. By understanding the basics, meeting eligibility criteria, and employing effective repayment strategies, borrowers can navigate this secure loan option with confidence. Remember, while Bedford title loans provide benefits, it’s crucial to be mindful of potential risks and always prioritize responsible borrowing practices.