Lenders assess Title Loan risk using vehicle ownership data (make, model, age, mileage) for standard loans and add driver safety records, maintenance history, and trucking experience for Semi Truck Loans. Market trends impact risk assessment, with lenders adjusting criteria during economic fluctuations to minimize losses. Borrowing terms vary based on lender's focus on collateral or repayment ability. Understanding these differences is crucial for informed decisions about short-term loans.

In the competitive landscape of short-term lending, title loan risk assessment varies significantly among lenders. This article delves into the multifaceted dynamics driving these differences, exploring critical factors such as borrower creditworthiness, collateral valuation, and market trends. By comparing lender approaches and methods, we uncover the strategies that inform risk evaluations, providing insights essential for both industry participants and consumers navigating this unique financing sector.

- Understanding Title Loan Risk Assessment Factors

- Comparing Lender Approaches and Methods

- Impact of Market Trends on Risk Evaluation

Understanding Title Loan Risk Assessment Factors

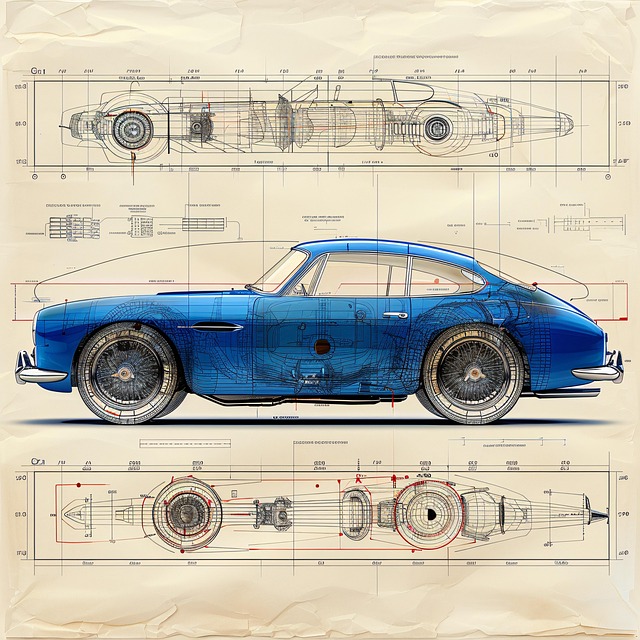

When assessing risk for Title Loan products, lenders consider a variety of factors that go beyond traditional credit scoring. Unlike typical loans, where credit history plays a significant role, title loan risk assessment focuses on the value and condition of the underlying asset—in this case, the borrower’s vehicle ownership. Key risk assessment factors include the vehicle’s make, model, age, mileage, and overall condition. Lenders also evaluate the borrower’s ability to repay by examining their income stability and employment status. The appeal of title loans lies in their accessibility; even borrowers with poor credit or no credit history can gain approval for Quick Funding based on their Vehicle Ownership.

Semi Truck Loans, a specialized subset within the title loan sector, introduce additional risk considerations due to the higher value and unique operational requirements of these vehicles. Lenders must account for factors like the driver’s safety record, vehicle maintenance history, and the borrower’s experience in operating semi-trucks. These stringent assessments ensure responsible lending practices while providing borrowers with a crucial financial safety net during times of need.

Comparing Lender Approaches and Methods

When evaluating different title loan lenders, a critical aspect to consider is their unique approaches and methods for conducting risk assessments. Each lender has its own set of criteria and factors that influence their decision-making process. Some may focus extensively on the value of the collateral (e.g., truck title loans), while others prioritize the borrower’s ability to repay through flexible payment plans. These variations in risk assessment strategies can significantly impact loan eligibility and terms offered to borrowers.

Lenders often employ a combination of financial analysis, credit checks, and alternative data points. For instance, some lenders may rely heavily on direct deposit as a marker for repayment capability, while others might consider the borrower’s employment history and local economic factors. Understanding these differences is crucial for borrowers, as it enables them to compare offers, choose the most suitable lender, and make informed decisions regarding their financial needs, especially when navigating short-term loan options like truck title loans.

Impact of Market Trends on Risk Evaluation

Market trends play a significant role in shaping how title loan lenders conduct their risk assessments. In today’s dynamic economic landscape, lenders must remain agile and adaptable to changing consumer behaviors and financial market fluctuations. For instance, during periods of economic uncertainty, default rates on loans, including title loans, may increase due to rising unemployment or sudden shifts in housing markets. Lenders will respond by adjusting their evaluation criteria, such as employing more rigorous credit checks and downsizing loan amounts to mitigate potential losses.

This trend is especially notable in regions like Houston, where the local market’s health can significantly impact lending practices. For example, a booming job market and rising property values might encourage lenders to offer more favorable terms, including lower interest rates and flexible repayment options, catering to borrowers seeking debt consolidation through Houston title loans. Conversely, economic downturns could lead to stricter qualification requirements, effectively screening out high-risk borrowers while attracting more secure loan applicants.

Title loan risk assessment varies significantly among lenders, with each adopting unique approaches influenced by market trends. Understanding these factors is crucial for borrowers seeking transparent evaluations and fair lending practices. By comparing lender methods, individuals can make informed decisions and navigate the complexities of title loans effectively. This knowledge ensures borrowers are aware of potential risks and rewards, fostering a more responsible borrowing environment.