Title loan payment calculators are online tools that help borrowers understand loan commitments before securing a title loan. By inputting details like loan amount, interest rates, and repayment terms, users get estimated monthly payments. These free platforms offer accurate, transparent estimates without hidden fees, aiding individuals with less-than-perfect credit in making informed decisions. Using the calculator strategically involves inputting desired loan parameters and comparing outcomes across different lenders. Many platforms also offer online applications for easy access from home.

Looking for a reliable way to manage your title loan payments? Discover the power of free online Title Loan Payment Calculators – essential tools that empower you with accurate, up-to-the-minute insights. In this guide, we’ll explore why these calculators are crucial, highlight top-rated free options known for their accuracy, and provide expert tips on using them effectively to make informed financial decisions. Take control of your title loan repayments today!

- Understanding Title Loan Payment Calculators

- Top Free Online Tools for Accuracy

- How to Use Your Calculator Effectively

Understanding Title Loan Payment Calculators

Title loan payment calculators are essential tools designed to help borrowers understand their financial obligations when taking out a title loan. These online resources allow users to input specific details about their loan, such as the loan amount, interest rates, and repayment term, to instantly generate an estimated monthly payment. By utilizing these calculators, individuals can gain valuable insights into the cost of borrowing, enabling them to make informed decisions before securing a title loan.

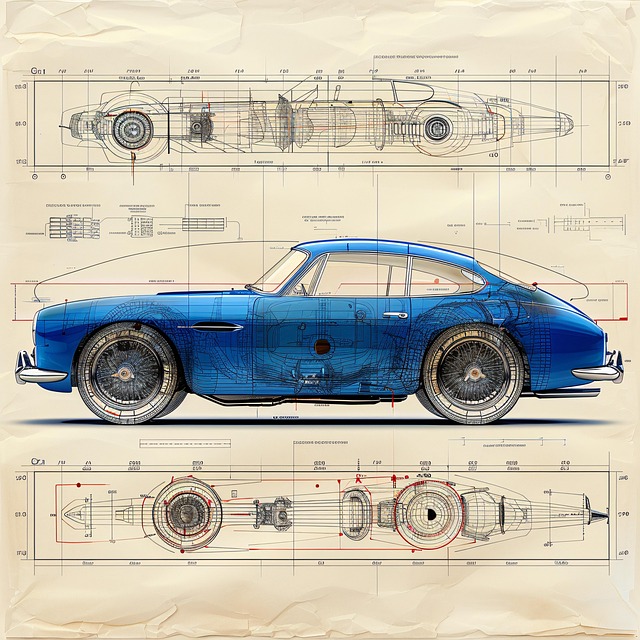

For instance, when considering a Boat Title Loan, a borrower might want to explore different scenarios with varying interest rates and terms. A direct deposit option could also impact repayment calculations. By employing these calculators, borrowers can compare results, choose the most suitable repayment plan, and manage their finances more effectively throughout the loan period.

Top Free Online Tools for Accuracy

When it comes to managing your finances, especially with options like title loan payment calculators, accuracy is paramount. Top free online tools offer an easy and reliable way to estimate your repayments without any hidden fees or complications. These platforms are designed to provide transparent results, allowing you to make informed decisions regarding your title loan payment calculator.

Many individuals turn to these resources when considering a cash advance or loan approval, particularly if they have less-than-perfect credit. The best tools ensure that your data remains secure and private while offering precise calculations for both principal and interest. This is crucial, especially with the variety of bad credit loans available, as it helps you choose the most suitable option tailored to your financial needs.

How to Use Your Calculator Effectively

Using a Title loan payment calculator is an efficient way to understand your financial obligations before securing a loan. These tools are designed to provide an accurate estimate of your monthly payments, interest rates, and total costs associated with a title loan. To make the most of these calculators, start by inputting your desired loan amount—whether it’s for a Boat Title Loan or any other type of secured lending. Next, consider your Loan Requirements; enter the expected term length in months, and select an interest rate that aligns with current market rates.

Once you’ve filled in these key details, click calculate to generate a breakdown of your potential payments. This process empowers you to make informed decisions, allowing you to choose a loan term that suits your budget while comparing offers from various lenders. Additionally, many online platforms offer the convenience of an Online Application, making it easy to start this calculation process from the comfort of your home.

A reliable title loan payment calculator is an invaluable tool for borrowers, offering transparency and control over their loan terms. By utilizing these free online resources, you can make informed decisions about your financial obligations. With a few simple inputs, these calculators provide accurate estimates for repayment schedules, helping you choose the best loan option to suit your needs. So, whether you’re considering a short-term solution or a long-term investment, a well-used title loan payment calculator can be your secret weapon in navigating complex financial landscapes.