Unbanked individuals facing financial emergencies have limited options, but title loans offer a viable alternative by leveraging vehicle equity for quick funding without strict bank requirements. Non-traditional lenders in cities like San Antonio provide flexible terms and refinancing to help unbanked customers manage their finances until stable footing is achieved. Despite criticism, title loans fill a crucial gap in the financial services landscape for this demographic.

Many individuals, lacking traditional banking access (unbanked), turn to title loans as an emergency financial solution. This article explores the unique challenges and strategies these unbanked borrowers employ to navigate through crises. We delve into alternative financing options available to those excluded from the formal banking sector and analyze the role of title loans in providing immediate relief. Additionally, we present strategies to overcome barriers, ensuring unbanked customers have access to the support they need during financial emergencies.

- Exploring Alternatives for Unbanked Individuals

- The Role of Title Loans in Financial Crises

- Strategies to Overcome Barriers for Unbanked Borrowers

Exploring Alternatives for Unbanked Individuals

For unbanked individuals facing emergency financial situations, traditional banking options are often out of reach. This leaves them exploring alternative solutions to bridge the gap until their next paycheck or fixed income source. One avenue gaining traction is the concept of title loans, which offer a unique opportunity for those without a conventional banking history.

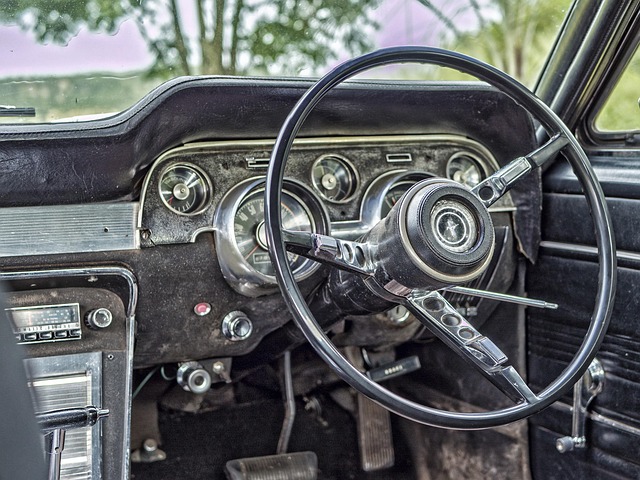

These non-traditional financing methods allow unbanked customers to leverage their vehicle’s equity as collateral in exchange for quick funding. The title loan process involves a straightforward application, assessment of the vehicle’s value, and approval for a loan amount based on the customer’s needs. Unlike bank loans, which may require extensive documentation and credit checks, title loans offer a more accessible path to emergency solutions, enabling individuals to keep your vehicle as they secure much-needed financial support.

The Role of Title Loans in Financial Crises

For many unbanked individuals, accessing traditional financial services can be challenging due to a lack of banking infrastructure or poor credit history. During financial crises, these folks often turn to alternative lenders offering quick funding solutions like title loans as a last resort. These short-term loans, secured against a vehicle’s title, cater specifically to the immediate need for cash among unbanked customers who may have limited options for debt consolidation or financial assistance.

Title loans provide a safety net in emergencies by delivering rapid approval and access to funds within a short timeframe. While not without criticism due to potential high-interest rates and risk of asset forfeiture, they fill a gap in the financial services landscape, especially for those unable to avail themselves of conventional banking products. This unconventional solution has become a lifeline for many unbanked customers facing unexpected expenses or dire financial situations, offering them a chance to bridge the gap until more stable financial footing is achieved.

Strategies to Overcome Barriers for Unbanked Borrowers

Many unbanked individuals seeking emergency financial solutions often face unique challenges when it comes to borrowing options. This demographic, typically lacking access to traditional banking services, must navigate alternative lending avenues. One such option gaining traction is title loans, which can provide much-needed capital for unforeseen expenses.

To overcome barriers and make these loans more accessible, several strategies are worth considering. Non-traditional lenders in cities like San Antonio can offer tailored loan payoff plans and flexible refinancing options to accommodate the diverse financial needs of unbanked customers. These measures ensure that borrowers have a clearer path to repayment and the ability to manage their finances effectively, even without traditional banking ties.

Unbanked individuals often face unique challenges during emergencies, but exploring alternatives like title loans can provide much-needed financial solutions. By understanding their options and implementing strategies to overcome barriers, these customers can access emergency funds quickly. This ensures they’re equipped to navigate financial crises, highlighting the significant role title loans play in supporting unbanked borrowers during difficult times.